Taxonomy Regulation

- Category: European Union Carbon Market Glossary

As stresses the European Commission's in its June 2023 Communication, the Taxonomy is a "common language" which plays a key role in the EU's sustainable finance framework and be further used by undertakings to plan investments and set targets for their transition.

Practically speaking the Taxonomy can be defined as the list of economic activities and associated technical screening criteria setting out the required level of environmental performance.

|

|

26 March 2024 2023 Corporate Reporting Enforcement and Regulatory Activities Report, ESMA32-193237008-8269

Platform on Sustainable Finance report on a compendium of market practices

The main goal of the draft Guidelines is to ensure that national competent authorities carry out their supervision of listed companies’ sustainability information under the CSRD, the ESRS and Article 8 of the Taxonomy Regulation in a converged manner.

Commission Delegated Regulation of 27.6.2023 amending Delegated Regulation (EU) 2021/2139 establishing additional technical screening criteria for determining the conditions under which certain economic activities qualify as contributing substantially to climate change mitigation or climate change adaptation and for determining whether those activities cause no significant harm to any of the other environmental objectives (C(2023)3850 final) lays down the amendments to: - Annex I to the Taxonomy Climate Delegated Act by adding or complementing technical screening criteria for climate change mitigation for certain economic activities in the transport and manufacturing sectors. Annex I also includes targeted amendments of existing provisions that address certain technical and legal inconsistencies identified since the application of the Taxonomy Climate Delegated Act; - Annex II to the Taxonomy Climate Delegated Act by adding the technical screening criteria for climate change adaptation for certain economic activities that are adapted to climate change or enable the adaptation of other economic activities from the water, construction, disaster risk management, information and communication, and professional services sectors. Annex II also includes targeted amendments of existing provisions that address certain technical and legal inconsistencies identified since the application of the Taxonomy Climate Delegated Act. Text amending the Climate Delegated Act Annex I: Climate change mitigation Annex II: Climate change adaptation Timeline of the delegated act and stakeholder's feedback

Text of the Environmental Delegated Act and amending the Disclosures Delegated Act

13 June 2023

|

Taxonomy Regulation in the EU carbon market legal framework stands for the Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088. The Regulation was published in the Official Journal on 22 June 2020 and entered into force 20 days later.

|

The key objective of the Taxonomy Regulation is to establish a unified classification system for sustainable economic activities to help reorient capital flows towards sustainable investments. Concepts of sustainable investments and environmentally sustainable activities in the EU Sustainable Finance framework, ESMA, 22 November 2023, ESMA30-379-2279 |

There is also a more general term in use: "taxonomy framework”, which is taken (see Transition finance report, Platform on Sustainable Finance, March 2021, p. 15) to include:

- the Taxonomy Regulation itself,

- the Delegated Acts containing technical screening criteria for substantial contribution to climate change mitigation and climate change adaptation,

- the Delegated Act providing details of undertakings’ taxonomy disclosures (Article 8 of the Taxonomy Regulation),

- the forthcoming EU Green Bond Standard, and sometimes

- the relevant elements of the Non-Financial Reporting Directive (NFRD).

|

|

General remarks

The Taxonomy Regulation applies to:

(a) measures adopted by the EU Member States or by the European Union that set out requirements for financial market participants or issuers in respect of financial products or corporate bonds that are made available as environmentally sustainable;

(b) financial market participants that make available financial products;

(c) undertakings which are subject to the obligation to publish a non-financial statement or a consolidated non-financial statement pursuant to Article 19a or Article 29a of Directive 2013/34/EU of the European Parliament and of the Council of 26 June 2013 (on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings), respectively.

The Taxonomy Regulation establishes the world’s first-ever “green list” – an EU classification system (the "taxonomy") to facilitate sustainable finance (or green investments - although the Regulation itself does not refer to such a term).

More specifically, the Taxonomy Regulation establishes the criteria for environmentally sustainable economic activities - under the EU taxonomy, most economic activities are screened and criteria are determined (on the level of emissions, recycling rates, water management requirements, etc.) per activity area to determine whether it can be labelled as sustainable by investors and asset managers.

Investments in environmentally sustainable economic activities are investments in taxonomy-aligned activities.

By defining environmentally sustainable economic activities, not undertakings, the taxonomy enables undertakings to transition by gradually increasing their share of environmentally sustainable activities.

|

|

The relevant legal wording can be found in Article 1 of the Taxonomy Regulation, according to which the Regulation "establishes the criteria for determining whether an economic activity qualifies as environmentally sustainable for the purposes of establishing the degree to which an investment is environmentally sustainable".

In principle, the Taxonomy Regulation lays out three types of activities:

1. low-carbon (Article 10(1));

2. transitional activities (Article 10(2));

3. enabling activities (Article 16).

The framework is based on six taxonomy environmental objectives.

Technical screening criteria (TSC)

|

The EU Taxonomy User Guide, June 2023 An online tool that enables users to search for economic activities covered in the Climate Delegated Act and directly access their respective technical screening criteria. The format of the Taxonomy Compass aims to make the criteria easier to use by enabling users to check: (i) which activities are included in the EU Taxonomy (i.e. which are taxonomy eligible); (ii) which objectives they substantially contribute to; and (iii) what criteria have to be met for activities to be considered taxonomy aligned. For instance, the tool includes a filtering option that users can adjust to only see enabling and/or transitional activities. In addition, the text of the technical screening criteria includes hyperlinks to EU regulations and directives that are mentioned, enabling users to consult the relevant pieces of EU legislation. The EU Taxonomy Compass is used in the market as a basis for undertakings’ reporting. The Taxonomy Compass’s content can be downloaded in Excel and JSON format, enabling users to embed the compass in their internal systems.

EU Taxonomy Navigator, European Commission website Users can search for specific questions that are of interest to them and filter the questions by organisation type and FAQ document. In the future, the Commission aims to further improve the repository’s filtering features to include options such as filtering by delegated act or by sector of activities.

An interactive tool to show non-financial undertakings in a step-by-step guide how to determine their taxonomy eligibility and alignment ratios. The tool guides users through seven main steps 45 to calculate their turnover, CapEx and OpEx KPIs and automatically fills in the respective reporting templates included in Annex II to the Taxonomy Disclosures Delegated Act.

EU taxonomy for sustainable activities, European Commission website

Sustainable finance – EU classification system for green investments

EU Taxonomy Stakeholder Request Mechanism

|

The technical screening criteria (TSC) under the taxonomy legal framework are laid down by Commission Delegated Regulations.

The first TSC delegated regulation has been published in the EU Official Journal on 9 December 2021 (Commission Delegated Regulation (EU) 2021/2139 of 4 June 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining whether that economic activity causes no significant harm to any of the other environmental objectives - the Taxonomy Climate Delegated Act).

On 2 February 2022 European Commission presented and passed to the European Parliament and the EU Member States the Taxonomy Complementary Climate Delegated Act (Commission Delegated Regulation (EU) 2022/1214 of 9 March 2022 amending Delegated Regulation (EU) 2021/2139 as regards economic activities in certain energy sectors and Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities).

On 27 June 2023 the European Commission adopted the Delegated Regulation amending Delegated Regulation (EU) 2021/2139 establishing additional technical screening criteria for determining the conditions under which certain economic activities qualify as contributing substantially to climate change mitigation or climate change adaptation and for determining whether those activities cause no significant harm to any of the other environmental objectives (C(2023)3850 final), which lays down the amendments to:

- Annex I to the Taxonomy Climate Delegated Act by adding or complementing technical screening criteria for climate change mitigation for certain economic activities in the transport and manufacturing sectors. Annex I also includes targeted amendments of existing provisions that address certain technical and legal inconsistencies identified since the application of the Taxonomy Climate Delegated Act;

- Annex II to the Taxonomy Climate Delegated Act by adding the technical screening criteria for climate change adaptation for certain economic activities that are adapted to climate change or enable the adaptation of other economic activities from the water, construction, disaster risk management, information and communication, and professional services sectors. Annex II also includes targeted amendments of existing provisions that address certain technical and legal inconsistencies identified since the application of the Taxonomy Climate Delegated Act.

On 21 November 2023 Commission Delegated Regulation (EU) 2023/2485 of 27 June 2023 amending Delegated Regulation (EU) 2021/2139 establishing additional technical screening criteria for determining the conditions under which certain economic activities qualify as contributing substantially to climate change mitigation or climate change adaptation and for determining whether those activities cause no significant harm to any of the other environmental objectives has been published in the EU Official Journal.

Further delegated regulations cover other environmental objectives of the taxonomy: water, circular economy, pollution prevention and biodiversity. Draft Commission Delegated Regulation supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and restoration of biodiversity and ecosystems and for determining whether that economic activity causes no significant harm to any of the other environmental objectives and amending Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities (Taxonomy Environmental Delegated Act, Ref. Ares(2023)2481554) has been published on 5 April 2023. The relevant Delegated Regulation has been adopted by the European Commission on 27 June 2023.

On 21 November 2023 Commission Delegated Regulation (EU) 2023/2486 of 27 June 2023 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and restoration of biodiversity and ecosystems and for determining whether that economic activity causes no significant harm to any of the other environmental objectives and amending Commission Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities has been published in the EU Official Journal.

The taxonomy uses

As the Council of the EU underlines, the taxonomy will enable investors to re-orient their investments towards more sustainable technologies and businesses. Hence, the taxonomy is first and foremost a tool for investors, however it introduces disclosure requirements, rather than telling investors in what to invest. It needs to be stressed, there is no obligation to invest only into taxonomy-compliant economic activities. However, if a financial product is marketed and/or sold to investors as ‘environmentally sustainable’, then the extent to which it is green (the ‘greenness’) must be disclosed to investors by reference to the taxonomy. This allows for many different investment strategies to co-exist, while avoiding a straightjacket approach (FAQs, Commission Technical Expert Group on Sustainable Finance).

|

|

It will be instrumental for the EU to become climate neutral by 2050 and achieve the Paris Agreement's 2030 targets. These include a 40% cut in greenhouse gas emissions for which the Commission estimates that the EU has to fill an investment gap of about 180 billion EUR per year.

Before the Taxonomy Regulation, there was no common classification system at EU or global level which defined environmentally sustainable economic activity. The document titled: “FAQs, Commission Technical Expert Group on Sustainable Finance", published on the European Commission’s website, explains that the taxonomy will have to be used by:

- the EU Member States for the purposes of any measures setting out requirements on market actors in respect of financial products or corporate bonds that are marketed or deemed as environmentally sustainable,

- financial market participants offering financial products as environmentally sustainable investments or investments having similar characteristics (they would have to disclose information on how the criteria for environmentally sustainable economic activities are used to determine the environmental sustainability of the investment).

|

|

The taxonomy is not and will not be a mandatory list of activities in which to invest. Market-led labels can continue to exist and funds targeting environmental objectives are not limited to investing in taxonomy-compliant activities – they just need to be clear on whether and to what extent their green products finance activities that qualify under the taxonomy. In addition, the taxonomy can also be used on a voluntary basis by any financial institution. For example, banks could potentially use it as a basis for their lending activities.

The taxonomy should moreover encourage companies to raise funds for projects that meet the criteria of the taxonomy, or to show the percentage of revenue or turnover from green activities with reference to the taxonomy, in order to raise green funding.

The specific uses of the taxonomy have been explained in the FAQ document (p. 9) as follows:

1. as regards financial assets (loans, bonds, equity):

- assets that are used to finance only the environmentally sustainable activities of the company (e.g. "green bonds" with transparent use of proceeds for environmentally beneficial purposes) could be considered environmentally sustainable, while other assets that only partially finance green activities may have various degrees of environmental sustainability;

- the degree of environmental sustainability can similarly be determined for investment portfolios consisting of several companies, which will incentivise investments into environmentally sustainable economic activities, without penalising or creating disincentives for investments into other economic activities;

2. as regards financial products (i.e. funds) and investment strategies:

- as the taxonomy provides a tool to assess the degree to which financial assets or companies contribute substantially to environmental objectives, it also allows financial market participants to use the taxonomy as a factor for selecting their investments;

- what’s important, it does not prescribe such strategy and allows for different degrees of ‘greenness’ and for different investment strategies currently existing in the market, such as those purely based on exclusion criteria.

The said FAQ document also mentions that the European Commission is looking into the development of an EU Ecolabel for financial products, which will consider the issue of how the taxonomy links to financial products, and therefore indirectly how it links to financial assets and companies. In this vein, on 21 December 2022 ESMA has published the document "TRV Risk Analysis, EU Ecolabel: Calibrating green criteria for retail funds” (ESMA document number: 50-165-2329).The European Commission has also launched an online tool (the taxonomy compass) designed to facilitate the use of the taxonomy.

Data shows that the taxonomy is working as intended (European Commission Recommendation (EU) 2023/1425 of 27 June 2023 on transition finance, C(2023) 3844). According to the European Commission’s document of 13 June 2023 “Questions and Answers on the Sustainable Finance package” taxonomy is increasingly being used by undertakings to signal their sustainability performance and efforts. As of 17 May 2023, 63% of companies from the STOXX Europe 600 have already disclosed their taxonomy figures. Among these, 30% (178 companies) reported some levels of alignment with the taxonomy, notably for their capital expenditure (CapEx), 23% (139 companies), their revenue and 21% (127 companies) for their operating expenditure (OpEx). On average, the taxonomy alignment of these companies is around 17% for revenue, 23% for CapEx and 24% for OpEx. Reporting figures also suggest that nearly two in three companies that disclosed Taxonomy-eligible CapEx reported some levels of alignment with the taxonomy and one in two companies that disclosed Taxonomy-eligible revenue reported some levels of alignment with the taxonomy.

The taxonomy as a transition tool, transition plans

ESMA Public Statement of 25 October 2023 (European common enforcement priorities for 2023 annual financial reports, ESMA32-193237008-1793) accentuates the role of the EU Taxonomy as a transition tool beyond a reporting tool.

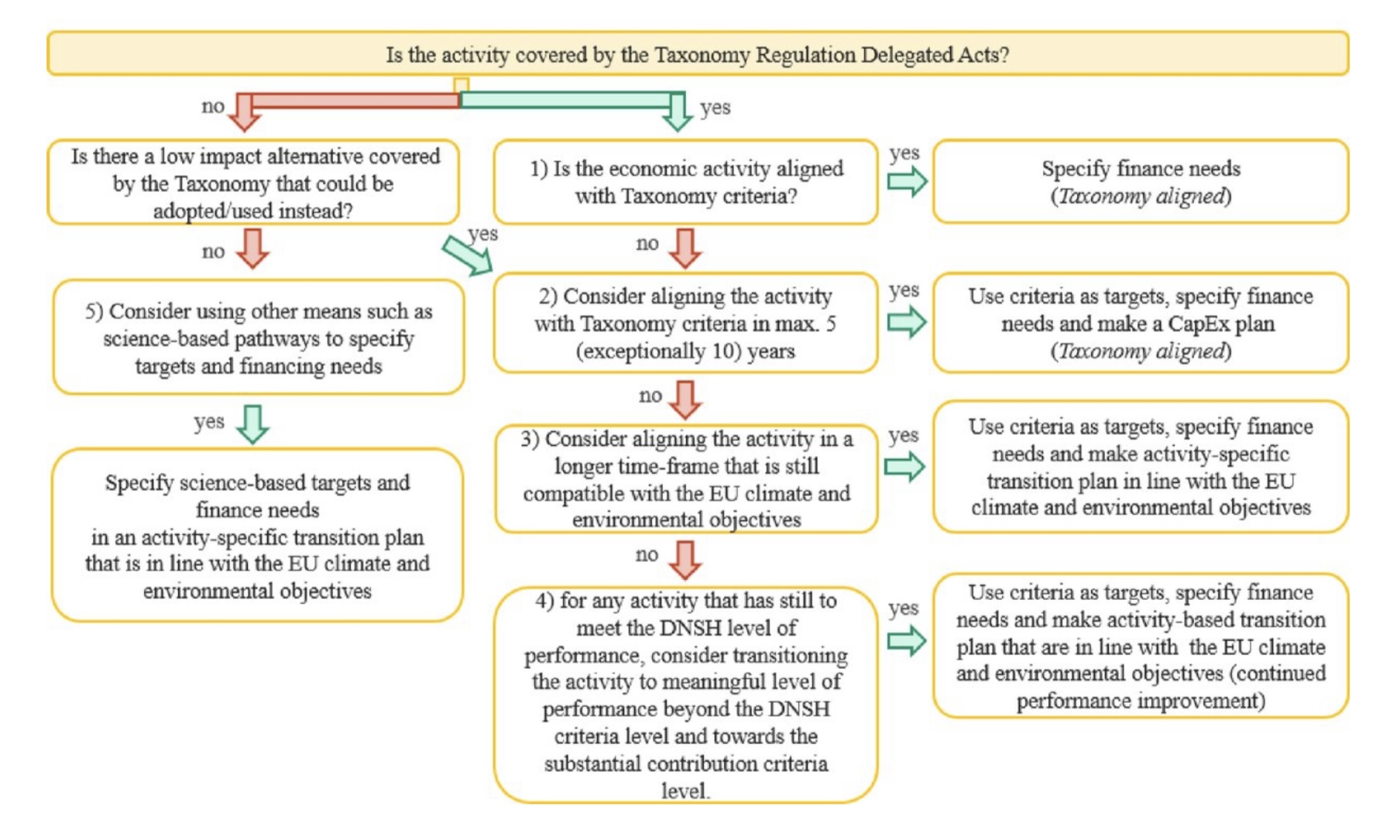

The European Commission Recommendation (EU) 2023/1425 of 27 June 2023 on transition finance (C(2023) 3844) underlines the role of activity based transition plans as the key part of an entity level transition strategy. European Commission observes in particular that:

- undertakings can use the taxonomy to define their transition finance needs at activity level,

- the taxonomy does not prescribe the timeline by which an undertaking should align its activities with any of its criteria, instead, it leaves flexibility to market actors to use the timetables of their own science-based transition paths,

- undertakings can reference taxonomy criteria in their climate and environmental target setting and where those targets are aligned with the transition and their achievement is credible, they can raise transition finance for their implementation,

- where an economic activity is already aligned with the taxonomy, undertakings could consider any current and future financing needs for maintaining taxonomy alignment also in the future,

where an economic activity is eligible but not yet aligned with the taxonomy, undertakings could consider aligning it with the technical screening criteria of the taxonomy within 5 (exceptionally 10) years (according to the Taxonomy Disclosures Delegated Act, the period to reach taxonomy-alignment can exceed five years only where a longer period is objectively justified by specific features of the economic activity and the upgrade concerned, with a maximum of 10 years) as well as specify the transition investment needed to reach these targets in a CapEx plan (such capital expenditure is considered taxonomy aligned investment), -

where taxonomy alignment in 5 (exceptionally 10) years is not feasible, it is possible to consider aligning an asset or economic activity with the associated taxonomy performance criteria over a longer time horizon that is still compatible with the transition (transition investments that will only reach taxonomy-alignment over a longer time frame than the 5 (exceptionally 10) years recognised under Delegated Regulation (EU) 2021/2178, could be accompanied by an activity-specific transition plan that is compatible with the transition, justifying the longer time-horizon for reaching the targets and showing how taxonomy-alignment will be reached in subsequent step),

-

for environmental aspects, the targets could be aligned with international and Union environmental policy objectives and targets, including those related to the sustainable protection and restoration of water and marine resources, circular economy, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems.

For example, where necessary, undertakings can use the taxonomy criteria to plan stepwise alignment with the taxonomy: as a first time-bound target, to transition beyond performance levels defined by the do-no-significant-harm criteria, and as a second time-bound target to align with substantial contribution criteria, explained in an activity-based transition plan.

Transition plans are a useful tool to translate climate or environmental targets at the levels of both undertakings and economic activities into actions and an investment plan when communicating with financial intermediaries and investors. Financial intermediaries and investors might also take into account information from transition plans and the integrity, transparency and accountability of the targets included in the plans when assessing the transition and physical sustainability risks associated with an investment.

Transition plans are currently not mandatory, but they are emerging as one of the key forward-looking tools that undertakings can use to set out and articulate their targets and the financing needed to reach those targets, and include information on milestones, activities, processes and resources. Transition plans can be set out by relying on Directive (EU) 2022/2464 and reporting standards under this Directive, where transition plans are part of the overall business strategy of an undertaking aiming to align itself with the goal of the Paris Agreement to limit the global temperature increase to 1.5°C.

A transition plan, which is an aspect of the overall strategy of the undertaking, can also cover the transition to environmental objectives. The credibility of a transition plan might be strengthened through its adoption by the management of the company, through including a structured set of short-, medium- and long-term targets and actions, including allocated and needed resources to ensure that the targets and actions are implemented in a credible and consistent way, including consideration and avoidance of long-term lock-in to GHG-intensive or environmentally significantly harmful activities or assets, considering the lifetime of those assets.

Diagram: Using the EU Taxonomy to specify transition finance needs

Source: European Commission Recommendation (EU) 2023/1425 of 27 June 2023 on transition finance, C(2023) 3844

ESMA document of 26 March 2024 „2023 Corporate Reporting Enforcement and Regulatory Activities Report” (ESMA32-193237008-8269) contains a review of regulatory compliance in this regard. In the said report ESMA notes that, taking into account analysed data, 55% of issuers disclosed a climate-related transition plan. European enforcers also assessed whether at a minimum the plans disclosed included information that could enable an understanding of the issuer's past, current, and future mitigation efforts to ensure that its strategy and business model(s) are compatible with the transition to a sustainable economy. Transition plans should also typically include emission reduction targets.

ESMA observes that, while the EU requirements applicable to the reporting period 2022 did not explicitly single out the transition plan disclosures, the lack thereof may be an indication of greenwashing risk and therefore a possible threat to investor protection. This is particularly the case when, for example, the non-financial statements vaguely indicated certain ambitions to become "climate-neutral" or "net-zero" or similar wording, without supporting this statement with disclosures that indicate specific actions to pursue this ambition or without explaining the means put in place to achieve those objectives, most notably by distinguishing between emission reductions and the use of other means such as carbon credits or GHG removals and the related credibility and integrity of these.

Some plans were also published with a number of omissions of some of the key elements of a transition plan, such as the description of the actions and the timeline for their implementation, the indication of the progress made on implementing those actions and meeting pre-set targets, the resources necessary to pursue the plan as well as the challenges and uncertainties surrounding the plan.

For further details in this regard see the aforementioned European Commission Recommendation (EU) 2023/1425 of 27 June 2023.

Platform on Sustainable Finance

The Taxonomy Regulation foresees the establishment of a Platform on Sustainable Finance (Article 20). Among the tasks of this platform will be to review the thresholds by taking into account technological changes and to advise the European Commission on the need to update the taxonomy by including or excluding certain activities. However, as the said FAQ document explains (p.7), this process should not lead to uncertainty or liability risks for investors.

Financial market participants who feel that a certain activity should be considered as environmentally sustainable for investment purposes should inform the Commission by submitting scientific evidence for their suggestion. This feedback will help the Commission and the Sustainable Finance Platform to evaluate the appropriateness of complementing or updating the taxonomy. It is also stressed that some of the technical criteria proposed may take the form of dynamic thresholds that are tightened over time in order to meet the increasingly ambitious objectives in a gradual way. This is intended to be an approach that allows for dynamism but also provides for certainty upfront as the path of tightening can be determined when establishing the thresholds.

Publication requirements

The Taxonomy Regulation' requires, in its Article 8, undertakings subject to an obligation to publish non-financial information pursuant to Article 19a or Article 29a of the Accounting Directive to include in their non-financial statements or consolidated non-financial statements information on how, and to what extent, their activities are associated with economic activities that qualify as environmentally sustainable under Articles 3 and 9 of the Regulation.

|

Taxonomy Regulation, Article 8

Transparency of undertakings in non-financial statements 1.Any undertaking which is subject to an obligation to publish non-financial information pursuant to Article 19a or Article 29a of Directive 2013/34/EU shall include in its non-financial statement or consolidated non-financial statement information on how and to what extent the undertaking’s activities are associated with economic activities that qualify as environmentally sustainable under Articles 3 and 9 of this Regulation. 2.In particular, non-financial undertakings shall disclose the following: (a) the proportion of their turnover derived from products or services associated with economic activities that qualify as environmentally sustainable under Articles 3 and 9; and (b) the proportion of their capital expenditure and the proportion of their operating expenditure related to assets or processes associated with economic activities that qualify as environmentally sustainable under Articles 3 and 9. 3.If an undertaking publishes non-financial information pursuant to Article 19a or Article 29a of Directive 2013/34/EU in a separate report in accordance with Article 19a(4) or Article 29a(4) of that Directive, the information referred to in paragraphs 1 and 2 of this Article shall be published in that separate report. 4.The Commission shall adopt a delegated act in accordance with Article 23 to supplement paragraphs 1 and 2 of this Article to specify the content and presentation of the information to be disclosed pursuant to those paragraphs, including the methodology to be used in order to comply with them, taking into account the specificities of both financial and non-financial undertakings and the technical screening criteria established pursuant to this Regulation. The Commission shall adopt that delegated act by 1 June 2021. |

Taxonomy |

For this purpose, Article 8(2) requires non-financial undertakings to use three taxonomy key performance indicators (KPIs) related to environmentally sustainable activities, i.e. the proportion of their turnover, their capital expenditure (‘CapEx’) and their operating expenditure (‘OpEx’).

Following the review of the NFRD by the Corporate Sustainability Reporting Directive (CSRD), the scope of undertakings covered by Article 8 of the Taxonomy Regulation has been enlarged (in particular, to include listed small and medium size enterprises - SMEs).

Moreover, Article 8(4) of the Taxonomy Regulation requires the European Commission to adopt a delegated act to supplement the above obligations by specifying the content, presentation and methodology of the information to be disclosed by both financial and non-financial undertakings subject to the Non-Financial Reporting Directive.

The delegated act under Article 8(4) is to set out when and how relevant turnover and expenditures associated with activities included in the Delegated Regulation count as taxonomy-aligned. This delegation has been exercised by the Commission Delegated Regulation (EU) 2021/2178 of 6 July 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation (Taxonomy Disclosures Delegated Act).

Hence, the Taxonomy Disclosures Delegated Act specifies the information to be disclosed as well as the timing for the disclosure - for non-financial undertakings within the scope of these requirements, 2023 is the first year of reporting of alignment information regarding the climate mitigation and adaptation objectives (including regarding activities covered by the Complementary Climate Delegated Act on gas and nuclear), in addition to eligibility information.

Qualitative disclosures for asset managers, credit institutions, investment firms and insurance and reinsurance undertakings

Under the Commission Delegated Regulation of 6 July 2021 the main KPIs for financial undertakings (banks, investment firms, asset managers, insurers) relate to the proportion of environmentally sustainable economic activities in their financial activities, such as lending, investment and insurance.

According to the Annex XI of the Commission Delegated Regulation of 6 July 2021 the disclosure of quantitative KPIs must be accompanied by the following qualitative information to support the financial undertakings’ explanations and markets’ understanding of these KPIs:

– contextual information in support of the quantitative indicators including the scope of assets and activities covered by the KPIs, information on data sources and limitation;

– explanations of the nature and objectives of taxonomy-aligned economic activities and the evolution of the taxonomy-aligned economic activities over time, starting from the second year of implementation, distinguishing between business-related and methodological and data-related elements;

– description of the compliance with the Taxonomy Regulation in the financial undertaking’s business strategy, product design processes and engagement with clients and counterparties;

– for credit institutions that are not required to disclose quantitative information for trading exposures, qualitative information on the alignment of trading portfolios with the Taxonomy Regulation, including overall composition, trends observed, objectives and policy;

– additional or complementary information in support of the financial undertaking’s strategies and the weight of the financing of taxonomy-aligned economic activities in their overall activity.

It is also noteworthy that the Complementary Climate Delegated Act presented by the European Commission on 2 February 2022 (subject to the scrutiny of the European Parliament and the Member States) provides for specific disclosure requirements associated with natural gas and nuclear energy activities included in the act, by amending the aforementioned Commission Delegated Regulation (EU) 2021/2178 of 6 July 2021.

The amendment will introduce requirements for large listed non-financial and financial companies to disclose the proportion of their activities linked to natural gas and nuclear energy (more specifically, financial and non-financial companies should present specific disclosure requirements that would show to what degree gas and nuclear energy activities, complying with the technical screening criteria, is in the numerator and denominator of the key performance indicators of those undertakings).

With the help of this specific disclosure requirement, investors that are not willing to invest in nuclear and gas activities under the conditions in the Complementary Climate Delegated Act would be able to identify and invest in activities and financial products that have no exposures to economic activities in the nuclear and gas sectors - see below Recital 15 of the Complementary Climate Delegated Act presented by the European Commission on 2 February 2022.

Complementary Climate Delegated Act presented by the European Commission on 2 February 2022, Recital 15

It is necessary that non-financial and financial undertakings provide investors with a high degree of transparency concerning their investments in fossil gas and nuclear energy generation activities for which technical screening criteria should be laid down. To provide that transparency, specific disclosure requirements for non-financial and financial undertakings should be laid down. In order to ensure comparability of the information disclosed to investors, that information should be presented in the form of a template that indicates clearly the proportion of fossil gas and nuclear energy activities in the denominator and, where appropriate, the numerator of key performance indicators of those undertakings. In order to provide a high degree of transparency to investors in financial products referred to in Article 5 and Article 6 of Regulation (EU) 2020/852 concerning exposures to fossil gas and nuclear energy activities, for which technical screening criteria are laid down, the Commission will amend or propose to amend the disclosure framework pertaining to those financial products as appropriate to provide for full transparency over the whole life of those financial products. To ensure that such information is clearly identified by end- investors, the Commission will consider amending the requirements on the financial and insurance advice given by distributors.

Further modificarions of the Commission Delegated Regulation (EU) 2021/2178 have been made by the Commission Delegated Regulation of 27.6.2023 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and restoration of biodiversity and ecosystems and for determining whether that economic activity causes no significant harm to any of the other environmental objectives and amending Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities (C(2023) 3851 final), to clarify the disclosure obligations for the additional activities.

Timelines for the disclosures implementation

The disclosure requirements are to be implemented stepwise. In particular, from 1 January 2022 until 31 December 2022, non-financial undertakings are only required to disclose the proportion of taxonomy-eligible and taxonomy non-eligible economic activities in their total turnover, capital and operational expenditure and the respective qualitative information. The details are stipulated in Article 10 of the Commission Delegated Regulation of 6 July 2021 - see below.

Commission Delegated Regulation (EU) 2021/2178 of 6 July 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation

Article 10

Entry into force and application

1. From 1 January 2022 until 31 December 2022, non-financial undertakings shall only disclose the proportion of Taxonomy-eligible and Taxonomy non-eligible economic activities in their total turnover, capital and operational expenditure and the qualitative information referred to in Section 1.2. of Annex I relevant for this disclosure.

2. From 1 January 2022 until 31 December 2023, financial undertakings shall only disclose:

(a) the proportion in their total assets of exposures to Taxonomy non-eligible and Taxonomy-eligible economic activities;

(b) the proportion in their total assets of the exposures referred to in Article 7, paragraphs 1 and 2;

(c) the proportion in their total assets of the exposures referred to in Article 7(3);

(d) the qualitative information referred to in Annex XI.

Credit institutions shall also disclose the proportion of their trading portfolio and on demand inter-bank loans in their total assets.

Insurance and reinsurance undertakings shall also disclose the proportion of Taxonomy-eligible and Taxonomy non-eligible non-life insurance economic activities.

3. The key performance indicators of non-financial undertakings, including any accompanying information to be disclosed pursuant to Annex I and II of this Regulation, shall be disclosed from 1 January 2023.

4. The key performance indicators of financial undertakings, including any accompanying information to be disclosed pursuant to Annex III, V, VII, IX, XI of this Regulation, shall be disclosed from 1 January 2024.

Sections 1.2.3. and 1.2.4. of Annex V shall apply from 1 January 2026.

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

As of January 2022 (for the reporting period 2021), companies under the scope of the NFRD started reporting the proportion of their activities (or the proportion of their exposure to activities) that are considered as eligible in the EU Taxonomy vs. those that are not eligible (i.e., not covered in the Taxonomy). At this stage, the companies in question are not required to assess the Taxonomy-alignment of these activities. They are also only required to report against activities related to the climate objectives (activities related to other objectives are to be published in 2023).

This is the exact first step in the Taxonomy compliance procedure: to identify Taxonomy-eligible activities. It applies to any company, which must pose and answer the question: “Which of the activities performed by my company are covered by the EU Taxonomy?”.

In 2023 (for the reporting period 2022), non-financial companies under the scope of the NFRD need to report what activities are considered as aligned with the EU Taxonomy's climate objectives.

This is the second step in the Taxonomy compliance procedure: to assess EU Taxonomy alignment of the activities and to identify Taxonomy-aligned ones. The Technical Screening Criteria will be used for this purpose. This second step applies to any company falling under the scope of NFRD/CSDR, and these companies must pose and answer the following questions:

- How can my company assess if specific activities qualify as contributing substantially to climate change mitigation and are therefore potentially aligned with the EU Taxonomy?

- How can my company assess that eligible activities meet the Do No Significant Harm (DNSH) criteria?

- How can my company benefit from the EU Taxonomy if it conducts activities that enable others to adapt to impacts of climate change?

Similar requirements apply to large financial institutions in 2024 for activities related to climate objectives (for the reporting period 2023), with the exception of trading book and fees and commissions for non-banking activities from credit institutions (banks) that are delayed to 2026. Hence, financial undertakings are required to report their green assets ratio (GAR) and other KPIs as of 1 January 2024.

After a transition period of three years, in 2026 (for the reporting period 2025), credit institutions (banks) will also need to report on alignment of their trading book and fees and commissions for non-banking activities.

The CSRD enlarges the scope of companies that will need to publish sustainability information to all large and all listed companies (with the exception of micro companies). Large companies that are not under the scope of the NFRD will need to report for the first time in 2026 (for the reporting period 2025).

Listed SMEs will need to report for the first time in 2027 (for the reporting period 2026). They may however decide to opt out of the reporting requirements for a further two years.

|

Commission Delegated Regulation (EU) 2023/2486 of 27 June 2023 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and restoration of biodiversity and ecosystems and for determining whether that economic activity causes no significant harm to any of the other environmental objectives and amending Commission Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities (Taxonomy Environmental Delegated Act) Article 5 Amendments to Delegated Regulation (EU) 2021/2178 Delegated Regulation (EU) 2021/2178 is amended as follows:

|

Enforcement

The ESMA document of 26 March 2024 „2023 Corporate Reporting Enforcement and Regulatory Activities Report” (ESMA32-193237008-8269)presents the review of regulatory compliance as regards disclosures relating to Article 8 of the Taxonomy Regulation. ESMA recalled that financial year 2022 had been the first year of reporting of alignment information regarding the climate mitigation and adaptation objectives for the non-financial undertakings in scope. To provide timely feedback to the market, ESMA and enforcers carried out a fact-finding exercise on the reporting under the Disclosures Delegated Act (Commission Delegated Regulation (EU) 2021/2178 of 6 July 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation), whose results were published in October 2023.

The study covered 54 non-financial issuers mainly active in four sectors covered by the Taxonomy Climate Delegated Act. 14 additional issuers were also considered by enforcers in relation to this priority. Enforcers took nine enforcement actions in relation to issuers’ disclosures relating to Article 8 of the Taxonomy Regulation, or the lack thereof, in 2022 non-financial statements, all by requiring a correction in the future non-financial statement. The corrections in the future non-financial statements relate, among other topics, to inconsistencies or errors in CapEx and in OpEx alignment KPI calculations, not correctly providing quantitative information in the mandatory template, and a lack of information on relevant methodologies. Some enforcers, instead of taking enforcement actions, issued recommendations to issuers or carried out reviews assessing the application of the Taxonomy Regulation across issuers, with findings released to market participants as part of educational efforts.

Links

Links