"Standard contract" in the REMIT compliance system means a contract concerning a wholesale energy product admitted to trading at an organised market place (OMP), irrespective of whether or not the transaction actually takes place on that market place. In the opposition to the above definition the term "non-standard contract" has been established, which means a contract concerning any wholesale energy product "that is not a standard contract". Both definitions are relevant for REMIT transactions and orders reporting.

Commission Implementing Regulation No 1348/2014 on data reporting implementing REMIT envisions two important databases maintained by the Agency for the Cooperation of Energy Regulators (ACER) in order to facilitate REMIT reporting:

- first - containing a list of organised market places,

- second - a public list of standard contracts.

Let's take here a closer look at this later list.

List of standard contracts

The legal base for the ACER's list of standard wholesale energy contracts is Article 3(2) of the Commission Implementing Regulation No 1348/2014.

According to this provision ACER shall draw up a list of standard contracts and update that list in a timely manner in order to facilitate reporting.

In order to assist the Agency to comply with its obligation, organised market places shall submit identifying reference data for each wholesale energy product they admit to trading to the Agency. The information shall be submitted before trading commences in that particular contract in a format defined by the Agency. Organised market places shall submit updates of the information as changes occur.

As ACER explains in the Trade Reporting User Manual (TRUM) the purpose of the list of standard contracts is to specify the supply contract types for which Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014 (the standard reporting form) is applicable.

The creation of the list of standard contracts is not intended to assign unique identifiers to the contracts listed, nor will the information collected be used for matching against the transaction reports. The only purpose of the public list of standard contracts is to display the characteristics of each contract type for which the standard reporting form is applicable. The list of standard contracts is intended to cover both physical and financial contracts traded at organised market places. The detailed requirements for the content of fields of the list of standard contracts have been stipulated by the ACER's REMIT Guidance on the List of Standard Contracts (see attachment). The identifying reference data, to be submitted by organised market places, pursuant to the said ACER's REMIT Guidance on the List of Standard Contracts, must contain the following information:

a) Contract name

This field identifies the name of the contract as identified by the organised market place hosting the trading of the contract. This field is identical to field 22 in Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014. The contract name may or may not be a venue specific name. The contract name can be unique for a particular organised market place or the same name can also be used by several organised market places.

b) Delivery zone

This field report the EIC Y code (or alternative code if the EIC is not available) to identify the delivery and/or balancing point for the contract. This field is identical to field 48 in Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014.

c) Energy commodity type

Description of accepted values NG=Gas EL=Electricity This field identifies the energy commodity of the product delivered; either natural gas or electricity. The field is identical to field 24 in Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014.

d) Contract type

Accepted values for this field are:

AU=Auction

CO=Continuous

FW=Forward style contract

FU=Future style contract

OP=Option style contract

OP_FW=Option on a forward

OP_FU=Option on a future

OP_SW=Option on a swap

SP=Spread

SW=Swap (financial)

OT=Other

This field identifies the type of contract that is reported. The field is identical to field 23 in Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014.

e) Load type

Accepted values for this field are:

BL=Base load

PL=Peak load

OP=Off-Peak load

BH=Hour/Block Hours

SH =Shaped

GD=Gas Day

OT=Other

This field identifies the delivery profile (base load, peak load, off-peak, block of hours or other) of the contract. The load type should be defined as per the definition of the organised market place hosting the contract. This field is identical to field 52 in Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014.

f) Organised market place ID

This can be LEI or MIC or ACER code

g) Full name of the market place

h) Type of organised market place

Accepted values for this field are: Broker, EXC= Exchange, OTH= Other person professionally arranging transactions.

The ACER's list of standard wholesale energy contracts is available here. The numbers in that regard are quite significant as the ACER's document Recap of the REMIT transaction reporting regime: List of Organised Market Places and the List of Standard contracts of the 8 September 2015 mentioned 7500 standard contracts reported to ACER by organised market places, while in October 2018 the Centralised European Registry of Energy Market Participants (CEREMP) listed 13673 standard contracts.

ACER's understanding of the term "standard contract"

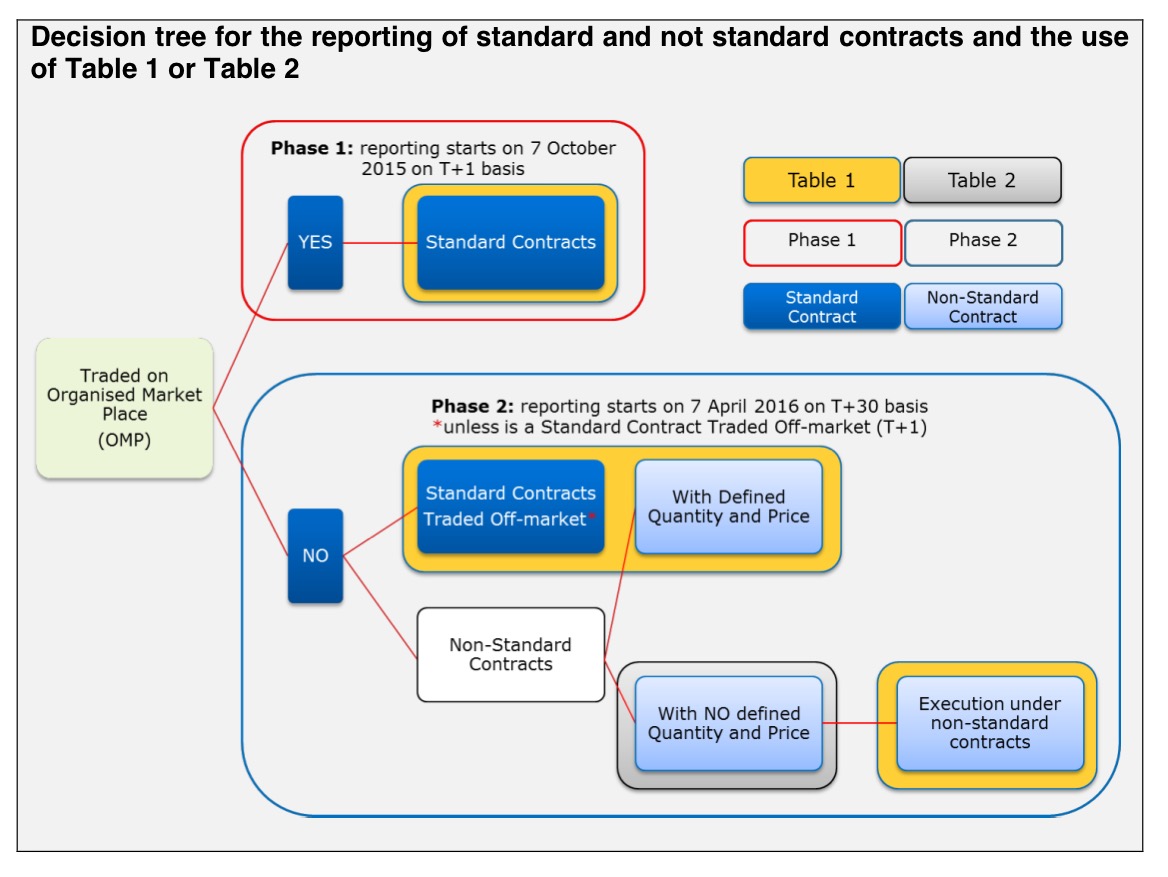

The prima facie simple and clear definition of standard contract becomes somewaht complex in the light of ACER's remarks contained in the TRUM. The said Commission Implementing Regulation No 1348/2014 mandates that any contract admitted to trading at an organised market place is a standard contract. If the same contract is traded outside the organised market place, this shall still be considered a standard contract. It has been depicted in the TRUM with the use of the following diagram:

(Source of the diagram: TRUM)

The REMIT Implementing Regulation imply that any contract admitted to trading at an organised market place is a standard contract. Furthermore, if the same contract is traded outside the organised market place, this shall still be considered a standard contract. An example of a contract admitted to trading at an organised market place is a futures contract on gas or electricity. This futures contract is a wholesale energy product, and as per the definition of the TRUM it is a tradable instrument that allows market participants to trade a product (i.e. energy commodity) that may also be traded bilaterally or through a broker outside the exchange. In this case, such contract shall be considered a standard contract.

(Source of the diagram: TRUM)

Transactions that take place on broker platforms, including those that are voice brokered, are often based on bilateral general agreements, e.g. a master agreement which sets the rules for trading activity of the two counterparties to the contract. As the conclusion of such contracts take place on the broker's platform (including voice brokered), these contracts are standard contracts. Another example is a spot or forward contract for the physical delivery of electricity concluded on a broker's platform under a general/master agreement. This is a standard contract irrespective of its profile and complexity, e.g. a shaped (profile) contract traded through a broker (including voice brokered) shall be considered a standard contract. Two parties may also trade and conclude the same contract under a general/master agreement bilaterally outside the organised market place.

Importance of specific delivery point/area

When a contract for the delivery of gas or electricity at a specific delivery point/area is not traded at an organised market place, but only bilaterally between the two parties, that contract should not be considered a standard contract even if a similar contract for the delivery of gas or electricity at a different delivery point/area is traded at an organised market place

If the two parties bilaterally trade a contract which is admitted to trading at an organised market place, that contract shall be considered a standard contract, e.g. a spot or forward contract for the physical delivery of gas or electricity. However, when a shaped (profile) contract is traded outside the market place, that contract should not be considered a standard contract. When a contract for the delivery of gas or electricity at a specific delivery point/area is not traded at an organised market place, but only bilaterally between the two parties, that contract should not be considered a standard contract even if a similar contract for the delivery of gas or electricity at a different delivery point/area is traded at an organised market place.

For example, if a physical forward for the delivery of gas in country (A) in the month of July is traded on a broker platform, but a contract with the same characteristics for the delivery of gas in country (B) in the month of July is not traded on an organised market, the latter should not be considered a standard contract.

Finally, in the edition of the TRUM of 30 June 2020 (p. 19) ACER referred to potential uncertainties about the specifications of a standard contract agreed bilaterally. The Agency understands that there might be some circumstances where market participants may not have full visibility to the specifications of the standard contracts traded on organised market places. Therefore, according to the ACER, whenever two market participants enter into a bilateral contract agreed outside an organised market place and, despite the information provided by the public List of Standard Contracts available on the REMIT portal, they do not have the certainty that their contract is the same as the one traded on organised market places, it can be assumed that:

- the bilaterally agreed contract normally entails some elements of customisation,

- these elements of customisation distinct the bilateral contract from contracts on wholesale energy products admitted to trading at an organised market place.

Parties may therefore report such a contract on a T+1 month basis and, where the contract has a defined price and quantity, with Table 1 of the Annex to the REMIT Implementing Regulation.

|

Local Flexibility Products

FAQs on REMIT transaction reporting, 16th edition, 13 March 2024

Question 2.1.54 Extra field in the schema [NEW] Our Exchange plans to offer the possibility to trade Local Flexibility Products within the EU. Such products are designed to solve local congestions on the grid of DSOs or the TSO through the trading of electricity. Local Flexibility Products are offered on markets characterised by a single buyer, that is the System Operator, representing the interests of DSOs and the TSO and multiple sellers. Local Flexibility Products can be traded as part of auction or continuous trading within the day-ahead or intraday timeframe. When operating a flexibility market, precise asset location information is necessary for the System Operator to manage congestion and frequency. We would like to clarify whether the product concerning such congestion management (local flexibility) is subject to REMIT reporting requirements. Additionally, we are seeking guidance on ACER's expectations regarding the reporting of transaction data for trading activities related to congestion management.

Answer It is the Agency’s understanding that in case of Local Flexibility Products the platform offered by the Exchange is used by, on one side, the TSO/DSOs (via the System Operator) to access the liquidity of the Exchange to coordinate their congestion management solutions, and, on the other side, by the Exchange members. Despite the presence of an aggregator (i.e. the System Operator) with the function to reduce congestion in the electricity grid, this arrangement represents the bringing together of multiple third-party buying and selling interests in wholesale energy products in a way that results in a contract. Therefore, both orders and trades should be reported to ACER in accordance with Article 3(1)(i) and (ii) of REMIT Implementing Regulation. The contracts related to these new products are considered as standard contracts traded on an OMP and, thus, shall be listed in ACER’s List of Standard Contracts. When reporting Local Flexibility Products under REMIT, the following transaction reporting requirements shall be followed with regards to specific data fields, also with the purpose to correctly flag these transactions as related to products for congestion management: • Since the contracts related to Local Flexibility Products are considered as standard contracts traded on an OMP, they shall be reported using Table 1 of the Annex to REMIT Implementing Regulation. • Both Data Field (21) Contract ID and Data Field (22) Contract name shall start with the prefix “CM_”, followed by the Contract ID and Name, respectively, assigned by the OMP. The prefix ‘CM’ shall stand for ‘Congestion Management’. • Data Field (27) Organised market place ID/OTC: This field identifies the organised market place on which the order was placed, and the trade was concluded related to the Local Flexibility Product. • The Extra field available in the REMITTable1 electronic format shall be used to report the locational information by reporting the respective EAN code as the unique identification number that links the respective connection point to a specific user/address. It will represent the required locational information in the Extra field. For example, if the EAN code is 123456789012345678, it is to be reported as follows: REMITTable1_V3: <Extra>EAN==123456789012345678</Extra> |

|

Frequently Asked Questions (FAQs) on REMIT transaction reporting

Question 1.1.20 Could ACER provide us with additional guidance on the distinction between standard contracts traded outside the organised market places and bilateral contracts that are non-standard contracts? It would be useful to have clear guidance on the reporting time line, e.g. T+1 day or T+1 month.

Answer The Agency has already provided guidance on the definition of standard contract admitted to trade on organised market places in the TRUM. However, the Agency understands that there might be some circumstances where market participants may not have full visibility to the specifications of the standard contracts traded on organised market places. Therefore, whenever two market participants enter into a bilateral contract agreed outside an organised market place and they do not have the certainty that their contract is the same as the one traded on organised market places, it can be assumed that the bilaterally agreed contract normally entails elements of customisation. These elements of customisation distinct the bilateral contract from contracts concerning a wholesale energy product admitted to trading at an organised market place. They may therefore report such a contract on a T+1 month basis and, where the contract has a defined price and quantity, with Table 1 of the Annex to the REMIT Implementing Regulation. |

Consequences of differentiation between standard and non-standard contracts for the transaction reporting obligation under REMIT

|

Frequently Asked Questions (FAQs) on REMIT transaction reporting

Question 1.1.18 All standard contracts have to be reported on a T+1 basis independent of the market they were traded on (OMP or OTC). Since there is no implementation period transactions have to be reported instantly in case a non-standard contract becomes part of that list on a T+1 basis (instead of a T+30 basis). It is not possible for market participants to change the infrastructure for reporting in one day to become compliant.

Answer When a contract previously reported as non-standard contract is admitted to trade at an organised market place we do understand that market participants may need some time before they are able to report their transactions on a T+1 day basis rather than on a T+1 month basis. In this case market participant should make their best efforts to minimise the time they need to start reporting the contract on a T+1 day basis. |

As was said above, under REMIT:

- standard contracts are reported with the use of the Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014 (Reportable details of standard contracts for the supply of electricity and gas (Standard reporting form)),

- non-standard contracts are reported with the use of the Table 2 of the said Annex (Reportable details of non-standard contracts for the supply of electricity and gas (Non-standard reporting form)).

Second important feature of standard contracts under the REMIT reporting scheme is they are reportable on a T+1 day basis (while the mandatory deadline for non-standard contracts is T+1 month).

Given there is no implementation period in case an OTC non-contract is admitted to trading at the organised market place and becomes part of the list of standard contracts, such contracts, as a consequence, must be reported immediately (i.e. on a T+1 basis instead of a T+30 basis).

Acknowledging practical difficulties in abiding by this legal obligation ACER clarified "market participant should make their best efforts to minimise the time they need to start reporting the contract on a T+1 day basis" (see box).

Meaning of "admitted to trading" at an organised market place

ACER has issued an extensive guidance on what is meant by "admitted to trading" at an organised market place when the difference between the standard and non-standard contracts is considered (see box below).

This guidance aims to clarify the Agency's understanding of the difference between a standard contract and a non-standard contract based on Article 2 of Commission Implementing Regulation (EU) No 1348/2014 which states:

(2) 'standard contract' means a contract concerning a wholesale energy product admitted to trading at an organised market place, irrespective of whether or not the transaction actually takes place on that market place;

(3) 'non-standard contract' means a contract concerning any wholesale energy product that is not a standard contract;

In the Agency's view it is essential to further clarify the meaning of "admitted to trading" at an organised market place.

A contract admitted to trading at an organised market place is a contract that is visible to the market and available for trading to market participants.

Exchange traded contracts

For exchange traded contracts it is clear what "a contract admitted to trading" means. In this case a contract that is listed on the exchange is a tradable instrument and it can be registered at the exchange when two parties agree on the price off-screen.

Broker platform traded contracts

For a contract admitted to trading on brokers' platforms it is worth to further clarify the meaning of "admitted to trading".

Brokers, in the context of Article 2(4) of Commission Implementing Regulation (EU) No 1348/2014, advertise tradable contracts on their platforms.

These contracts have certain specifications such as clip size (contract size), delivery point of the energy commodity, delivery start and end date, hours of the delivery and any other specification to identify the contract.

These contracts, e.g. within day or day ahead contract as well as any forward contract, are tradable multiple times until their "expiration date and time" (last trading date and time) is reached.

Once a contract is admitted to trading on the Broker's platform (visible on their screen) it can usually be traded several times either on the screen or voice brokered by both by both buyers and sellers until the date and time the contract is tradable. For example:

1. Hourly electricity product: this can be traded for several days before the gate closure;

2. Day-ahead gas or electricity product: this can be traded for several hours during the day before the delivery of the gas/electricity starts; and

3. A monthly/quarterly/seasonal forward product: this can be traded every day for several months before the delivery starts.

In the Agency's view these contracts have to be considered standard contracts admitted to trading at an organised market place.

As a consequence the organised market place where these wholesale energy products were executed or the order was placed shall, at the request of the market participant, offer a data reporting agreement in line with Article 6(1) of Commission Implementing Regulation (EU) No 1348/2014.

Voice-brokered contracts

In general, the above considerations apply the same way for broker platform traded contracts and voice-brokered contracts. In this context, the references in the TRUM to "including voice brokered" should be understood as referring to those situations where the contracts:

1) are admitted to trading at organised market places;

2) an order is visible on the screen; and

3) a voice brokered order matches the order on the screen. That trade is considered a voice brokered trade.

Specificities of voice-brokered shaped/profile contracts

When a shaped/profile contract is voice brokered without being advertised on the screen of the broker (e.g. a broker's client asks the broker to find a counterparty to a shaped/profile contract), it would be traded only once and would then expire and not be tradable any more (as opposed to those contracts that are traded on the screen and that can be traded multiple times). In the Agenot to be considered "admitted" (advertised on the broker's screen) to trading at an organised market place and it should not be considered a standard contract. Therefore, and in line with Article 7(4) of Commission Implementing Regulation (EU) No 1348/2014 these contracts shall be reported no later than one month following their conclusion, modification or termination.

Since these contracts are voice brokered and executed at an organised market place, in the Agency's view, the broker (in the context of Article 2(4) of the Commission Implementing Regulation) shall at the request of the market participant offer a data reporting agreement in line with Article 6(1) of the Commission Implementing Regulation (EU) No 1348/2014.

Some organised market places may allow their clients to upload on the screen (and therefore be visible to the market) complex shaped/profile contracts for the trading on that organised market place and those contracts which are subject to bids or offers.

Although these contracts might not be traded several times (they may be, or may not be, removed once they are matched) they are still admitted to trading on the screen of the broker and therefore, in the Agency's view, they have to be considered admitted to trading at an organised market place. When this is the case, no matter the contract's complexity, as long as the contract is visible to the market it is considered admitted to trading at the organised market place and it should be considered a standard contract.

The Agency understands that the reporting of complex contracts on a T+1 day basis may bring up some difficulties for the organised market place and/or the reporting party; however, they should make their best effort to report complex shaped/profile contracts (considered standard contracts according to REMIT) as soon as possible.

Consequences of the criterion "admitted to trading" for the transaction reporting obligation

Transactions related to products admitted to trading at the organised market place are subject to the reporting obligations for standard contracts and reportable on a T+ 1 day basis, irrespective of whether they are traded on screen or voice brokered.

Transactions related to any other products that is not a standard contract are subject to the reporting obligations for non-standard contracts and reportable on a T+1 month basis.

TRUM version 2.1, p. 19 et seq.

Reporting for non-standard contracts specifying at least an outright volume and price

ACER's clarification of outright volume and price and reporting frequency for transactions executed within the framework of non-standard contracts

"Details of transactions executed within the framework of non-standard contracts specifying at least an outright volume and price shall be reported using Table 1 of the Annex to the Implementing Acts.

With regard to "specifying at least an outright volume and price", the Agency understands that once the volume and the price of the transaction is known to the two parties (which can occur after the delivery of the commodity), the transaction is complete.

There is little difference between a physical spot/forward contract traded at an organised market place with a price settled against an index and an execution under non-standard contract framework which settles days after the delivery of the energy commodity ends. In fact, both of these two contracts may not have a fixed price or volume before the delivery of the energy commodity starts and, most likely, both of them will be completely settled after the delivery period ends.

However, while the physical spot/forward contract traded on an organised market place is reported with the contracted volume and the fixing index (which most likely is publicly available), the transaction executed under the framework of a non-standard contract has to be reported once the delivered quantity and the price are known, but still using Table 1 of the Annex to the Implementing Acts.

As far the Agency is aware, details of transactions executed within the framework of non-standard contracts specifying at least an outright volume and price are available to both parties to the contract by the invoicing date at the latest. On that basis, those executions under the framework of non-standard contract are reportable no later than 30 days after the invoicing date using Table 1 of the Annex of the Implementing Acts."

The differentiation that standard contracts are reported with the use of Table 1 of the Annex to the Commission Implementing Regulation No 1348/2014 while non-standard contracts with the use of Table 2, can not be considered fully comprehensive without mentioning Article 5(1) of the said Regulation which states:

"[d]etails of transactions executed within the framework of non-standard contracts specifying at least an outright volume and price shall be reported using Table 1 of the Annex".

According to the TRUM (point 3.2.5, p. 16), this Article implies that "even if the contract is considered non-standard contract but has an agreed price and quantity, the contract has to be reported using Table 1 of the Implementing Acts.

However, it is important to note that under the non-standard contract reporting requirement such a contract would be reportable no later than 30 days from its execution rather than within the time limit for standard contracts of no later than the following business day."

REMIT Guidance on the List of Standard Contracts, ACER, 8 October 2015

Links

Links