MiFID II ancillary activity ("commodity derivatives trader") exemption - Article 2(1)(j)

- Category: MiFID II/MiFIR

Why do I consider ancillary activity exemption from MiFID II to be the central point of interest for firms involved in commodity and carbon trading in the following years?

|

|

4 April 2023

2 March 2023 European Parliament Report on the proposal for a directive of the European Parliament and of the Council amending Directive 2014/65/EU on markets in financial instruments (COM(2021)0726 – C9‑0438/2021 – 2021/0384(COD)) - the amendments to Article 2(4) of MiFID II suggest changes to the parameters Ancillary Activity Exemption. Recital 10a: The current ancillary activity exemption was amended by Directive (EU) 2021/338. That Directive also sets out that instead of a regulatory technical standard, the criteria for establishing when an activity is to be considered to be ancillary to the main business at group level would be established through a Commission delegated act. Commission Delegated Regulation (EU) 2021/1833 entered into force on 3 August 2021 and reduced the administrative burden for persons that trade in commodity derivatives or emission allowances or derivatives thereof on a professional basis to ascertain if they are eligible for the ancillary activity exemption. This exemption entails that they are not required to obtain authorisation as an investment firm when their trading activity is ancillary to their main business. All Union commodity firms can currently benefit from that exemption. Considering the size and nature of the business of some of these entities, and following the energy crisis of 2022, the Commission should review the ancillary activity exemption and how that rule has affected liquidity in and the orderly functioning of commodity markets. A review of this exemption was also mentioned in ESMA's answer to the Commission's call for advice to address the excessive volatility in energy derivatives markets. The Commission might also consider whether to mandate ESMA to revise or replace the current exemption test to ensure that the biggest entities are duly licenced and supervised as investment firms for their trading and investment service provision activities.

Article 2 is amended as follows: (a) in paragraph 1, point (d), point (ii) is replaced by the following: ‘(ii) are members of or participants in a regulated market or an MTF, with the exception of non-financial entities that execute transactions on a trading venue for the purpose of liquidity management or that are objectively measurable as reducing risks directly related to the commercial activities or treasury financing activities of those non-financial entities or their groups;’; (b) in paragraph 4, the first two subparagraphs are replaced by the following: ‘4. By [18 months after the entry into force of this amending Directive], the Commission shall adopt a delegated act in accordance with Article 89 in order to supplement this Directive by specifying, for the purpose of point (j) of paragraph 1 of this Article, the criteria for establishing when an activity is to be considered to be ancillary to the main business at group level. Those criteria shall take into account the following elements: (a) whether the net outstanding notional exposure in commodity derivatives or emission allowances or derivatives thereof for cash settlement traded in the Union, excluding commodity derivatives or emission allowances or derivatives thereof traded on a trading venue, is below an annual threshold of EUR 3 billion; or (b) whether the capital employed by the group to which the person belongs is predominantly allocated to the main business of the group; or (c) whether or not the size of the activities referred to in point (j) of paragraph 1 exceeds the total size of the other trading activities at group level; or (ca) whether and to what extent the investment services are provided for hedging purposes.’

23 September 2022 The revised Q&A document reflects mainly the amendments introduced by the Recovery Package for commodity derivatives, including those introduced by the entry into force of the latest technical standards and the Commission Delegated Regulation on the ancillary activity criteria (CDR 2021/1833) replacing RTS 20 which became applicable in November 2021. The main changes in the field of ancillary activity exemption include amendment of the criteria to be met for the ancillary activity exemption and deletion of and the yearly notification of eligibility by the market participant to the relevant NCA.

|

Important update

Directive (EU) 2021/338 of the European Parliament and of the Council of 16 February 2021 amending Directive 2014/65/EU as regards information requirements, product governance and position limits, and Directives 2013/36/EU and (EU) 2019/878 as regards their application to investment firms, to help the recovery from the COVID-19 pandemic substantially modifies legal framework regarding MiFID ancillary exemption.

The said Directive set out new provisions regarding the ancillary activity tests and empowers the European Commission to adopt a delegated act specifying the relevant criteria.

The delegation was exercised by adoption on 14 July 2021 of the Commission Delegated Regulation supplementing MiFID II by specifying the criteria for establishing when an activity is to be considered to be ancillary to the main business at group level.

This modification is not reflected in the remainder of this article, which is mainly based on previous provisions. However, some parts remain applicable and some updates are included.

Directive (EU) 2021/338 of the European Parliament and of the Council of 16 February 2021 amending Directive 2014/65/EU as regards information requirements, product governance and position limits, and Directives 2013/36/EU and (EU) 2019/878 as regards their application to investment firms, to help the recovery from the COVID-19 crisis

Recital 11

Directive 2014/65/EU allows persons that trade in commodity derivatives or emission allowances or derivatives thereof on a professional basis to make use of an exemption from the requirement to obtain authorisation as an investment firm when their trading activity is ancillary to their main business. Currently, persons applying for the ancillary activity exemption are required to notify annually the relevant competent authority that they make use of that exemption and to provide the necessary elements to satisfy the two quantitative tests that determine whether their trading activity is ancillary to their main business. The first test compares the size of an entity’s speculative trading activity to the total trading activity in the Union on an asset class basis. The second test compares the size of the speculative trading activity, with all asset classes included, to the total trading activity in financial instruments by the entity at group level. There is an alternative form of the second test, which consists of comparing the estimated capital used for the speculative trading activity to the actual amount of capital used at group level for the main business. For the purposes of establishing when an activity is considered to be an ancillary activity, competent authorities should be able to rely on a combination of quantitative and qualitative elements, subject to clearly defined conditions. The Commission should be empowered to provide guidance on the circumstances under which national authorities can apply an approach combining quantitative and qualitative threshold criteria, as well as to develop a delegated act on the criteria. Persons that are eligible for the ancillary activity exemption, including market makers, are those dealing on own account or those providing investment services other than dealing on own account in commodity derivatives or emission allowances or derivatives thereof to customers or suppliers of their main business. The exemption should be available for each of those cases individually and on an aggregate basis where the activity is ancillary to their main business, when considered on a group basis. The ancillary activity exemption should not be available for persons who apply a high-frequency algorithmic trading technique or are part of a group the main business of which is the provision of investment services or banking activities, or acting as a market maker in relation to commodity derivatives.

It follows from the key legislative modification brought by MiFID II with respect to this institution, i.e. the essential (and ground-breaking in nature) fact is that strict, quantitative parameters have been established, which delineate what trades and volumes can be understood as "ancillary".

Another important requirement introduced initially by the MiFID II was for annual notification of financial authorities by counterparties making use of this exemption, however, this formality was abolished by the Directive (EU) 2021/338 of the European Parliament and of the Council of 16 February 2021 amending Directive 2014/65/EU as regards information requirements, product governance and position limits, and Directives 2013/36/EU and (EU) 2019/878 as regards their application to investment firms, to help the recovery from the COVID-19 crisis. Now persons making use of the ancillary activity exemption are required to report only upon request to the competent authority the basis on which they have assessed that their activity is ancillary to their main business.

Under the regulatory regime of MiFID I, Article 2(1)(i) exempted persons dealing on own account in financial instruments, or providing investment services in commodity derivatives to the clients of their main business, provided this was an ancillary activity to their main business, when considered on a group basis, and that the main business was not the provision of investment services within the meaning of MiFID or banking services under Directive 2000/12/EC. This exemption and the one provided by Article 2(1)(k) of MiFID I were intended to cover commercial users and producers of commodities.

The European Securities and Markets Authority (ESMA) observed that the exemption available under MiFID I "are effectively carried over under Article 2(1)(j) of MiFID II in similar but not identical terms. However, the exemption that is currently available under Article 2(1)(k) of MiFID I will cease to exist thereby additional focus will be placed on those exemptions that are carried over."

“Ancillary” transactions for the purposes of the exemption at issue are transactions in financial instruments necessary to support physical trades.

Under MiFID I the criterion for determining when the activity was "ancillary" to the main business was traditionally understood as excluding dealing on own account for speculative purposes in the case of commodity producers (see FCA handbook) however, there were no quantitative criteria in that regard. In the absence of quantitative criteria, market participants under MiFID I did not typically calculate the scale of their activities in specific instruments with regard to determining how much MiFID business they undertook compared to their main business. Moreover, under MiFID I there were no requirements for market participants to notify competent authorities of the use of this exemption.

The effect of this status quo was supervisory practices under MiFID I on how to identify that an activity was "ancillary" to the main business of a person typically made a case-by-case assessment taking into account the variety of factors for key areas of business (such as revenues, profits, employees, etc.), additionally, they were not harmonised across the EU (Cost Benefit Analysis – Annex II Draft Regulatory and Implementing Technical Standards MiFID II/MiFIR of 28 September 2015 (ESMA/2015/1464), p. 414, 415).

The above-mentioned shortcoming of absent quantitative criteria is rectified by the MiFID's new embodiment and its subordinate legislation and this is the first key regulatory switch when it comes to MiFID II new legal environment for commodity and carbon derivatives markets.

Further, the most salient features of the new ancillary activity exemption under the new Article 2(1)(j) MiFID II framework are:

- its scope has been strictly defined and covers financial instruments' types i.e. commodity derivatives, emission allowances and derivatives thereof,

- persons dealing on own account when executing client orders mustn't benefit from this exemption (as well as from any other MiFID II exemption), and in effect must be covered by the MiFID II (see Recital 23 MiFID II).

Article 2(1)(j) MiFID II before Directive (EU) 2021/338

MiFID II Directive does not apply to persons:

(i) who deal on own account, including market makers, in commodity derivatives, emission allowances or derivatives thereof, excluding persons who deal on own account by executing client orders; or

(ii) providing investment services, other than dealing on own account, in commodity derivatives or emission allowances or derivatives thereof to the customers or suppliers of their main business;

provided that:

- for each of the above cases individually and on an aggregate basis this is an ancillary activity to their main business, when considered on a group basis, and that main business is not the provision of investment services within the meaning of this Directive or banking services under Directive 2006/48/EC, or acting as a market-maker in relation to commodity derivatives,

- those persons do not apply a high frequency algorithmic trading technique, and

those persons notify annually the relevant competent authority that they make use of this exemption and upon request report to the competent authority the basis on which they consider that their activity under points (i) and (ii) is ancillary to their main business.

Article 2(1)(j) MiFID II amended by the Directive (EU) 2021/338

Article 1 Amendments to Directive 2014/65/EU

Directive 2014/65/EU is amended as follows:

(1) Article 2 is amended as follows:

(a) in paragraph 1, point (j) is replaced by the following:

‘(j) persons:

(i) dealing on own account, including market makers, in commodity derivatives or emission allowances or derivatives thereof, excluding persons who deal on own account when executing client orders; or

(ii) providing investment services, other than dealing on own account, in commodity derivatives or emission allowances or derivatives thereof to the customers or suppliers of their main business;

provided that:

— for each of those cases individually and on an aggregate basis, the activity is ancillary to their main business, when considered on a group basis,

— those persons are not part of a group the main business of which is the provision of investment services within the meaning of this Directive, the performance of any activity listed in Annex I to Directive 2013/36/EU, or acting as a market maker for commodity derivatives,

— those persons do not apply a high-frequency algorithmic trading technique, and

— those persons report upon request to the competent authority the basis on which they have assessed that their activity under points (i) and (ii) is ancillary to their main business.'

Given, additionally, the extensive scope of MiFID II encompassing more and more commodity trades (see: Physically settled commodity derivatives in MiFID II) and the requirement for the above-mentioned annual notification to be reasoned on the request of financial authorities, it becomes obvious, the strict compliance and legal monitoring of these issues represents the fundamental prudence test for any commodity (as well as carbon) business venture. The preferential treatment of hedging transactions under the new MiFID II ancillary activity exemption is undoubtedly helpful, but does not clear the entire spectrum of potential risks. For the above reasons fully understandable are words of the ESMA Chair, Steven Maijoor, who, introducing the newly-developed September 2015 package of MiFID II draft regulatory technical standards, said:

"The rules put out by ESMA today on MiFID II, MAR and CSDR will notably change the way Europe's secondary markets function. And this will no doubt impact market participants and regulators alike. The magnitude of this change should not be underestimated. But the past has taught us that change is needed in order to make markets more transparent, efficient, and safer to invest in. This will entail a certain cost but we should not forget the other side of this equation, which is the great benefits safer and sounder markets will bring to everybody" (ESMA Press release of 28 September 2015 (ESMA/2015/1466)).

However, it is to be noted a firm that "only engages in hedging in commodity derivatives markets, or has a trading activity deemed to be ancillary to its main business, will not be required to obtain a licence, regardless of its size" (European Banking Authority (EBA) Report on Investment Firms, Response to the Commission's Call for Advice of December 2014, EBA/Op/2015/20 (p. 23).

The ancillary activity exemption does not apply to persons using a high frequency algorithmic trading technique.

Interestingly, one more regulatory U-turn has appeared with the publication on 24 July 2020 by the European Commission of the Proposal for a Directive of the European Parliament and of the Council amending Directive 2014/65/EU as regards information requirements, product governance and position limits to help the recovery from the COVID-19 pandemic (({SWD(2020) 120 final}, COM(2020) 280 final, 2020/0152 (COD)), which, in its assumptions, seems to re-establish the original MiFID I model for ancillary activity exemption (i.e. the European Commission proposes, in particular, the elimination of quantitative criteria and mandatory notifications).

The said quantitative criteria in the context of the Great Britain leaving the EU do not appear adequate and sufficiently sound for MiFID II purposes.

Notification requirement (outdated by the Directive (EU) 2021/338)

In the case of exemption under Article 2(1)(j) of MiFID II (sometimes called: "ancillary activity exemption" or "commodity derivatives trader exemption") persons were initially required to notify annually the relevant competent authority that they made use of this measure and upon request report to the competent authority the basis on which they considered that their activity was ancillary to their main business.

Details for the respective requirement were stipulated in the MiFID II itself, Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business (RTS 20), clarifications issued by the European Securities and Markets Authority (ESMA) in the form of Questions and Answers on MiFID II and MiFIR commodity derivatives topics (ESMA70-872942901-28), as well as in guidance of the EU national competent authorities.

The notification requirement had an "automatic" character, i.e. no request from authorities was needed to initiate the notification procedure.

As opposite, the factual and legal reasoning substantiating the firm's position, it carried out the "ancillary" activity, and, consequently, was exempted from MiFID II, was provided only upon request.

Personal scope of the notification requirement

With respect to the question who was under obligation to notify annually the relevant competent authority of the use of the ancillary activity exemption ESMA explained (Questions and Answers, on MiFID II and MiFIR commodity derivatives topics, ESMA70-872942901-28) that:

"any (natural or legal) person that deals on own account or provides investment services in commodity derivatives as a regular occupation or business on a professional basis pursuant to Article 5 of MiFID II has to be authorised as an investment firm under MiFID II.

However, if the person meets the criteria for activities considered to be ancillary to the main business pursuant to Article 2(1)(j) and the provisions in RTS 20 and makes use of the ancillary activity exemption, then it has to notify annually the relevant competent authority that they make use of this exemption". Moreover, according to the ESMA’s stance of 27 March 2019 a third-country firm (or a third-country subsidiary of an EU firm) dealing on an EU trading venue in commodity derivatives or emission allowances or derivatives thereof was not in scope of the ancillary activity test as per RTS 20. Consequently such third-country firm (or third-country subsidiary of an EU firm) did not have to notify any EU competent authority or ESMA that it made use of the ancillary activity exemption.

|

|

- UK FCA notification guide for the MIFID II ancillary activity exemption,

- German BaFin instructions for the MiFID II ancillary activity notification,

- Spanish CNMV instructions for notification of the exception by ancillary activity and general comments.

|

Notification's timing

On 31 May 2017 ESMA said:

"Article 2(1)(j) of MiFID II exempts persons who deal in commodity derivatives on an ancillary basis under a number of conditions. One of these conditions is that they notify annually the relevant competent authority that they make use of this exemption. The notification needs to have been made for a firm to be able to rely on it. The first of such notifications must be made by January 3rd of 2018. For 2019 and subsequent years, the notification needs to be made by April 1st of each year. Any firm that has not applied for authorisation has to notify" (Questions and Answers, on MiFID II and MiFIR commodity derivatives topics, ESMA70-872942901-28).

ESMA added, moreover:

"When a person’s trading activity increases to such an extent that it can no longer be considered to be ancillary to its main business under Article 2(1)(j), the firm must apply to the competent authority for a license. Firms may not be certain whether they will be able to benefit from the exemption until the data on market size becomes available. Those who have reasonable grounds for considering they will be able to benefit from the ancillary activity exemption should notify. Where subsequently the market data indicates that this is not the case, the firm would be expected to apply for authorisation as soon as reasonably practicable".

Competent authority

According to the said ESMA Q&As, the notification was required to be made to the national competent authority "to which the person would need to apply for authorisation if it were unable to make use of the ancillary activity exemption". At the earlier legislative stage ESMA had been proposing the rule that the competent authority, to which firms should make the annual notification, would be the authority in the jurisdiction in which the firms have their head office. ESMA also noted, then, that entities situated in a third country which undertake ancillary activities in the EU wishing to benefit from the exemption should make the notification to the competent authority of the Member State where their branch is situated. These arrangements should not, however, be interpreted as a requirement for firms to establish a branch in the EU as a pre-requisite to using the ancillary activity exemption.

The more detailed remarks on the complexities involved with the notifications for the MiFID II ancillary activity exemption, as it stood under the previous provisions, are covered below under the headings "Group-relevance" and "Period for calculation".

"Ancillary" criteria

Among potential preconditions for this exemption MiFID II lists (non-mandatorily and non-exhaustively) the proportion of ancillary and main businesses relative to:

1) the size of trading activity, and

2) capitals employed.

Key points for assessments:

1. a group level relevant

2. different asset classes considered separately

3. excluded:

- hedging

- intra-group serving group liquidity and risk management

- market maker

- transactions executed in an entity of the group authorised under MiFID

The MiFID II recitals indicate that the said criteria should ensure that non-financial firms dealing in financial instruments "in a disproportionate manner" compared with the level of investment in the main business are covered by the scope of the MiFID II Directive. In doing so, these criteria should take at least into consideration:

1) the need for ancillary activities to constitute a minority of activities at group level, and

2) the size of their trading activity compared to the overall market trading activity in the asset class.

The rationale of the ancillary activity tests is to check whether entities not subject to financial regulation should be required to acquire an authorisation due to the relative or absolute size of their activity in commodity derivatives, emission allowances and derivatives thereof.

Overall, the pertinent tests were initially (before the Directive (EU) 2021/338 and Commission Delegated Regulation of 14 July 2021 supplementing MiFID II by specifying the criteria for establishing when an activity is to be considered to be ancillary to the main business at group level) designed as follows:

i. The first test (the "trading activity thresholds") expresses the relationship between "speculative" activity and the overall EU market activity in each class of commodity derivatives. The reasons are that firms having a significant share of the market in a particular class of derivatives will not be allowed to benefit from the exemption as they should compete with other market participants on a level playing field.

ii. The second test shall determine whether investment activity is large in size relative to what the entity does as its main business (the "main business thresholds").

"The two limbs of the test ("speculative" activity combined with market share) contribute to ensuring that the test does not capture very small firms with significant non hedging activities but limited market share for which the costs associated with the authorisation as a MiFID investment firm would not be justified by benefits in respect of market integrity or level playing field" (ESMA's Cost Benefit Analysis of 28 September 2015, p. 422).

When it comes to the specific interpretation of the above criteria (set in closer detail in the MiFID II secondary legislation) the ESMA's Discussion Paper on MiFID II/MiFIR of 22 May 2014, ESMA/2014/548) proposed, initially, a sophisticated and, some may say, excessively complex desing. This was followed by more conscise and transparent conceptions in the ESMA's Consultation Paper, MiFID II/MiFIR of 19 December 2014 (ESMA/2014/1570).

The ancillary thresholds proposed by ESMA in the December 2014 Paper were generally considered by same industries as excessively tight (see the example of the relevant correspondence).

See here for the rules of the ancillary test and the test for the size of the trading activity adopted in the latter ESMA's Paper of 19 December 2014.

On 28 September 2015 ESMA published Final Report Draft Regulatory and Implementing Technical Standards MiFID II/MiFIR (ESMA/2015/1464), where the initial ESMA's assumptions as regards the tests' construction underwent a major revamp.

The preliminary question was, however, what happens if the size of the trading activity of the firm compared to the overall market trading activity in the asset class will be above the threshold set in the level 2 legislation while ancillary activities of the firm will still constitute a minority of activities at a group level. The European financial regulator has explained the intention is such firms to be captured by MiFID II. It follows, the two metrics are alternatives (have to be passed cumulatively in order for investment activities to be considered as ancillary and therefore an exemption from MiFID II to apply). This conclusion is also confirmed by the ESMA's remark in the Consultation Paper, MiFID II/MiFIR of 19 December 2014 (ESMA/2014/1570) p. 508 (which clarifies a firm will be captured by the scope of MiFID II "if it either exceeds the threshold set in the ancillary activity test or if it exceeds the threshold set in the trading activity test") as well as the ESMA's Final Report of 28 September 2015 (p. 322) and ESMA's Cost Benefit Analysis of 28 September 2015 (p. 415).

Group-relevance

Another key MiFID II assumption for ancillary test is that the assessments of the proportion of ancillary and main businesses are to be done on a group basis.

The 'group' is defined in Article 2(11) of Directive 2013/34/EU on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings (Accounting Directive), and Article 4(1)(34) of MiFID II refers thereto.

Non-EU entities of a group are covered by the "group"

in the MiFID II meaning regardless of whether the group

is headquartered inside or outside the EU.

Simply put (since the Accounting Directive in that regard is rather elaborate - see here for more detailed description of possible arrangements representing the "group" within the Accounting Directive's meaning), the "group" exists in every case where a dominant influence is exercised by one company over another.

In spite of suggestions for an expansion of the definition of control in order to include elements of indirect control, such as dominance over marketing channels, client relationships, IT infrastructure, administration and back-office procedures, given that Article 4(32) and (33) of MiFID II refers to Article 22 of the Accounting Directive, where elements of control are listed, and there is already understanding (also in other Directives) for this provision, there should't be an expectation that ESMA will give further guidance on the question of when a subsidiary is controlled by a parent undertaking for the purposes of defining main and ancillary activities.

One element deserves, however, to be particularly accentuated, namely the non-EU entities of a group are also covered by the "group" in the MiFID II meaning. The said provisions apply regardless of whether the group is headquartered inside or outside the EU.

Recital 1 of the Commission Delegated Regulation (EU) of 1.12.2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business

The assessment whether persons are dealing on own account or are providing investment services in commodity derivatives, emission allowances and derivatives thereof in the Union as an activity ancillary to their main business should be performed at a group level. In line with Article 2(11) of Directive 2013/34/EU of the European Parliament and of the Council, a group is considered to comprise the parent undertaking and all its subsidiary undertakings and includes entities domiciled in the Union and in third countries regardless of whether the group is headquartered inside or outside the Union.

The consequences of this regulatory interpretation may be significant, but the approach consisting in taking into account also non-EU activities of a group in relation to the group definition when looking at tests designed to identify ancillary activity is supported by strong argumentation:

- in view of the fact the main commercial activities of commodity firms are often located outside the EU, it is necessary to provide a full picture of the group's activities for competent authorities and in order to avoid loopholes;

- a group definition, which does not take into account global activities would give rise to competitive distortions;

- an "EU-only-approach" would require firms to differentiate between EU and non-EU activities in the financial reporting and accounting processes and, thus, require amendments to those processes;

- a global group definition is consistent with the group definition under Article 10 EMIR that refers to clearing thresholds.

Considerable burden for firms of obtaining global data under differing regulatory requirements and the fact that trading decisions are often taken or coordinated at a regional rather than at a global level are taken into account when setting this interpretation, however, in view of the above benefits, ESMA adheres to the definition of the group encompassing also non-EU activities.

|

MiFID II ancillary activity exemption - the procedure's summary

Norton Rose video on ancillary activity exemption

|

Market participants were split over the question whether the calculations should be computed at the level of the group or of the person. They argued that the MiFID licensing regime applies at person level. The ambiguity was also raised whether the group level approach would entail that all entities within the group would be required to obtain a MiFID license where a threshold is exceeded.

Refering to the above issues ESMA, however, observed that the MiFID regime distinguishes between on the one hand (i) the person who has to apply for an authorisation and can benefit from an exemption and, on the other hand, (ii) the requirements for the exemption to the authorisation regime.

The latter refer to the group. Both the licensing requirement and the exemption apply to persons. The persons who can apply for an exemption, i.e., persons dealing on own account or providing investment services, need to make sure that the activity is ancillary to their main business, either on their own personal basis, or regarding the group they belong to.

ESMA concluded that where in a group the thresholds are exceeded, the group has to ensure that the thresholds are not breached in the future, i.e. by setting up a MiFID licensed entity.

The above ESMA's approach is reflected in the Recital 1 of the Commission Delegated Regulation (EU) of 1.12.2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business, which reads:

“The assessment whether persons are dealing on own account or are providing investment services in commodity derivatives, emission allowances and derivatives thereof in the Union as an activity ancillary to their main business should be performed at a group level. In line with Article 2(11) of Directive 2013/34/EU of the European Parliament and of the Council, a group is considered to comprise the parent undertaking and all its subsidiary undertakings and includes entities domiciled in the Union and in third countries regardless of whether the group is headquartered inside or outside the Union.”

In the Questions and Answers ESMA has, moreover, explained that all entities within a group, which cannot be considered as a non-financial group, are required to obtain authorisation as an investment firm under MiFID II, if they wish to trade commodity derivatives. ESMA also underlined that any person that is party to a commodity derivative will need to notify its relevant National Competent Authority and that the notification to the said authority for that person is a condition for using the exemption.

The ancillary exemption applies to persons and this also applies to persons who are part of a group. Therefore, it is not possible for a group to apply for an exemption on behalf of all the entities that the group contains.

It is noteworthy, on 9 April 2018 ESMA invited the European Commission to clarify whether the ancillary activity test should be performed at the group or single entity level (ESMA70-154-5851). The European Commission has answered to the above ESMA’s letter on of 31 May 2018. Referring to the issue the European Commission firstly reminds that Article 2(1)(j) applies the ancillary activity test by comparing the MiFID activities that a person is engaged in with the commercial activities of the person or the group of which the person forms part. In doing so, Article 2(1)(j) accommodates varying commercial group structures whereby groups divide their business activities into separate legal entities to match the different stages in the commercial value chain. The European Commission further observed, that within a group the legal entity facing the market for trading in financial instruments is rarely if ever identical with the legal entity which undertakes, e.g., extraction or production activities. In line with the structure of Article 2(1)(j) MiFID II, the reference to "persons within a group" in Delegated Regulation 2017/592 requires that the ancillary activities test needs to be calculated by each person within a group that engages in either of the two relevant MiFID activities mentioned in the said provision (i.e. dealing on own account and providing investment services in relation to commodity derivatives).

Based on the above observations the European Commission draws a conclusion that the ancillary activities test must be calculated as many times as necessary for each separate person who trades in commodity derivatives within a group. The above view is reasoned by the fact that an authorisation pursuant to MiFID II cannot be obtained by a group of entities which, taken together, do not have a single legal personality, but should be obtained by the relevant entity (or entities) within that group. The Commission also invokes the evidence, which show that a representative sample of the major European energy and agricultural groups conduct the MiFID activities described in Article 2(1)(j) through a single trading entity. This is based on a variety of prudential and commercial considerations which are “well-known” to ESMA (e.g., capital requirements for trading activities, credit quality and netting opportunities). According to the European Commission, this, in practice, means that “the ancillary activity test will need to be performed only once for each group within that sample”. Moreover, in the European Commission’s opinion:

- Article 2(1)(j) MiFID II requires that the test of whether the MiFID activities are ancillary needs to be assessed for both MiFID activities (dealing on own account and providing investment services other than dealing on own account) individually, and on an aggregate basis.

- in practical terms this implies that if a person undertakes both activities, it must pass the ancillary activity test with respect to both MiFID activities and cannot be exempt from MiFID II merely by passing the test for one of the MiFID activities.

Market share test (outdated by the Directive (EU) 2021/338 and Commission Delegated Regulation of 14 July 2021 supplementing MiFID II by specifying the criteria for establishing when an activity is to be considered to be ancillary to the main business at group level)

"Overall market trading activity" = the European Union

trading activity

When it comes to the test for the size of the trading activity, the scope of the term "overall market trading activity" is particularly important, as representing the metric, the person's trading activity is compared to (MiFID II Directive leaves the room for the level 2 legislation for the detailed determination in that regard). For practical reasons the term "overall market trading activity" is understood in this context as the European Union trading activity instead of the reference to the global scale (practical measurement difficulties are acknowledged by ESMA in the latter case). Another key choice with respect to the potential "overall market trading activity" measurement's methods is between the number of contracts or gross notional value of contracts bought and sold during a specified period of time. The latter indicator can be considered as more objective, given the flexibility the parties possess in allocating the trading volumes into individual contracts. In that regard methods for calculation of clearing thresholds under EMIR Regulation pose a clear-cut analogy.

"Commodity firms will have to either curtail some of their 'speculative' trading activity or become authorised under MiFID II, since the exemptions they benefited from under MiFID I are substantially narrowed. Consequently, the ancillary activity exemption and the thresholds ESMA will set is the focus of interest. ESMA's aim, in this regard, is to follow a principle of fairness: the exemption is intended to benefit commercial users and producers of commodities but to capture those firms which undertake pure financial trading that is not related to the hedging of their commercial operations."

Steven Maijoor ESMA Chair, MIFID/MIFIR - CSD hearing before ECON, 24 March 2015 (ESMA/2015/620)

EMIR clearing thresholds as well as ancillary activity criteria for the purposes of MiFID II exemption both can be perceived as the borderlines differentiating sistemically important counterparties from those not impacting the financial system as a whole. It seems logical, if the gross notional value of contracts has already been considered an appropriate metric for EMIR, there should be significant reasons for the adoption of different criterion for MiFID II. It seems that there aren't any in that regard. Gross notional value has been adopted as the relevant metric for measuring trading volumes in calculating ancillary activity thresholds in the draft RTS attached to the ESMA's Final Report of 28 September 2015 and, finally, in the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business.

The resemblance between EMIR institutions and MiFID II ancillary exemption is even more striking when it comes to asset-relevant issues (ESMA decided the size of the trading activity for the purposes of MiFID II ancillary exemption should be divided into the separate asset classes). This seems to reflect, among others, the markets' diversity, where markets for certain goods or assets are global in nature, while for others may be mainly regional. Moreover, the ESMA's stance was that where an entity operates simultaneously in different markets, and is captured by MiFID within one market, it will fall under the scope of MiFID II for all its activities. The above rule is reasoned by the fact that the firm can not be, in principle, MiFID-exempted for its, say, agricultural trading activities, and concurrently subjected to MiFID when it comes to, say, metals. So, the specific exemptions notwithstanding (like for REMIT-related products (the so-called REMIT carve-out) or transitional oil and coal exemption), firm always comes into and leaves the MiFID licence requirements as an integral whole.

Under EMIR the analogous rule applies with respect to clearing thresholds where passing the threshold by the non-financial firm for one asset class, results in the clearing obligation for all asset classes (however, this principle is going to be changed by the European Commission Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208, of May 2017).

Overall, the onus of this test under MiFID II rests, among others, on the reasonable determination of the metric where as the numerator appears the "size of the trading activity of the firm", and as the denominator, "the overall market trading activity".

The European financial regulator initially anticipated to set this proportion at the relatively low level. Draft regulatory technical standards included in the above-mentioned ESMA's Consultation Paper, MiFID II/MiFIR of 19 December 2014 (ESMA/2014/1570) proposed the uniform level of 0,5%, while ESMA's Final Report of 28 September 2015 differentiated thresholds depending on asset classes. Detailed methodologies applied in each of these approaches differed from each other.

Pursuant to the ESMA's Final Report of 28 September 2015 market share test compared the level of a person's trading activity against the overall trading activity in the European Union on an asset class basis to determine the person's market share in accordance with the following rules:

1. The size of the trading activity was determined by deducting the sum of the volume of the transactions referred to in points (a), (b) and (c) of the fifth subparagraph of Article 2(4) of MiFID II ('privileged transactions' - see below) from the volume of the overall trading activity undertaken by the group. Transactions executed in an entity of the group authorised under MiFID were also deducted.

2. The volume of the trading activity was determined by the gross notional value of contracts in commodity derivatives, emission allowances and derivatives thereof on the basis of a rolling annual average of the preceding three calendar years.

3. The overall market size was determined on the basis of trading activity undertaken in the European Union in relation to each asset class: metals, oil, coal, emission allowances and derivatives thereof, gas, power, agricultural products and other commodities.

4. Trading activity comprised trading in contracts traded ouside trading venues to which a person that was located in a EU Member State was party and contracts that were traded on trading venues located in a EU Member State.

5. As commodity markets differ significantly in terms of size, number of market participants, level of liquidity and other characteristics, different thresholds applied for different asset classes in relation to the test on the size of the trading activity, as follows:

(a) 4 % in relation to derivatives on metals;

(b) 3 % in relation to derivatives on oil and oil products;

(c) 10 % in relation to derivatives on coal;

(d) 3 % in relation to derivatives on gas;

(e) 6 % in relation to derivatives on power;

(f) 4 % in relation to derivatives on agricultural products;

(g) 15% in relation to derivatives on other commodities, including freight and commodities referred to in Section C 10 of Annex I to MiFID II;

(h) 20 % in relation to emission allowances or derivatives thereof.

The determination that the overall market trading activity takes into account only the EU activity did not resolve all pertinent problems. There were still some difficulties in performing calculations, in particular, regarding the overall market size in specific asset classes.

ESMA initially asserted it had no legal empowerment to establish such a benchmark, on the other hand it also said it intended to make data available on a best effort basis (ESMA's Cost Benefit Analysis of 28 September 2015, p. 417). However, the said document acknowledges costs would be incurred by market participants to gather and aggregate data on own trading across a group of entities and of overall trading volume for each of the eight asset classes, where the non-financial firm would not rely on the overall market data made available by ESMA. Commodity firms will incur, moreover, one-off staff and IT costs to compute their market share according to the test. On-going compliance costs may be incurred to perform those calculations on a periodic basis throughout the year to monitor where the firm's market share stands, rather than just once a year for notification purposes, as formally requested by Level 1.

The final set-up of the market share test for the MiFID II ancillary activity exemption has been determined in the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business, its details and further legal developments involved are analysed in the article MiFID II ancillary activity exemption - market share test.

Main business test - minority of activities

MiFID II stipulates that ancillary activities must constitute a minority of activities at group level. In the above-mentioned Discussion Paper of 22 May 2014 ESMA proposed the approach that the ancillary activity in commodity derivatives, emission allowances and derivatives thereof could only be considered as constituting a minority of activities if it accounted for less than maximum 50% of the main business of the group. ESMA indicated, moreover, as the ancillary activity must be ancillary on an individual and on an aggregate basis, less than maximum 50% of the main activity at group level must represent all three elements:

- the capital for dealing on own account,

- the capital for the provision of other investment services to customers or suppliers, and

- the sum of these two factors.

In the Consultation Paper of 19 December 2014 ESMA reviewed and amended the suggested approach in relation to these calculations and took into account the overall activity of a group's main business without any further reductions. Moreover, ESMA decided it was necessary to reduce the threshold significantly - to 5% only - "as otherwise even entities with a very low level of commercial activity would not exceed the threshold". The second reason for such radical threshold's reduction was the fact that in relation to this test only trading activity undertaken for non-hedging purposes had to be taken into account. Hence, in the effect of the revised calculation methodology the ancillary test, as designed by the ESMA's Consultation Paper of 19 December 2014, included a comparison of the capital employed (see the remarks below on the interpretation and evolution of the approach as regards the "capital employed" metric) by the person seeking the exemption for trading activities undertaken in the EU for non-hedging purposes on the one hand, and the capital employed for the overall activity undertaken by the whole group globally on the other hand (threshold proposed to be set at 5%). There were no simple comparisons between the earlier threshold at 50 % and the revised 5 % level since each was based on different calculations methodology.

The EU financial regulator also clarified that the comparison of the ancillary activity against the main activity should be done by comparing all ancillary activities taken together against the main activity. Where a firm undertakes only one of the ancillary activities mentioned in Article 2(1)(j) (i.e. dealing on own account or providing investment services), it would only have to undertake the ancillary test on the basis of this individual ancillary activity.

Why the measure for "capital employed" has been considered not appropriate

MiFID II further stipulates thatin determining the extent to which ancillary activities constitute a minority of activities at group level "the capital employed for carrying out the ancillary activity relative to the capital employed for carrying out the main business should be considered. However, this factor shall in no case be sufficient to demonstrate that the activity is ancillary to the main business of the group." ESMA, while preparing draft secondary legislation, initially consulted on a proposal that was based on considering the ratio of the capital employed for carrying out the ancillary activity to the capital employed for carrying out the main business.

Since MiFID II does not indicate explicitly, how the term "capital" should be interpreted, the following capital approaches were considered for the purposes of designating the scope for ancillary activity exemption:

1) regulatory,

2) economic,

3) accounting.

Mindful of the fact MiFID-exempted firms are not required to perform regulatory capital calculations (CRD IV) this measure was considered as not useful for determining the scope for MiFID ancillary activity exemption. Moreover, from the two remaining possibilities economic capital metric was also disregarded for its major drawbacks:

- lack of a clear definition (there are only available the more descriptive designations of the working capital, for instance as the "cost to carry out a business"),

- measurement difficulties (the possible use of profit and loss statement as a proxy would require specification of concrete items relevant for calculations),

- the perception of the working capital as revenue rather than a capital measurement,

-the necessity for firms to carry out new calculations instead of using some sort of already existing data.

For these reasons ESMA in the December 2014 papers preferred an accounting capital measure for ancillary activity calculations or, but only where this measure was not available, an economic capital indicator. Accounting capital measure was also adopted in the draft RTS of December 2014 for the ancillary test. The said draft RTS clarified, moreover, "capital" means capital encompassing total equity, current debt and non-current debt. However, potential difficulties were noted, particularly in assigning capital under accounting capital measures to different activities, i.e. the ancillary activities, the group's main business and the privileged transactions. Furthermore, the sectoral document Adjustment of ESMA's approach towards the ancillary activity exemption of 13 July 2015 acknowledged the fact for industrial firms "it is not common practice to allocate capital for certain activities (like trading or hedging activities or intra-group transactions)". From practical point of view some proxies for the capital employed calculations were considered by industrial firms, in particular, the value of collateral engaged (initial margins and variation margins) as well as the value of the loss incurred on the trading activity (which, in fact, consumed the capital).

According to the ESMA's Cost Benefit Analysis of 28 September 2015 the responses received by ESMA demonstrated that no more than a couple of firms were able to provide the data needed to perform the test in a consistent way, i.e. using either accounting capital or the same proxy for all the components. Comments indicated that the mandatory use of accounting capital or even the allocation of capital at this level of business would be a source of very significant costs whilst other proxies would not be of relevance either. Acknowledging the above circumstances and in order to avoid the minority test being a source of very significant costs, ESMA decided in the draft RTS of 28 September 2015 to abandon the above conception and develop the main business test as an alternative approach.

Commission Delegated Regulation (EU) of 1.12.2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business represents once more regulatory switch, as it included capital test, in the modified form, in Article 3(5) - (10) - for details see here.

Discontent over the methodology for calculation of the ancillary activity exemption thresholds and the revised main business test according to ESMA's September 28, 2015 Final Report

The ancillary activity thresholds' values (both 5% and 0,5% respectively), along with the accompanying calculations' methodology, proposed by ESMA in December 2014, sparked some industries' criticism and the opinions were voiced these thresholds "are so restrictive that they render the ancillary activity exemption without effect" and that they "do not respect the text and spirit of the adopted legislation" (see for example the Eurelectric concerns regarding proposed MiFID II implementing rules of 10 April 2015, which recommended the thresholds' setting at a substantially higher level - i.e. 20-25% for the capital employed test and around 15% for the market-share test).

In the above letter to European Commissioners Eurelectric argued, moreover, "companies should not fall under MiFID unless they fail both tests" - i.e. contrary to the rules proposed by ESMA, which advocated for an alternative character of both tests.

On 16 June 2015 Steven Maijoor, Chair European Securities and Markets Authority, (Opening Statement, Economic and Monetary Committee (ESMA/2015/936)) signalled that the ESMA draft text that went out for consultation in December 2014 was undergoing further major refinements.

Certain details of these potential modifications were revealed in MiFID in/out changes start to emerge.

Further light on specific methodologies with respect to potential modifications to the December 2014 ESMA approach was shed by the industry documents (see, for example: MiFID II ancillary activity exemption - test based on different categories of market size threshold).

Protracted lack of information and transparency on these important parameters effected in correspondence between the European Commission and some Members of the European Parliament.

More certainty was envisioned to be given in October 2015, since the end of September 2015 was set as the date for the conclusion of the common work of the European Commission's and ESMA's staff on the respective draft RTS (see the correspondence between the European Commission and ESMA: ESMA letter of 11 May 2015 (ESMA/2015/841) and the European Commission's response of 12 May 2015).

ESMA's draft of 28 September 2015 of the Commission Delegated Regulation supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for criteria to establish when an activity is considered to be ancillary to the main business

Article 3

Main business threshold

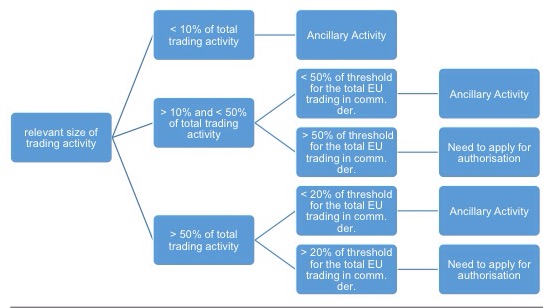

1. Ancillary activities shall be considered to constitute a minority of activities at group level compared to the main business of the group where the size of the trading activities calculated in accordance with paragraph 34 does not account for more than 10% of the total size of the trading activity of the group calculated in accordance with paragraph 4.

2. By way of derogation from paragraph 1,

(a) where the size of the trading activities calculated in accordance with paragraph 34 accounts for more than 10% but less than 50% of the total size of the trading activity of the group calculated in accordance with paragraph 4, ancillary activities shall be considered to constitute a minority of activities at group level only where the size of the trading activity for each of the asset classes referred to in Article 2(1) accounts for less than 50% of the threshold established by Article 2(1) of the overall market's size in the relevant asset class.

(b) where the size of the trading activity calculated in accordance with paragraph 34 accounts for equal to or more than 50% of the size of the trading activity calculated in accordance with paragraph 4, ancillary activities shall be considered to constitute a minority of activities at group level only where the size of the trading activity for each of the asset classes referred to in Article 2(1) accounts for less than 20% of the threshold established by Article 2(1) of the overall market's size in the relevant asset class.

3. The size of the activities referred to in points (i) and (ii) of Article 2(1)(j) of Directive 2014/65/EU undertaken by persons within a group shall be calculated by aggregating the trading activity undertaken by those persons in all of the asset classes referred to in Article 2(1) in accordance with the same calculation criteria as that referred to in Article 2(2).

4. The total size of the trading activity undertaken by persons within a group shall be calculated by aggregating the gross notional value of all contracts in financial instruments to which persons within that group are a party to.

5. The gross notional value shall be denominated in EUR.

In order to establish whether the ancillary activity constitutes a minority of activities at group level, the main business test, as presented by ESMA in September 2015, assessed the size of the trading activity, excluding privileged transactions and transactions executed by authorised entities of the group, undertaken by the group in all asset classes (the numerator) against the size of the overall trading activity, including privileged transactions and transactions executed by authorised entities of the group, undertaken by the group in total for all asset classes (the denominator).

ESMA argued the size of the trading activity as used in the second test, including privileged transactions and transactions executed by authorised entities, was taken as a proxy for the commercial activity that the person or group does as its main business. This proxy should be easy and cost efficient for persons to apply as it builds on data already required to be collected for the first test while at the same time establishing a meaningful test.

As the recitals to the September 2015 draft RTS state, "rational risk-averse entity, such as a producer, processor or consumer of commodities, will seek to hedge the volume of the commercial activity of its main business with an equivalent volume of commodity derivatives, emission allowances or derivatives thereof. Therefore the volume of turnover of commodity derivatives measured in the gross notional value of the underlying, which are purchased or sold is an appropriate proxy for the size of the main business of the group. Main business of group that is not related to commodities would not use commodity derivatives as a risk-reducing tool and therefore any co-existing trading in commodity derivatives would ab initio be speculative and unable to benefit from the ancillary exemption."

The main business test as designed by ESMA in September 2015 may inadvertently capture persons with a high proportion of trading which is neither privileged transactions nor executed in an authorised entity of the group but nevertheless have a very low level of trading activity in total.

In addition, hedging activity cannot be considered a perfect proxy for the commercial activity that the person or group conducts as its main business as it does not take into account other investments of commodity market participants in fixed assets unrelated to derivative markets.

Therefore, the main business test has been designed in the ESMA's September 2015 draft RTS as not solely operating on the basis of the application of this proxy but rather should contain a backstop mechanism which recognises that the trading activity undertaken by the persons within the group should also exceed a certain percentage of any of the thresholds set under the first test for each relevant asset class to be deemed non-ancillary.

The higher the percentage of the speculative activity within all trading activity, the lower this threshold. Calibrating the main business test in this way should ensure that only relevant and sizable participants in European commodity derivative markets should be determined as not conducting their activities as ancillary to their main business.

This specific backstop mechanism has been explained practically by ESMA in the MiFID II Briefing on Non-Financials Topics of 28 September (2015 ESMA/2015/1470):

- If a firm's speculative trading activity is 10-50% of its total trading, it may be MiFID II exempt providing its market share is less than 50% of each threshold in the market share test e.g. 2% for metals, 1.5% for oil etc.

- If a firm's speculative trading activity is above 50% of its total trading, it may be MiFID II exempt providing its market share is less than 20% of each threshold in the market share test e.g. 0.8% for metals, 0.3% for oil etc.

Table: Market share thresholds by commodity group under ancillary exemption test pursuant to ESMA's Final Report of 28 September 2015

|

Proportion of non-priviledged commodity derivatives trading versus total EU commodity derivatives trading at group level (gross notional value) |

Oil | Gas | Power | Coal | Metals | Emissions |

Derivatives on other commodities, including freight and "exotic" (Section C 10 of Annex I to MiFID II) |

| Under 10% | 3% | 3% | 6% | 10% | 4% | 20% | 15% |

| 10% - 49,9% | 1.50% | 1.50% | 3% | 5% | 2% | 10% | 7.50% |

| 50% or greater | 0.60% | 0.65% | 1.20% | 2% | 0.80% | 4% | 3% |

The backstop mechanism as set out in the table above has been finally implemented in Article 3(2) of the Commission Delegated Regulation (EU) of 1.12.2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business, however, entities passing the capital test (in the shape introduced by the European Commission in the said Regulation) are automatically given the highest market share thresholds.

ESMA's Final Report of 28 September 2015 includes also a graphical depiction in that regard, as follows:

Diagram source: ESMA's Final Report of 28 September 2015 (ESMA/2015/1464), p. 330

ESMA underlined, this alternative test should be a source of reduced compliance costs (as under the final draft RTS the data to be used in the main business test in the numerator is identical to the one used for the market share test), whilst delivering more reliable and consistent outcomes than the former capital test. However, there were still concerns expressed by some industries (see for example Ensuring effective and efficient regulation of European commodity derivative markets of 4 September 2015) that the scale of a company's non-trading asset base remained irrelevant for ancillary activity tests.

The shortcoming behind the former way the calculations were carried out, was companies with an underlying physical business and a corresponding asset base would be treated the same way as companies which had not invested in and did not operate assets.

Some industries argued this would prevent a true assessment of the relationship between the trading activity and the rest of a group business involving the production, processing and supply of energy resources.

It was also questioned that hedging activity in financial instruments can or should be used as a proxy for a person's main business for the purposes of the exemption.

According to some industries, hedging activity was not a viable proxy as it ignored significant investments of commodity market participants in fixed assets and resource-intensive activities entirely unrelated to derivative markets.

Trading with end-consumers would also be a problem.

However, the main business test with the above backstop mechanism has been maintained in the respective Regulation finally adopted by the European Commission (along with the updated capital test).

Exclusions - privileged transactions

The above assessments and calculations with respect to both of the metrics envisioned by the MiFID II for ancillary exemption exclude (Article 2(4) of MiFID II):

(a) intra-group transactions as referred to in Article 3 of EMIR Regulation, serving group-wide liquidity and/or risk management purposes;

(b) transactions in derivatives which are objectively measurable as reducing risks directly related to the commercial activity or treasury financing activity (i.e. hedging);

(c) transactions in commodity derivatives and emission allowances entered into to fulfil obligations to provide liquidity on a trading venue ("where such obligations are required by regulatory authorities in accordance with Union or national laws, regulations and administrative provisions or by trading venues");

jointly: "privileged transactions".

There is also a special treatment for trading activities conducted by a MiFID authorised firm within the group (see below).

Hedging

Hedging for the purposes of the MiFID II ancillary exemption is to be understood in the way elaborated for EMIR (see: calculation of clearing thresholds under EMIR Regulation and the wording of Article 10 of the Commission Delegated Regulation (EU) No 149/2013 supplementing EMIR). This is expressly mandated by recital 21 MiFID II.

ESMA's draft of 28 September 2015 of the Commission Delegated Regulation supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for criteria to establish when an activity is considered to be ancillary to the main business

"Article 5 Transactions qualifying as reducing risks

1. For the purposes of the fifth subparagraph of point (b) of Article 2(4), of Directive 2014/65/EU, a transaction in derivatives shall be considered to reduce objectively measurable risks directly relating to commercial activity or treasury financing activity when one of the following criteria are met:

(a) it reduces the risks arising from the potential change in the value of assets, services, inputs, products, commodities or liabilities that the person or its group owns, produces, manufactures, processes, provides, purchases, merchandises, leases, sells, or incurs or reasonably anticipates owning, producing, manufacturing, processing, providing, purchasing, merchandising, leasing, selling or incurring in the normal course of its business;

(b) it covers the risks arising from the potential indirect impact on the value of assets, services, inputs, products, commodities or liabilities referred to in point (a), resulting from fluctuation of interest rates, inflation rates, foreign exchange rates or credit risk;

(c) it qualifies as a hedging contract pursuant to International Financial Reporting Standards adopted in accordance with Article 3 of Regulation (EC) No 1606/2002 of the European Parliament and Council.

2. For the purposes of paragraph 1, a qualifying risk-reducing transaction taken on its own or in combination with other derivatives is one for which the non-financial entity:

(a) describes the following in its internal policies:

(i) the types of commodity derivative contracts included in the portfolios used to reduce risks directly relating to commercial activity and their eligibility criteria;

(ii) the link between the portfolio and the risks that the portfolio is mitigating;

(iii) the measures adopted to ensure that the transactions concerning those contracts serve no other purpose than covering risks directly related to the commercial activities of the non-financial entity, and that any transaction serving a different purpose can be clearly identified;

(b) is able to provide a sufficiently disaggregate view of the portfolios in terms of class of commodity derivative, underlying commodity, time horizon and any other relevant factors."

Equally, the ESMA acknowledged that Article 3 EMIR is sufficiently clear in determining what is defined as intra-group transactions serving group-wide liquidity and risk management purposes.

Consequently, MiFID II ancillary activity reference to intra-group transactions is redirected to Article 3 of EMIR (see the intra-group transaction under EMIR).

This referral requires, however, the reservation made on account of non-OTC derivatives (considering the divergences in scope of EMIR and MiFID II).

Hence, OTC derivatives as well as non-OTC derivatives, both having the hedge character, should be equally excluded for the purposes of MiFID II ancillary activity exemption.

Potential issue when applying hedging exemption on a cross-border basis may arise in connection with Article 3 of EMIR, which specifies that an EU counterparty can use this exemption with a counterparty in the same group but in a third country only where the European Commission has adopted an implementing act to deem the third country equivalent to the EU (Article 13(2) of EMIR).

Another aspect is the prescriptive approach adopted by ESMA with respect to the necessary content of internal policies and procedures (ESMA EMIR Q&As, OTC Derivatives Question 10) has been extended to MiFID - see in the box Article 5 of the ESMA's Draft of 28 September 2015 of the Commission Delegated Regulation supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for criteria to establish when an activity is considered to be ancillary to the main business.

ESMA's Final Report of 28 September 2015 contains, however (p. 333), additional explanation from the EU financial regulatory body stating "ESMA disagrees that the positions taken are too restrictive and notes that it does permit portfolio hedging.

It is also reasonable to require a firm to demonstrate some linkage between transactions and its hedging position." Hence, the ESMA's view appears settled in that regard.

The implementation of the said arrangements will come with some costs on the part of market participants.

Non-financial firms making use of the EMIR clearing threshold exemption are required to compute risk reducing transactions already, but, to perform the ancillary activity tests, they will have to revisit calculations in order to include exchange-traded transactions (ETDs).

As ESMA's Cost Benefit Analysis of 28 September 2015 acknowledges (p. 424), firms "will incur one-off staff and IT costs for setting up calculation, and validation procedures of privileged transactions, including risk-reducing transactions, and on-going costs to run those calculations on a periodic basis. For non-financial firms that are using the EMIR exemption, costs may be substantially lower as they already have to identify risk-reducing transactions in respect of their OTC contracts. They would nonetheless still need to amend existing procedures to capture on ETDs."

Liquidity trades

Article 2(4) fifth paragraph, letter (c) of MiFID II grants permission to be classified as privileged transactions and thus to be set aside for the purposes of the ancillary activity calculations for “transactions in commodity derivatives and emission allowances entered into to fulfil obligations to provide liquidity on a trading venue, where such obligations are required by regulatory authorities in accordance with Union law or with national laws, regulations and administrative provisions, or by trading venues”.

Article 2(4)(c) of MiFID II establishes two alternatives of liquidity provision programmes that can be exempt from the ancillary activity calculations:

- one being based on requirements by regulatory authorities, and

- the other based on requirements imposed by trading venues.

Under both alternatives it is only the transactions carried out under the liquidity programme that are exempt but not the liquidity provider as a person.

As examples of transactions entered into to fulfil obligations to provide liquidity on a trading venue ESMA considered at the stage of the legislative process the mandatory market making requirements established by the UK energy regulator Ofgem obliging the large electricity suppliers to post the prices at which they buy and sell wholesale electricity on power trading platforms up to two years in advance and to trade at these prices.

ESMA provided, moreover, in the form of Q&As the following clarifications with respect to “obligations to provide liquidity” (Article 2(4)(c) of MiFID II).

Firstly, the term “obligations to provide liquidity” has been presented in the opposition to the related term market maker, which is used in Article 2(1)(j)(i) of MiFID II to determine the scope of the ancillary activity exemption and which is defined in Article 4(1)(7) of MiFID II.

As a consequence, a liquidity provider under Article 2(4)(c) of MiFID II in addition to providing liquidity on a continuous basis and being willing to deal on own account against its proprietary capital has to be under genuine obligations to carry out transactions.

Such obligations have to be specified in advance by the trading venue and have to be the subject of an enforceable agreement between the trading venue and the liquidity provider.

The obligations a trading venue requires liquidity providers to fulfil have to be transparent to other market participants and be applied in a non-discriminatory manner.

The obligations of any liquidity provider have to go clearly beyond the activities of any ordinary market participant providing liquidity in a more general sense by simply trading on the market.

The obligations should contain elements such as or comparable to quoting requirements with a maximum spread, a minimum volume, a minimum quote duration and, depending on the trading model, a maximum response time to provide quotes and a minimum participation rate.

In the ESMA's view, only transactions executed under these obligations should be considered privileged transactions as liquidity trades.

Emission allowances' treatment

Privileged transactions mustn't be extended beyond the above scope, particularly to activities exempt under Article 2(1)(e) - i.e. MiFID II exemption for EU ETS operators.

The conception that activities covered by the MiFID II exemption for EU ETS operators should not be counted when defining what is ancillary to the main business under MiFID II Article 2(1)(j) and (4) has been rejected by the EU financial regulator as it would result in enlarging the scope of privileged transactions mentioned in Article 2(4) - what is not in line with the MiFID II Level 1 text.

Pursuant to ESMA, transactions in emission allowances do not count towards the ancillary activity as far as can be considered as a part of the privileged transactions.

However, considering the ongoing process for MIFID II implementation, it seems, there is still room for discussion on the emission allowances' treatment with respect to the detailed way, in which ancillary-exemption thresholds' calculations are made.

First thing is, the existence and effects of the MiFID II exemption for the EU ETS operators should be carefully accounted for.

This exemption is designed for spot trading and the needs for surrendering CO2 units for the purpose of EU ETS compliance obligation were acknowledged also on the ground of the MiFID II level 1 text.