Sustainable finance

- Category: European Union Carbon Market Glossary

'Sustainable finance’ generally refers to the process of taking due account of climate, environmental and social considerations in investment decision-making, leading to increased investments in longer-term and sustainable activities (European Commission Communication of 6 July 2021, Strategy for financing the transition to a sustainable economy, COM(2021) 390 final, p. 1).

|

|

15 December 2023 The EBA proposes a voluntary EU green loan label to help spur markets

Sustainable Finance - implementation timeline

European Commission sustainable finance package Questions and Answers on the Sustainable Finance package

|

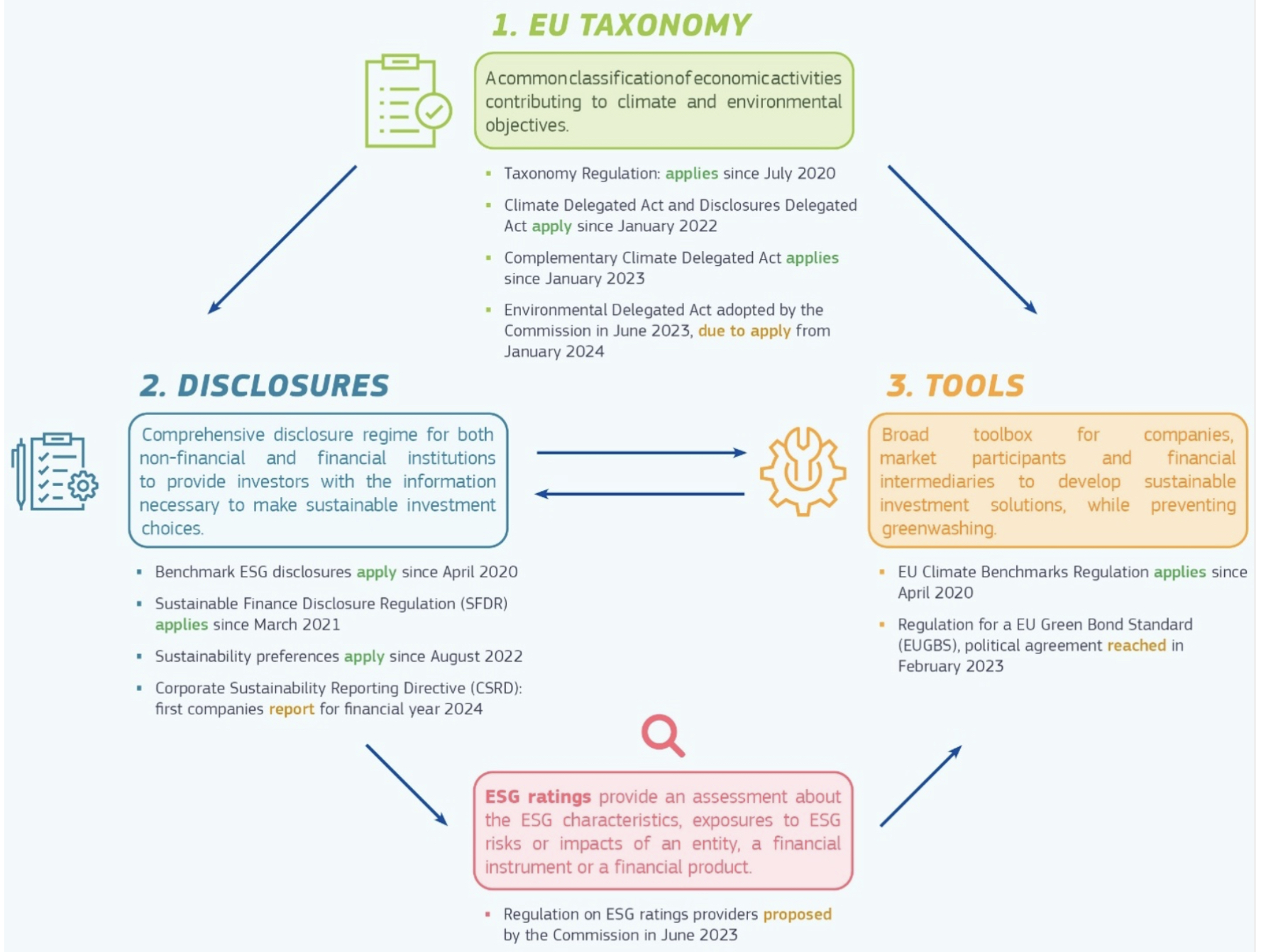

To sum up - the three key building blocks for the EU sustainable financial framework are:

- the EU taxonomy as a classification system,

- a mandatory disclosure regime in form of the CSRD and SFDR and

- benchmarks, standards and labels including the two new benchmarks created by the Benchmark Regulation.

Source: Commission Staff Working Document, Enhancing the usability of the EU Taxonomy and the overall EU sustainable finance framework, Accompanying the document, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, A sustainable finance framework that works on the ground (SWD(2023) 209 final)

The above framework is complemented by specific provisions in CRR, IFR and MiFID II - see below for details.

The growth of sustainable investing has been one of the major trends in financial markets in recent years. ESMA document of 10 February 2022 (TRV Risk Analysis, Text mining ESG disclosures in rating agency press releases, ESMA 80-195-1352) observes that in just the first half of 2021, EU sustainable fund assets increased by 20%, to EUR 1.5 tn, marking the 39th consecutive month of net inflows for these funds. This trend reflects the increasing appetite of investors and professional market participants to incorporate ESG (environmental, social, governance) factors into their decision making.

Sustainable finance is sometimes also referred to as green finance, however, although there are some overlaps, it seems these terms should be differentiated.

Neither the SFDR or Taxonomy Regulation defines the terms “sustainable” or “green” in general terms but these regulations do provide definitions of how a type of activity can be judged to be sustainable (Transition finance report, Platform on Sustainable Finance, March 2021).

Sustainable finance legal framework is based on the common understanding of some basic concepts, in particular:

- environmentally sustainable economic activities;

- environmentally sustainable investment.

International dimension

At the international level, there has been a number of initiatives by international bodies to frame ESG factors:

a. the United Nations’ Principles for Responsible Investment (UNPRI) aim at supporting its signatories, i.e.:

(i) asset owners/institutional investors,

(ii) investment managers and

(iii) service providers, including consultancy, information and data

- to incorporate ESG factors into their investment and ownership decisions;

b. the United Nations’ Environment Programme Finance Initiative (UNEP FI)’s Principles for Responsible Banking, aim at aligning the banks’ business strategy with the objectives of the SDGs and the Paris Agreement;

c. the Global Reporting Initiative’s from the Global Sustainability Standards Board (GRI-GSSB), aim at helping organisations to better understand, manage and communicate their impacts on issues relating to sustainability;

d. the Equator Principles, adopted by financial market institutions, which provide a common baseline and framework to identify, assess and manage environmental and social risks when financing projects;

e. the Natural Capital Protocol + Supplement (Finance), which provides a standardised framework for organisations to identify, measure, and value their impacts and dependencies on natural capital.

Regulations at the European level

At the European level, a main legal reference to frame ESG factors is the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (Sustainable Finance Disclosure Regulation - SFDR).

The SDFR aims at enhancing transparency and informing end investors about sustainability-related aspects, particularly in terms of the principal adverse impacts (PAI), which could be understood as those impacts of investment decisions and advice that result in negative effects on sustainability factors.

The SDFR does not provide granular information on the characteristic of sustainability factors, however, it provides a definition of sustainability factors meaning environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters.

The EU framework for a sustainable finance is complemented by:

1. Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 (Taxonomy Regulation),

2. Regulation (EU) 2019/2089 of the European Parliament and of the Council of 27 November 2019 amending Regulation (EU) 2016/1011 as regards EU Climate Transition Benchmarks, EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks (Benchmarks Regulation).

The Taxonomy Regulation complements the SFDR by requiring those financial market participants that are subject to the disclosure obligations set out in SFDR to disclose the degree of environmental sustainability of the financial products that they claim pursue environmental objectives (FAQs, Commission Technical Expert Group on Sustainable Finance). Hence, the disclosure obligations laid down in the Taxonomy Regulation supplement the rules on sustainability-related disclosures and the rules on transparency in pre-contractual disclosures and in periodic reports stipulated in the SFDR (Recital 19 of the Taxonomy Regulation).

The disclosure requirement under the Taxonomy Regulation will have to reference the EU taxonomy to show how and to what extent the criteria are used to determine the environmental sustainability of the investment. This disclosure will allow investors to understand and compare more easily the degree of "greenness" of investment strategies.

The Taxonomy Regulation therefore provides more clarity on what green investments offer in terms of environmental outcomes. It also provides clear signals to economic operators on what constitutes substantial contribution to environmental objectives.

Financial market participants offering ‘green’ financial products will therefore have to:

- disclose how they reach their environmental sustainability target under the SFDR – having some freedom in how to best describe their environmental investment strategies;

- reference the EU taxonomy when describing the degree of ‘greenness’ of the given product.

This will introduce an element of comparability, without prejudging those green investments that do not contain underlying economic activities from the EU taxonomy.

This framework is complemented by the wide variety of further specific provisions, in particular:

1. the Non-Financial Reporting Directive (Directive 2014/95/EU - the NFRD and its successor CSRD),

2. Article 53 of the Regulation (EU) 2019/2033 of the European Parliament and of the Council of 27 November 2019 on the prudential requirements of investment firms and amending Regulations (EU) No 1093/2010, (EU) No 575/2013, (EU) No 600/2014 and (EU) No 806/2014 (IFR) on the disclosure of environmental, social and governance risks by investment firms,

|

Regulation (EU) 2019/2033 of the European Parliament and of the Council of 27 November 2019 on the prudential requirements of investment firms and amending Regulations (EU) No 1093/2010, (EU) No 575/2013, (EU) No 600/2014 and (EU) No 806/2014 (IFR) |

From 26 December 2022 investment firms which do not meet the criteria referred to in Article 32(4) of Directive (EU) 2019/2034 (class 2 investment firms) must disclose information on environmental, social and governance risks, including physical risks and transition risks, as defined in the report referred to in Article 35 of Directive (EU) 2019/2034.

Following the IFR, class 2 investment firms will have to disclose prudential information on ESG risks, similar to the information required from large institutions under the CRR in accordance with Article 449 CRR.

In the case of ESG prudential disclosures by investment firms, there is currently no mandate for the EBA to implement them.

3. Article 449a of Regulation (EU) No 575/2013 (CRR), which requires large institutions with securities traded on a regulated market of any EU Member State to disclose prudential information on environmental, social and governance risks, including physical risks and transition risks (as defined in the report referred to in Article 98(8) of CRD (Directive 2013/36/EU)).

|

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and amending Regulation (EU) No 648/2012 (CRR), Disclosure of environmental, social and governance risks (ESG risks) From 28 June 2022, large institutions which have issued securities that are admitted to trading on a regulated market of any Member State, as defined in point (21) of Article 4(1) of Directive 2014/65/EU, shall disclose information on ESG risks, including physical risks and transition risks, as defined in the report referred to in Article 98(8) of Directive 2013/36/EU. The information referred to in the first paragraph shall be disclosed on an annual basis for the first year and biannually thereafter. |

Article 434a CRR mandates the European Banking Authority (EBA) to develop draft implementing technical standards (ITS) specifying this disclosure requirement in a way that convey sufficiently comprehensive and comparable information for users of that information to assess the risk profiles of institutions.

With regard to Article of 449a the EBA published binding standards on Pillar 3 disclosures on ESG risks on 24 January 2022 (EBA Final Report on 24 January 2022, Final draft implementing technical standards on prudential disclosures on ESG risks in accordance with Article 449a CRR (EBA/ITS/2022/01)).

The said EBA’s Final draft of 24 January 2022 includes standard templates and tables with harmonised and comparable disclosures and associated instructions for the disclosure of information required in Article 449a CRR. Institutions will have to start disclosing this information from June 2022. The first disclosure will be annual and it will be semi-annual thereinafter. This means that in practice the first disclosure will take place in 2023 for the disclosure reference date as of the end of December 2022.

In accordance with Article 449a CRR, the Implementing Technical Standards (ITS) only apply to large institutions with instruments traded in a regulated market in a EU Member State. EBA, however, reserves that “potential extension of the disclosures required in the CRR text to a broader population of institutions will not lead to an automatic extension of the disclosures required in the ITS to other institutions. If the requirements in the level 1 text are at some point extended, the ITS will need to be revised and amended in order to define the disclosures applicable to institutions other than large institutions with traded instruments in a proportionate manner”.

It should be also noted that the scope of application of Article 449a (large institutions with traded instruments) and of the ITS is smaller than that of Article 8 of the Taxonomy Regulation (institutions subject to an obligation to publish non-financial information under the NFRD), and therefore only a subset of the institutions that will have to disclose the GAR under Article 8 of the Taxonomy Regulation will have to disclose it in their Pillar 3 reports.

Interactions with MiFID II

Integration of sustainability factors into the suitability assessment

The MiFID II rules on sustainability preferences ensure consistency with the SFDR and the Taxonomy Regulation and strengthen the effectiveness of sustainability-related disclosures under those Regulations.

Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms include, among other things, a requirement that EU MiFID II portfolio managers and advisers ask their clients about their “sustainability preferences”, and then comply with such preferences when making decisions or providing advice.

After the amendment the term “sustainability preferences” is defined in Article 2(7) of Delegated Regulation (EU) 2017/565 as a client’s or potential client’s choice as to whether and, if so, to what extent, one or more of the following financial instruments shall be integrated into his or her investment:

(a) a financial instrument for which the client or potential client determines that a minimum proportion shall be invested in environmentally sustainable investments (as defined in Article 2(1) of the Taxonomy Regulation);

(b) a financial instrument for which the client or potential client determines that a minimum proportion shall be invested in sustainable investments (as defined in Article 2(17) of SFDR);

(c) a financial instrument that considers principal adverse impacts on sustainability factors where qualitative or quantitative elements demonstrating that consideration are determined by the client or potential client.

Explanatory memorandum, Commission Delegated Regulation of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms (C(2021) 2616 final)

Since the product scopes of, on one side, MiFID II and, on the other side, the SFDR and the Taxonomy Regulation, are different, sustainability preferences are not restricted to financial products within the meaning of the SFDR and the Taxonomy Regulation, but are instead based on the Regulations’ sustainability-related concepts.

This allows investment firms recommend not only investment funds, but also other relevant financial instruments.

By way of example, "financial instruments that pursue a minimum proportion of sustainable investments” will always include financial products referred to in Article 9 of the SFDR and financial products referred to in Article 8 of the SFDR, provided such financial products pursue, at least to some extent, sustainable investments.

That minimum extent is determined by clients or potential clients, thus the rules on sustainability preference take into full account their sustainability-related ambitions.

Other examples include financial instruments with environmental or social characteristics that are, among others, based on an exclusion strategy and that might fall under sustainability preferences provided they, at least to some extent, pursue sustainable investments or they prove the principal adverse impacts are considered and addressed or mitigated, in line with minimum investment proportions or elements demonstrating consideration of principal adverse impacts on sustainability factors respectively, as determined by the client or potential client.

This also means that financial instruments that promote environmental or social characteristics without a proportion of sustainable investments or without a proportion of investments in taxonomy-compliant activities or where they do not consider principal adverse impacts will not be eligible for recommendation to the clients or potential clients based on their individual sustainability preferences.

However, such financial instruments can still be recommended within the suitability test, but not as financial instruments meeting individual sustainability preferences.

Further, it requires investment firms to prepare a report to the client that explains how the recommendation to the client meets his investment objectives, risk profile, capacity for loss bearing and sustainability preferences (ex-post information disclosure).

In addition, Article 1 requires investment firms to take into account sustainability risks, either in qualitative or quantitative terms, when complying with the organisational requirements and to integrate sustainability risk into their risk management policies.

Commission Delegated Regulation (EU) 2017/565 supplements Directive 2014/65/EU of the European Parliament and of the Council (MiFID II) by further specifying organisational requirements and operating conditions for investment firms.

In more detail, under the MiFID II framework, firms providing investment advice and portfolio management are required to obtain the necessary information about the client's knowledge and experience in the investment field, their ability to bear losses, and objectives including the client's risk tolerance to enable the firm to provide services and products that are suitable for the client (suitability assessment).

The information regarding the investment objectives of clients includes information on the length of time for which clients wish to hold the investment, their preferences regarding risk taking, risk profile, and the purposes of the investment. However, the information about investment objectives generally relates to financial objectives, while other non-financial objectives of the client, such as sustainability preferences, are usually not addressed. Before Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 suitability assessments generally did not include questions on clients’ sustainability preferences.

Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 modifies Delegated Regulation (EU) 2017/565 in two ways: first, it integrates client’s preferences in terms of sustainability as a top up to the suitability assessment, second, it integrates sustainability risk into the organisational requirements.

Explanatory Memorandum to the Commission Delegated Regulation (EU) 2021/1253 (C(2021) 2616 final) clarifies that as regards some of the objectives within the suitability assessment process, the Commission included some modifications in order to allow for the necessary differentiation between investment objectives, on the one hand, and sustainability preferences, on the other hand (this differentiation is important in order to avoid mis-selling). However, according to the Commission “sustainability factors should not take precedence over a client’s personal investment objective” - the sustainability preferences should only be addressed within the suitability process once the client’s investment objective has been identified.

The Commission clarifies that financial instruments with different levels of sustainability-related ambition will not need to be adapted - they will either benefit from the regime of sustainability preferences or will continue to be recommendable, but not as financial instruments meeting the sustainability preferences of the client. It is to be noted, the SFDR requires a financial product’s documentation to describe how its stated levels of sustainability or sustainability ambitions are to be achieved or are achieved. Hence, as it is not a labelling regime, different sustainability-related ambitions might be described.

Whilst financial products referred to in Article 9 of the SFDR must pursue the objective of sustainable investments, with no significant harm, as defined in Article 2, point (17), of the SFDR, financial products that fall under Article 8 of the SFDR might integrate different strategies, even including those that, despite claiming environmental, social and governance (ESG), socially responsible investing (SRI) or sustainability orientation, might lack sustainability-related materiality.

Given this and given different product scopes of MiFID II, the SFDR and the Taxonomy Regulation, Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 ensures that financial instruments that have some level of sustainability-related materiality are eligible for recommendation to the clients or potential clients who express clear sustainability preferences.

Sustainability preferences therefore comprise financial instruments that are either invested, at least to some extent, in taxonomy-compliant activities under the Taxonomy Regulation, or in sustainable investments, as defined in Article 2(17), of the SFDR, that also encompass taxonomy-compliant activities, or that consider negative externalities of investments on the environment or society in terms of principal adverse impacts on sustainability.

Integration of sustainability factors into the product governance obligations

On 2 August 2022 Commission Delegated Directive (EU) 2021/1269 of 21 April 2021 amending Delegated Directive (EU) 2017/593 as regards the integration of sustainability factors into the product governance obligations has been published in the EU Official Journal.

Explanatory Memorandum to this Directive refers to the fact that the conditions to identify a target market in Delegated Directive 2017/593 adopted under Articles 16(12) and 24(13) of MiFID II did not yet explicitly establish the details of the integration of sustainability factors and sustainability-related objectives by investment firms manufacturing financial instruments and their distributors.

Commission Delegated Directive (EU) 2021/1269 of 21 April 2021 clarifies that sustainability factors and sustainability related objectives should be taken into account in the product oversight and governance process.

The Commission Delegated Directive (EU) 2021/1269 of 21 April 2021 covers the following amendments to Delegated Directive (EU) 2017/593:

- Article 1 aims at clarifying that manufacturers should duly consider sustainability related objectives when specifying the type(s) of client for whose needs, characteristics and objectives the financial instrument is compatible with;

- the target market assessment in consideration of the respective product's risk/reward profile and product features should also cover the instrument's objective of sustainable investments or environmental or social characteristics. In the context of this review, manufacturers should also explicitly take clients’ sustainability related objectives into account.

- manufacturers should disclose sustainability factors of the financial instruments in a transparent way that allows investment firms to engage in dialogues with clients or potential clients in order to have sufficiently granular understanding of the clients’ individual sustainability preferences, pursuant to Commission Delegated Regulation (EU) 2017/565.

For sustainable investments, the identification of a negative target market will not be required. Article 2 of the Commission Delegated Directive (EU) 2021/1269 echoes those requirements for the distributors.

Links

Links