Electricity Price Area Differentials (EPAD) are instruments used in the Nordic countries involved with the operation of the virtual hubs in the electricity markets. Commission Staff Working Document of 14 March 2023 (SWD(2023) 58 final) observes that In the Nordics, trading has been organised around the notion of a virtual hub for many years. A virtual hub is not a trading venue as such, but rather an aggregation of bidding zones characterised by a reference price. A hub has a reference system price, against which market participants can hedge their price exposure. The system price is an unconstrained market clearing reference price for the Nordic region. It is calculated without any congestion restrictions by setting capacities to infinity.

To complement the Nordic hub, financial instruments like EPADs are issued to enable market participants to cover the price difference between the hub and their respective zone. Market participants can issue EPADs on an auctioning platform and a secondary market takes place on Nasdaq. The creation of a hub has allowed to enhance liquidity by aggregating volumes from individual bidding zones. However, in the public consultation, respondents complained about the declining liquidity of EPADs and explained that forward transmission capacity is not offered by TSOs. Nevertheless, respondents rate this experience rather or very positively and explain that Nordic hub product has been successful in providing more liquidity than what single zone futures would have had. In their view, virtual hubs are an interesting instrument to combine several markets to a larger, more liquid market. However, they insist on the importance of complementing financial futures with other instruments such as LTTRs or EPAD to enable them to work across borders.

In turn, Commission Staff Working Document of 30 November 2016 {COM(2016) 752 final} SWD(2016) 385 final), refers to the EPADs as follows (p. 35):

"In the context of a limited number of liquid forward markets in Europe, the cross-border access to these markets becomes particularly important. The cross-border access to forward markets depends on the market design. In most of Europe the cross-border access to forward markets is based on TRs, either physical (PTRs) or financial (FTRs), issued by TSOs which enable market participants to hedge short-term price differentials between two neighbouring zones. In the Nordic and Baltic markets and within Italy, cross-border access to forward markets is based on contracts which cover the difference between the relevant "hub" price (which represents the forward price reference for a group of bidding zones) and each specific bidding zone price. Examples of these contracts are the so-called Electricity Price Area Differentials (EPADs) in the Nordic and Baltic markets or FTRs within Italy."

Data on the EPADs' important economic parameters can be found in the ACER/CEER Annual Report of September 2016 on the Results of Monitoring the Internal Electricity Market in 2015 - see tables below.

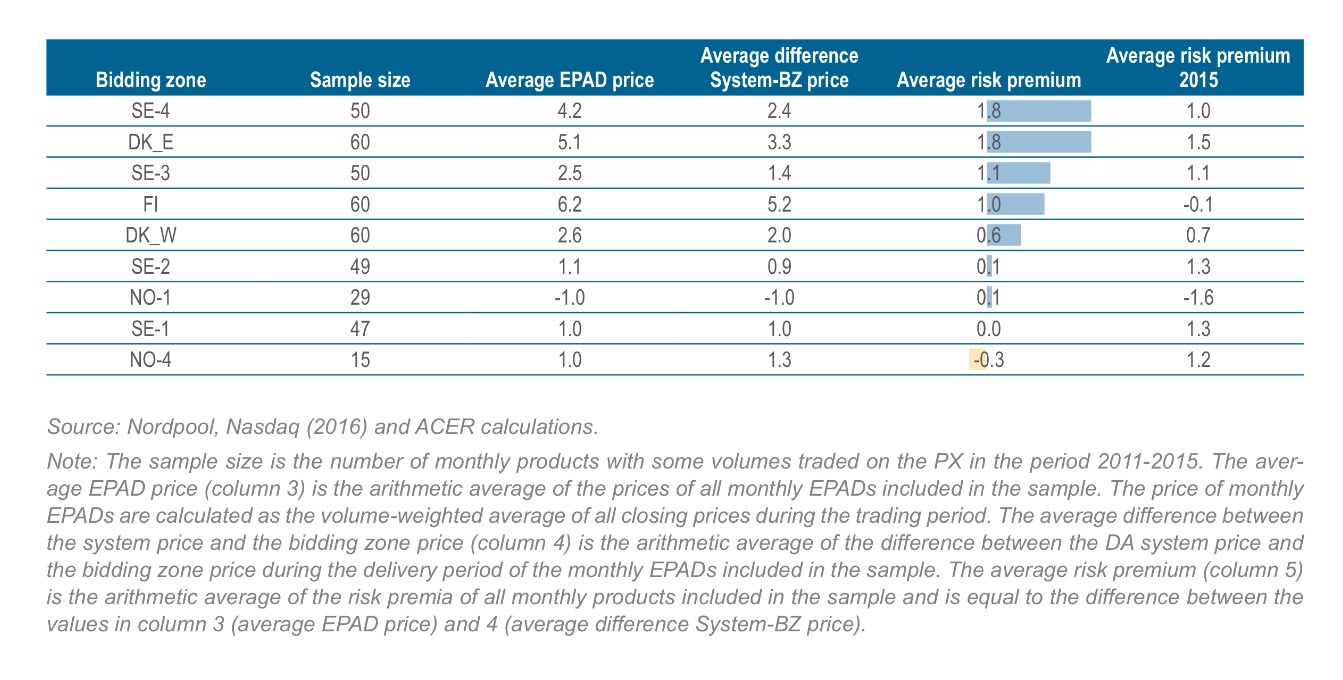

Discrepancies between the price of EPADs (monthly products) and the DA price spreads between the system price and the relevant price in the bidding zone – 2011–2015 (euros/MWh)

source: ACER/CEER Annual Report on the Results of Monitoring the Internal Electricity Market in 2015, September 2016, p. 39

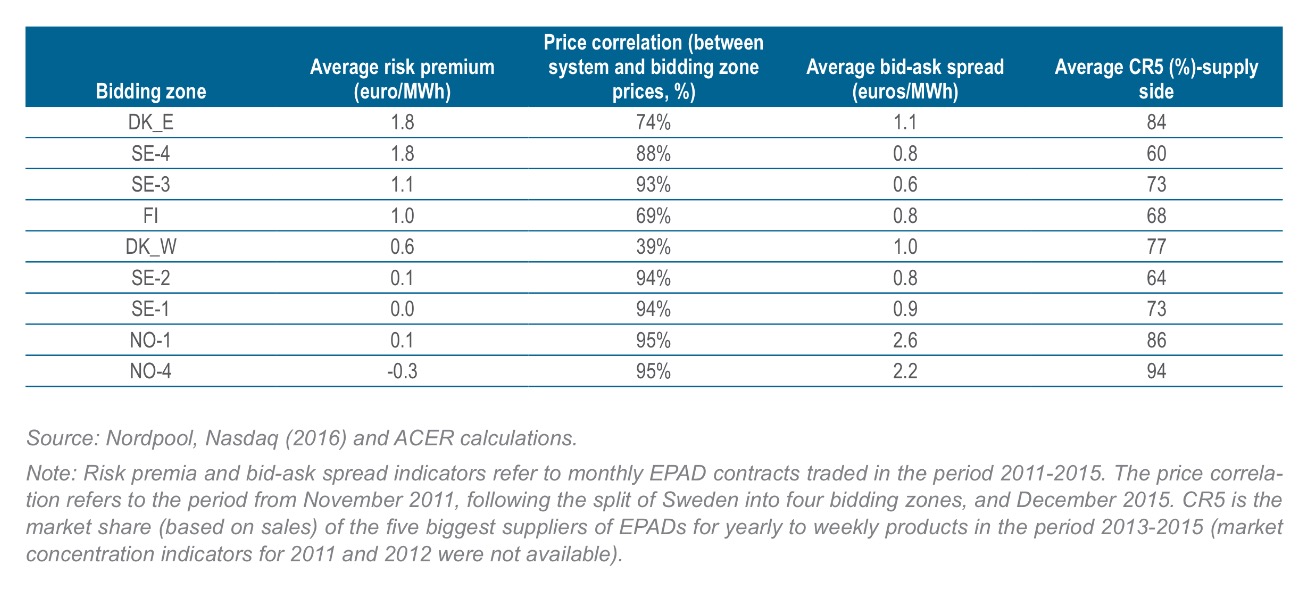

Average risk premia, price correlation between system and zonal price, average bid-ask spread, and supply concentration levels of traded EPADs on the power exchange – 2011–2015 (euros/MWh and %)

source: ACER/CEER Annual Report on the Results of Monitoring the Internal Electricity Market in 2015, September 2016, p. 40

Long-Term Transmission Rights (LTTRs)

|

Documentation