Obligation to publish inside information under REMIT

- Category: REMIT

Article 4 of REMIT introduced the obligation to disclose inside information, including information relevant to facilities for production, storage, consumption or transmission of electricity or natural gas or related to the capacity and use of LNG facilities, including planned or unplanned unavailability of these facilities.This means that information deemed as inside information must be made available to the public and they should include assets' information, but they may be not limited to these.

|

|

15 February 2024 REMIT breach: French energy regulator (CRE) fines Engie €500,000 CRE’s Dispute Settlement and Sanctions Committee (CoRDiS) has imposed a €500,000 fine on Engie for insider trading on the French wholesale electricity market and for failing to publicly disclose inside information in an effective and timely manner. Between 1 January 2019 and 31 December 2020, Engie breached Articles 3 and 4 of the REMIT Regulation on several occasions:

Access the Decision and CRE’s press release (both in French).

ACER analysis of compliance of market participants with ACER Guidance with regard to disclosure of inside information on an IIP published in the REMIT Quarterly Issue No. 29 /Q2 2022

14 June 2022

13 June 2022

|

Disclosure obligation under Article 4 of REMIT should be distinguished from the reporting requirement in line with Article 8 thereof, which introduced:

- the obligation to provide the Agency for the Cooperation of Energy Regulators (ACER or "Agency") with a record of wholesale energy market transactions (Article 8(1)), including orders to trade ('transaction reporting'), and

- the obligation to report fundamental transparency information (Article 8(5)).

|

The disclosure of inside information by market participants in order to comply with the obligation set out in Article 4(1) of REMIT should occur, from 1 January 2021 onwards, on an Inside Information Platform (IIP) listed by ACER on the REMIT Portal (ACER Open Letter of 20 November 2020, REMIT Q&As II.4.57). |

However it should be noted that the transaction reporting under Article 8(1) of REMIT is not subjected to public disclosure and the access thereto is retained only to national regulators and ACER.

Personal scope of application - market participants, parent and related undertakings and undertakings under control or operational responsibility

The obligation to disclose inside information is imposed on the market participant according to Article 2(7) of REMIT. However, the disclosure obligation relates not only to inside information in respect of the market participant's own business or facilities, but also to inside information of the market participant's parent undertaking or related undertaking. In addition, the disclosure obligation is not only related to inside information in respect of business or facilities which the market participant or the respective undertakings owns, but also in respect of inside information they control or for whose operational matters that market participant or undertaking is responsible, even in part only.

Article 4(3) of REMIT extends the disclosure obligation of Article 4(1) of REMIT to a person employed by, or acting on behalf of, a market participant receiving the inside information in the normal course of the exercise of their employment, profession or duties as referred to in Article 3(1)(b) of REMIT. If so, that market participant or person shall ensure simultaneous, complete and effective disclosure of that information. However, this provision does not apply if the person receiving the information has a duty of confidentiality, regardless of whether such duty derives from law, regulation, articles of association or contracts.

In the ACER's opinion, the limitation of this exception to Article 4(3) of REMIT is considered to mean, in contrary, that no such exception applies to market participants in relation to parent undertakings or related undertakings according to Article 4(1) of REMIT.

It is noteworthy, the need to develop and implement guidelines and procedures for publication of inside information under REMIT relates to all market participants, even though they do not have any physical assets (Nord Pool Consulting AS document of 15 August 2017 “REMIT Best Practice, A sector review on how to comply with REMIT related to inside information and market abuse“, p. 33). Consequently, all market participants trading in the energy physical market should be prepared for publishing information to the market, which means being in the possession of relevant instructions or agreements, training and access to a UMM (Urgent Market Messages) reporting system in place.

In Q&A on REMIT (point III.7.15 updated on 30 June 2020) the ACER refered to the question whether the Virtual Power Plants (VPPs) have the obligation to disclose inside information under REMIT. According to the regulator it depends on the business case, each situation needs assessment, particularly when, for example, the VPP’s IT platform (responsible for pooling and dispatching resources) breaks down.

In the REMIT Q&As 27th edition updated on 31 March 2022 the ACER explained (Question III.7.12.) the situation of the market participant which held the inside information relating to another company’s facility (which was not a market participant).

This situation can happen, for example, but not limited to, when REMIT market participant is buying/importing energy from:

(i) outside EU, i.e. from an energy producer (not a REMIT market participant) and the potential inside information relates to its facility located outside of the EU; or

(ii) from an LSO/SSO, located outside EU, that is not a REMIT market participant.

The ACER referred to the 6th edition of the ACER Guidance on the application of REMIT (section 4.1), which reads: ‘’the obligation to disclose inside information does not apply to a person or a market participant who possesses inside information in respect of another market participant’s [or other entity’s] business or facilities, in so far as that owner of this inside information is not a parent or related undertaking.

Notwithstanding this, persons holding information in such circumstances will need to consider their compliance with Article 3 and in particular whether they hold such information as one of the persons listed in Article 3(2).’’

Therefore, in the above situation, if:

- a piece of information qualifies as inside information,

- market participant holds such inside information as one of the persons listed in Article 3(2) of REMIT (e.g. persons with access to the information through the exercise of their employment, profession or duties under Article 3(2)(c) of REMIT),

- overseas counterparty (not being REMIT market participant) does not publish the relevant inside information,

the EU-located REMIT market participant:

- will not be allowed to trade using such inside information as this would cause a potential breach of Article 3 of REMIT (insider trading),

- will need to assess if it holds any other information concerning their own business or facilities that could qualify as inside information that should be published pursuant to Article 4(1) of REMIT.

The latter publication would relate to the information about a certain amount of energy not being imported as originally foreseen (information concerning own business).

A specific agreement or clause between the above two companies is also recommended by the ACER to facilitate publication of inside information held by company affecting another entity activities.

In the aforementioned 27th edition of REMIT Q&As the ACER explained the situation of a conflict, i.e. Company A holds an inside information on the asset of another market participant (Company B), which does not consider the information to be inside information (Question III.7.12.).

According to the ACER, if Company A considers that this information meets the definition of inside information pursuant to Article 2(1) of REMIT (wherein the companies are not parent/related undertakings) Company A should fulfil its obligations to publish the part of the inside information that concerns their own business or facilities pursuant to Article 4(1) of REMIT.

In addition, the Agency would consider as best practice if both companies exchanged between themselves all the necessary information about their activities that affect or may affect the other company, through contractual arrangements between the two, e.g. via a specific agreement or clause in the contract existing between the two companies.

This should aim at facilitating both companies to publish inside information in case one company holds information that affects or may affect the other company’s activities.

Inside information disclosure thresholds

UK Ofgem communication of 11 July 2014 highlighted that under REMIT "there are no thresholds for the disclosure of inside information. Instead market participants' conduct will be assessed against the definition of insider information under REMIT Article 2(1)."

Acknowledging the fact of application of indicative thresholds by some market participants in their internal compliance processes, Ofgem (as well as ACER in its third edition of REMIT Guidance) refrained from publishing any thresholds. The said application of indicative thresholds by market participants in their internal compliance processes seems to be the regulators' preferred option, as ACER referred in its Guidance to firms' market experience, but also, responsibility.

Acknowledging the fact of application of indicative thresholds by some market participants in their internal compliance processes, Ofgem (as well as ACER in its third edition of REMIT Guidance) refrained from publishing any thresholds. The said application of indicative thresholds by market participants in their internal compliance processes seems to be the regulators' preferred option, as ACER referred in its Guidance to firms' market experience, but also, responsibility.

Also in the Document of 8 September 2015 Prohibition of market abuse under the Regulation on wholesale energy market integrity and transparency (EU) No 1227/2011 (REMIT) Ofgem reiterates that under REMIT there are no thresholds for the disclosure of inside information, but market participants' conduct consisting in using thresholds (for operational efficiency reasons) to determine whether to make a REMIT notification, will be assessed against the definition of inside information under REMIT Article 2(1). Ofgem stresses, moreover, whether or not a piece of information is covered by this definition is likely to depend on market conditions at the relevant time.

ACER’s conclusions of the 2nd Energy Market Integrity and Transparency Forum (6 - 7 September 2018) acknowledged that threshold limits are difficult to harmonise due to the complexity and specificity of the markets, but that REMIT data could nonetheless be used to study possible threshold definitions based on the reported status of the energy market.

ACER’s public consultation of 17 July 2019 on definition of inside information (PC_2019_R_05) can be seen as a consequence of the above process. The way the questions are formulated shows the inside information publication thresholds are still high on the ACER’s agenda. Here are some examples of the consultation questions:

1. Please describe your assessment of whether an information is to be considered an inside information. Please describe the process step by step including the tools used and the participants involved.

2. Has the unavailable capacity concerned by an outage of a production unit been a criteria in your assessment of REMIT inside information? Please provide detailed reasoning including the methodology to set your threshold(s).

3. If so, which amounts do you consider to be relevant and would apply as a threshold? Do those amounts vary depending on the relevant market situation? If there were changes in your methodology, please provide information in this regard as well.

4. Do you apply any further thresholds for other kinds of inside information?

5. Which criteria do you apply for using inside information disclosed by other market participants for decisions to enter into a transaction relating to, or to issue an order to trade in a wholesale energy product? Please describe the decision making process in detail including the reasoning involved.

6. Do you distinguish between inside information relating to the electricity and gas markets, or do you apply one general threshold which covers both electricity and gas markets? If applying different thresholds, what do you base your decision on (key factors)?

7. Do you take into account and distinguish between geographical peculiarities or different markets or is your decision based on different amounts of capacity?

8. Are the thresholds that already exist within the framework of the transparency regulation a factor you take into consideration in your assessment of inside information?

|

|

The content of the REMIT publication pursuant to ACER guidance and implementing regulation

ACER's Guidance on the application of Regulation (EU) No 1227/2011 of the European Parliament and of the Council on wholesale energy market integrity and transparency made a recommendation on the information the REMIT publication should and mustn't contain (see boxes). It is noteworthy, the ACER Guidance defines a minimum set of information required for publication, regardless of whether the information is published on a transparency platform or on the market participant's website.

Forbidden content

Each REMIT publication of inside information mustn't include:

1) statements by company executives,

2) any form of advertisement,

3) any other irrelevant information,

4) disclaimers (ACER discourages the use of disclaimers, if disclaimers are used, they should be clearly separated from the main body),

5) excessively long content (it should be as short as reasonably possible and usually not exceed 10 to 20 lines).

The aforementioned Ofgem communication of 8 September 2015 recommends market participants should publish their notifications in such a way as to ensure they are easy to understand. To this end, Ofgem encourages market participants to consider publishing an inside information "factsheet" to explain any part of their notification procedures/assumptions. Ofgem observes, some market participants have already taken this approach. In the Ofgem's opinion this aids transparency as an integral part of REMIT.

The required content

Each REMIT publication of inside information should include:

- the caption "Publication according to Article 4(1) of REMIT / UMM – Urgent Market Message"

- a subject heading that summarises the main content of the publication

- the name and contact information of the market participant

- if applicable, the name and location of the respective asset

- if applicable, the balancing area or market area concerned

- the time and date of the relevant occurrence, including e.g. the (estimated) duration of outages

- the time and date of publication

- if applicable, the reasons for the unavailability of generation units, consumption units or parts of the electricity or gas grid

- if applicable, a history of prior publications regarding the same event, e.g. if a prognosis is updated or an unplanned outage becomes a planned outage.

As regards the collection of inside information by the ACER, Article 10(1) of the Commission Implementing Regulation No 1348/2014 of 17 December 2014 on data reporting implementing Article 8(2) and Article 8(6) of Regulation (EU) No 1227/2011 of the European Parliament and of the Council on wholesale energy market integrity and transparency (OJ L 363, 18.12.2014, p. 121 - "REMIT Implementing Regulation") establishes further requirements in order to allow the Agency to efficiently collect inside information for market monitoring purposes. Under Article 10(1) of the REMIT Implementing Regulation, market participants disclosing inside information on their websites, or service providers disclosing such information on market participants' behalf, must provide web feeds to ACER.

Moreover, in line with Article 10(2) of the REMIT Implementing Regulation, when reporting information on transactions and fundamental data, including the reporting of web-feeds on the disclosure of inside information, the market participant is required to identify itself or be identified by the third party reporting on its behalf using the ACER registration code, which the market participant received, or the unique market participant code that the market participant provided while registering in accordance with Article 9 of REMIT.

Common schema for REMIT publications

Another important step towards the standard setting in the area of REMIT mandatory transparency was ACER's Public Consultation Paper of 27 May 2015 (PC_2015_R_03) REMIT Common Schema for the Disclosure of Inside Information.

Impact on carbon permit prices

In the above Consultation Paper ACER recommended, REMIT publication schema should include, among others, the field "impact on carbon permit prices". The European energy regulators's intention was to allow readers of the Urgent Market Message (UMM) to evaluate the impact of the event on carbon permit contracts. ACER underlined, moreover, adding this field "is the first step for websites and platforms, to be able to disclose inside information according to the Market Abuse Regulation standards avoiding double publication of the same inside information". The indication of likelihood of having significant effect on the price of emission allowances or actioned products based thereon had been proposed in the said Consultation Document as the optional information only. This was, presumably, on account of practical difficulties in assessing carbon price impacts of particular events relating to electricity production assets. It is often argued carbon price tendencies are mainly driven by macroeconomic data as well as politics, and not by individual circumstances (see for example EURELECTRIC response to the ACER Consultation Document, June 2015).

The text of adopted Annex VII to the REMIT MoP on transaction data, fundamental data and inside information reporting (version of 30 September 2015) shows, however, that ACER at present decided not to include the field relating to carbon prices' impact in the REMIT inside information schema. Moreover, ACER's annual report on its activities under REMIT in 2014 (p. 66) listed the "establishment of appropriate mechanisms to access emission allowances data" among the deprioritised ACER's activities/deliverables.

Decision Time

Another point recommended by ACER in the aforementioned Consultation Paper of 27 May 2015 for disclosure in the REMIT publication schema was "Decision Time". ACER gave an example of the company's management board resolution on the production plan of a power plant for the year ahead that included maintenance periods. ACER argued, the traders of the same asset owner should be aware of the maintenance periods at the time of publishing of the UMM together with the rest of the interested public.

According to this example, the management board decided on the maintenance plan on Date1 and the UMM was published later on Date2. The traders of the same company and the public would be informed on Date2, therefore the Decision Time (Date1) has to be publicly known on Date2. Decision Time disclosure duties may, however, entail procedural complexities involved with identifying exact date for the relevant decision in the course of decision-taking processes within market participants' organisational structures, particularly within corporate groupings (the issue accentuated equally by the above EURELECTRIC Response). However, as was the case with the carbon allowances' prices, Annex VII to the REMIT MoP on transaction data, fundamental data and inside information reporting has not included so far the field relating to the "Decision Time" in the REMIT inside information schema.

Annex VII to the MoP on data reporting

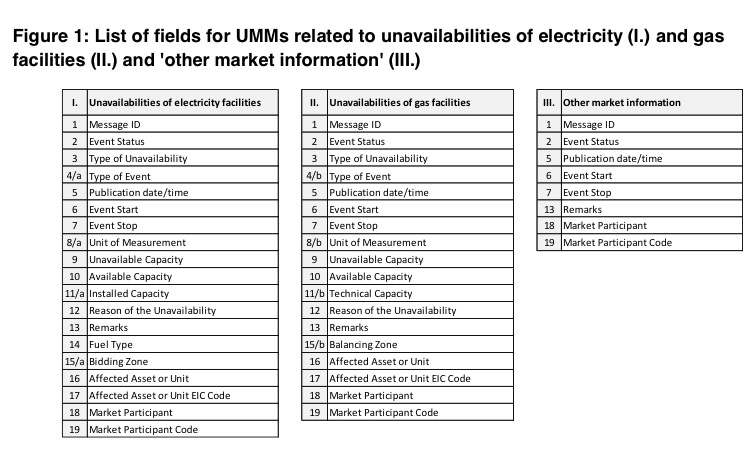

The aforementioned consultations effected in the adoption by the ACER on 30 September 2015 of the Annex VII to the REMIT Manual of Procedures on transaction data, fundamental data and inside information reporting (MoP on data reporting). In order to define the web feed standard for the disclosure of inside information, ACER developed three different XML schemas accommodating all identified types of inside information. This is structured as follows:

I. the schema "Unavailabilities of electricity facilities" should be used when market participants publish UMMs reporting planned or unplanned electricity unavailabilities of any size that are likely to significantly affect wholesale energy prices;

II. the schema "Unavailabilities of gas facilities" should be used when market participants publish UMMs reporting planned or unplanned gas unavailabilities of any size that are likely to significantly affect wholesale energy prices;

III. the schema "Other market information" should be used when market participants publish UMMs that do not fall under type I. or II. Typically these are events that are likely to significantly affect wholesale energy prices but are less structured and less frequent by nature than unavailabilities of facilities (for example: reporting corporate or market developments, commissioning a new power plant etc.).

For the detailed description of specific fields see Annex VII to the MoP.

As follows from minutes from 2021 Joint roundtable meeting of the ACER of 18 November 2021 with Inside Information and Transparency Platforms, ACER presented the changes that had been introduced in the electronic formats for the reporting of inside information. The reported updates affected two added data fields in the REMITUMMElectricitySchema_V2, namely Interval Start and Interval Stop, an added direction field in the REMITUMMGasSchema_V2 for indicating the entry or exit direction with regard to the reported balancing zone, as well as amendments in the accepted values for the Unit of measurement data field. ACER inquired whether the proposed date of discontinuing REMITUMMElectricitySchema_V1 and REMITUMMGasSchema_V1, scheduled for 1 February 2022, would be a feasible deadline for platforms to implement the new schemas. Participants proposed that ACER postpone the deadline, given that some platforms had not yet planned the developments and changes of their system. It was agreed to postpone the deadline to 1 June 2022.

Publications which require a prognosis

REMIT Quarterly, Issue No. 27/Q4 2021 referred to some excerpts from the ACER Guidance on the application of REMIT on timely and effective disclosure, and particularly to Chapter 4 of the Guidance, which provides minimum quality requirements and guidance for effective and timely disclosure of inside information.

As regards publications requiring prognosis, e.g. regarding the duration of an outage, the regulator made the following remarks:

1. ACER understands that such prognosis contains an element of uncertainty, therefore, ACER believes that market participants fulfil their publication requirements if the prognosis is based on all available data and has been prepared with reasonable effort, if a prognosis changes over time, the publication should be updated accordingly as soon as the new information is available,

2. ACER considers that market participants should develop a clear compliance plan towards real time or close to real time disclosure of inside information, beyond compliance with existing Third Energy Package transparency obligations.

Publication timelines

The updated 3rd edition of ACER's REMIT Guidance states that market participants should ensure inside information is published as soon as possible, but at the latest within one hour if not otherwise specified in applicable rules and regulations. The aforementioned Ofgem communication of 8 September 2015 echoes this position. Additionally, Ofgem considers that disclosing inside information to other market participants, including affected stakeholders, prior to public disclosure may constitute a breach of REMIT Article 3(1)(b). As Ofgem underlines, market participants should take account of REMIT Articles 3(1)(b) and (c) whenever considering sharing potential inside information or discussing products potentially affected by inside information.

Publication channels

Regulatory stance as regards inside information publication channels evolved over time. Initially, after the entry into force of REMIT the platforms for the disclosure of inside information (inside information platforms - IIPs) were not available in all EU Member States, and the requirements for such platforms were not clear, hence in some Member States market participants had been publishing inside information only on their websites. A clear delineation between regulatory requirements before 1 January 2021 and after this date must be drawn. Firstly, however, there is a need to drop a few lines about how it began.

Transparency platforms

ACER in first editions of its guidelines expressed a clear preference for discharging an obligation to publish inside information under REMIT through transparency platforms (for instance operated by Transmission System Operators or energy exchanges), "if such platforms exist". If a transparency platform was used which disclosed inside information in a timely manner, ACER considered a simultaneous publication on the market participant's website not necessary. However, the central platform was not available at European level, thus the creation of national platforms for the publication of inside information in compliance with art. 4 of REMIT was possible. There were also available transparency platforms established by energy exchanges e.g. Nord Pool Spot and EEX Transparency platform, mentioned in ACER guidelines.

Moreover, in January 2015 ACER started its online List of Inside Information Platforms (as part of the REMIT Portal).

In view of these developments and considering the existence of transparency platforms like Nord Pool Spot and EEX there were some ambiguities whether the publication of inside information on the market participant's own website only was allowed in light of ACER guidelines. However, the hypothetical thesis that the ACER's regulatory instrument like guidelines may force market participants from all EU Member States to publish their inside information through Nord Pool Spot or EEX transparency platforms did not appear reasonable. This dilemma lost, however, its main significance over time as the number of transparency platforms increased continously.

ACER's annual report on its activities under REMIT in 2014 (p. 52 and 55) observed the Agency was aware of eight platforms for the disclosure of inside information for electricity in various Member States of the European Union and seven for gas, while ACER' List of Inside Information Platforms, as visited on 2 December 2015, listed, non-exhaustively, nine transparency platforms for electricity and eight transparency platforms for gas. The ACER’s preferences as regards inside information publication channels did not change over time, as in the REMIT Quaterly, Issue No. 11 / Q4 2017 the Agency once more emphasised that “it is the Agency’s stated objective is to have all REMIT inside information disclosure happen via centralised platforms”.

The ACER’s Open letter of 30 May 2018 observed that:

- most market participants used their own websites for the disclosure of inside information,

- in many cases, these websites did not provide web feeds and therefore did not comply with legal requirements,

- less than 10% of all market participants used inside information platform.

Further, on 30 May 2018 the ACER releases the Open Letter, which informs that:

- the Agency doubts that the disclosure of inside information on the multitude of different company websites can be considered effective,

- the Agency considers the possibility of registering of transparency platforms and making the use of these platforms mandatory.

|

Article 4 REMIT Obligation to publish inside information

|

Market participants' websites

Before 1 January 2021 the publication of inside information on the market participant's own website was allowed by ACER - under some conditions. The condition precedent was the lack of adequate transparency platforms. If the said condition was not met, the publication of inside information on the market participant's own website was required to be effected simultaneously to a publication through a platform - thus as a additional publication channel. Hence, market participants were allowed to disclose inside information on their own websites either as a fall-back option or simultaneously to a disclosure of inside information through an inside information platform. However, regulatory guidelines appeared to treat the publication of inside information on the market participant's own website as an interim solution, allowed, moreover, only unless otherwise specified.

Other regulatory requirements for using market participant's website as a REMIT inside information publication channel covered the following elements:

a) format of the publication:

- non-discriminatory,

- user-friendly,

- quantifiable,

- facilitating the consolidation of the information with similar data from other sources;

b) fees for making inside information available - free of charge;

c) language of the publication: official language(s) of the relevant Member State and in English or in English only;

d) social media use: only as additional sources not replacing website publications.

Disclosure in CEREMP

It is important also to note that information on where the market participant’s inside information is published must be listed on the market participant’s record in the CEREMP.

In the minutes from 2021 Joint roundtable meeting of the ACER of 18 November 2021 with Inside Information and Transparency Platforms ACER answered to the market participant’s question about which URLs the market participants should provide in the CEREMP field "Place of publication of inside information", and more specifically, whether market participants should indicate the URL of the web-part or the URL to the web-feeds of the used IIP/backup solution. Referring to ACER Decision 01/2012, ACER clarified that the field needs to contain the place of publication of inside information, i.e. market participants should list the URL of the Inside Information Platform (and not the URL of the web feed), as this is where the messages are published.

As from 1 January 2021 market participants are required to publish inside information on an Inside Information Platform (IIP) listed by ACER and to publish this information in the CEREMP. As of 2022, market participants have the possibility to declare in CEREMP that they do not expect to have inside information.

RSS feeds

Pursuant to the REMIT Implementing Regulation No 1348/2014, market participants disclosing inside information on their website or service providers disclosing such information on market participants' behalf are required to "provide web feeds to enable the ACER to collect these data efficiently" (Article 10). In the REMIT Quaterly, Issue No. 11 / Q4 2017 ACER underlines the obligation to have a web feed when disclosing inside information is in force for all places of publication (including a company website) since January 2015 (exactly 7 January 2015 - see also answers to Questions 4.1.5 - 4.1.7 FAQs on REMIT fundamental data and inside information collection). This obligation is also stressed in the ACER’s public letter of 30 May 2018.

The Agency started the collection of inside information web feeds on 1 January 2017 through inside information platforms that publish Urgent Market Messages (UMMs) on behalf of market participants.

See also Our REMIT magnifying glass - check whether your transparency website uses RSS feed!

On 13 December 2018 the ACER has published the Guidance on the implementation of web feeds for Inside Information Platforms (Version 2.0). The document is targeted to inside information platforms that are currently listed on the REMIT Portal or those that intend to apply to be listed. It includes technical guidance on how the inside information is to be collected and ACER expects IT staff involved in technical implementation of web feeds to be familiar with the document. The said document does not apply to individual market participants.

In the answer to the Question 4.1.5, FAQs on REMIT fundamental data and inside information collection ACER said that “[t]he Agency will not be collecting web feeds from Market Participants’ websites until further notice.”

Required format of web feeds has been addressed by the ACER in the answer to the question III.3.10 of the Q&As on REMIT (updated on 14 December 2021).

Replaying to the question:

"Is there a special data format or protocol for the web feed (Article 10 of Commission Implementing Regulation (EU) No 1348/2014) how the data shall be provided to the Agency (e.g. email, .csv-file, etc.)?"

the ACER said:

"The Agency has published Guidance on the implementation of web feeds for Inside Information Platforms (UMM Guidance) which covers the technical issues concerning inside information disclosure under Article 10(1) and (2) of Commission Implementing Regulation (EU) No. 1348/2014. The UMM Guidance includes details of the standard web feed formats (RSS and ATOM) and the schema (.xsd) to be used. The UMM Guidance is published on the REMIT Portal: https://www.acer-remit.eu".

As follows from minutes from 2021 Joint roundtable meeting of the ACER of 18 November 2021 with Inside Information and Transparency Platforms the participants reported that they "would be more than happy to have the report available in order to check the status of their UMMs (Urgent Market Messages), since they did not receive feedback on whether their message arrived to ACER correctly".

Requirements as from 1 January 2021

In the forth edition of the Guidance on the application of Regulation (EU) No 1227/2011 of the European Parliament and of the Council of 25 October 2011 on wholesale energy market integrity and transparency (published on 17 July 2019) the ACER expressed the stance that, in order to achieve effective disclosure according to Article 4 of REMIT, the information shall be disclosed using a platform for the disclosure of inside information (Inside Information Platform or IIP), i.e. an electronic system for the delivery of information which allows multiple market participants to share information with the wide public and complies with the minimum quality requirements listed in the Guidelines. The exact same stance has been upheld in the fifth edition of the said Guidance of 8 April 2020 r. (p. 51, 52).

According to the Agency, using Inside Information Platforms as the default disclosure mechanism is supported by the fact that:

(a) This disclosure mechanism is indicated by a combined reading of Article 4(1) and Article 4(4) of REMIT. According to Article 4(4) of REMIT the publication of inside information, including in aggregated form, in accordance with Regulation (EU) 2019/94345 or (EC) No 715/2009, or guidelines and network codes adopted pursuant to those Regulations, constitutes simultaneous, complete and effective public disclosure. The transparency rules under these regulations stipulate a publication of transparency information on central information transparency platforms. Therefore, the disclosure by Inside Information Platforms would then foster a consistent understanding of effective disclosure according to Article 4(1) of REMIT and Article 4(4) of REMIT.

(b) This disclosure mechanism promotes convergence with technical standards established under financial market legislation in this regard, in particular those established under Article 17 of MAR, as further specified in Commission Implementing Regulation (EU) 2016/1055 laying down implementing standards with regards to the technical means for appropriate public disclosure of inside information.

(c) The reduction in the number of publication channels leads to a significant reduction in complexity and effort for market participants to access and use information that is published according to Article 4 of REMIT.

In order to facilitate the compliance with the disclosure obligation, a list of Inside Information Platforms available in Europe for the disclosure of inside information on wholesale energy markets is published on the Agency’s REMIT Portal, following an assessment of IIPs’ compliance with quality requirements listed in Chapter 7.2.2 of the Guidance, requirements for the reporting of inside information to the Agency described in the REMIT Manual of Procedures on transaction data, fundamental data and inside information reporting (REMIT MoP) and the Guidance on the implementation of web feeds. Inside Information Platforms should apply to be listed by the Agency and will be listed if they comply with the requirements.

REMIT Quarterly, Issue No. 27 /Q4 2021

In 2020, ACER commenced the process of registering inside information platforms (IIPs) based on their compliance with the minimum quality requirements for effective disclosure of inside information, as defined in Section 7.2.2 of the ACER Guidance on the application of REMIT.

The list of IIPs available on the REMIT Portal contains both the IIPs that comply with the requirements and can therefore already be used for the effective disclosure of inside information, as well as the ones that are still under evaluation and in the process of becoming fully registered IIPs.

For the purpose of effective disclosure of inside information, market participants can already register with IIPs that have passed the 1st phase of ACER’s IIP assessment, as stated in the updated Open Letter on the extension of the possibility for market participants to publish inside information on their own corporate website as a backup solution.

Regarding the publication of inside information, including in aggregated form, in accordance with Regulation (EU) 2019/94347 or (EC) No 715/2009, including guidelines and network codes adopted pursuant to those Regulations, and Commission Regulation (EU) No 543/2013, this is also considered, according to Article 4(4) REMIT, as a simultaneous, complete and effective public disclosure, provided that the published information concerns the same event(s) and has the same content and format and conforms to the minimum quality requirements (see Section 7.2.2) as the information required to be disclosed according to Article 4(1) of REMIT.

A simultaneous publication on the market participant’s website or through social media may be used as an additional source for publication. However, it cannot replace the disclosure on Inside Information Platforms. In case additional means for publication are used, e.g. a market participant’s website, the market participant must ensure that the published information is identical to the one published on the Inside Information Platform.

According to Article 2(2) of Commission Implementing Regulation (EU) 2016/1055, emission allowance market participants required to disclose inside information in accordance with Article 4 of REMIT may use the technical means established for the purpose of disclosing inside information under REMIT for the disclosure of inside information under Article 17(2) of MAR, provided the inside information required to be disclosed has substantially the same content and the technical means used for the disclosure ensure that the inside information is communicated to the relevant media. The Agency believes that REMIT inside information disclosure through platforms will allow market participants to meet these requirements, provided that the inside information platform fulfils the requirements of the MAR as well as the Commission Implementing Regulation (EU) 2016/1055.

Moreover, in the answer to the question 4.1.17. in the document Frequently Asked Questions (FAQs) on REMIT fundamental data and inside information collection, 6th Edition, 16 July 2019 ACER said that market participants should fully comply with the above requirements of the ACER Guidance as of 1 July 2020:

“Question 4.1.17

The requirements for the obligation to disclose inside information have been clarified and supplemented in chapter 7 of the fourth update of the 4th Edition of the ACER Guidance. These requirements should be fully complied with after a transition period, which will be communicated by the Agency. By which date should market participants comply with these requirements?

In order to provide market participants with an appropriate time to not only implement necessary changes regarding the disclosure mechanisms for the disclosure of inside information through platforms, but also to comply with the minimum quality requirements for an effective disclosure of inside information as laid down in the ACER Guidance, market participants should fully comply with the requirements of the ACER Guidance as of 1 July 2020.” This compliance deadline has been later extended by the ACER from 30 June 2020 to 1 January 2021.

In the ACER REMIT Quarterly published on 18 May 2020 the Agency said:

“On 17 July 2019, ACER published an update of the ACER Guidance on the application of REMIT in order to clarify the guidance on the disclosure of inside information and to increase transparency in the wholesale energy market.

The updates concerned the use of platforms for effective disclosure of inside information and the development of minimum quality requirements by Inside Information Platforms (IIPs).

In the light of the COVID-19 outbreak, the deadline by which market participants must become fully compliant with the guidance (i.e. by publishing inside information on an IIP listed by ACER) will be extended to 1 January 2021.”

In the 26th edition of the Q&As on REMIT of 14 December 2021 in an answer to the Question III.3.10 the ACER unequivocally concluded:

"As stated in the Open Letter published by ACER on 20 November 2020, the disclosure of inside information by market participants in order to comply with the obligation set out in Article 4(1) of REMIT should occur, from 1 January 2021 onwards, on an Inside Information Platform (IIP) listed by ACER on the REMIT Portal".

Market participants' own corporate websites as a backup solution

On 20 November 2020 the ACER published the Open Letter (REMIT Disclosure of inside information through Inside Information Platform, Ref. Ares(2020)6964593) explaining as follows:

- for the purpose of effective disclosure of inside information, market participants are able to register with IIPs which have passed the 1st phase of ACER’s IIP assessment;

- in case an IIP is temporarily unavailable, a market participant shall refer to the backup solution provided by the IIP;

- however, in the light of the exceptional circumstances triggered by the Covid-19 pandemic, ACER intends to provide market participants with the possibility to temporarily publish inside information on their own corporate website as a backup solution until 31 December 2021;

- in this case, the full list of the minimum quality requirements for effective disclosure of inside information indicated in Chapter 7.2.2 shall exceptionally not apply, since such requirements refer only to Inside Information Platforms, as long as the market participants provide relevant information on the use of the IIP and the corporate company website as a backup solution in the market participant’s registration in CEREMP and as long as the inside information is disclosed to as wide a public as possible on a non-discriminatory basis and is made accessible free of charge.

The possibility to use corporate company websites as backup solutions was initially envisioned to apply until 31 December 2021 but on 14 December 2021 the ACER published a new open letter on the extension of the possibility for market participants to publish inside information on their own corporate website as a backup solution until 31 December 2022.

Minimum data quality requirements for the said back-up solutions have been addressed by the ACER in the answer to the question III.7.22 of the Q&As on REMIT (updated on 14 December 2021). Replaying to the question:

"Assuming that a market participant uses the own company website as backup for the publication of inside information. What are the minimum data quality requirements for effective disclosure of inside information which apply in this case (for the backup solution)?"

the Agency explained:

"According to Article 4(1) of REMIT, market participants shall publicly disclose inside information which they possess in an effective and timely manner. ACER believes that in order to achieve effective disclosure according to Article 4 of REMIT, the information shall be disclosed using a platform for the disclosure of inside information (Inside Information Platform or IIP), i.e. an electronic system for the delivery of information which allows multiple market participants to share information with the wider public and complies with the minimum quality requirements listed in Chapter 4.2.2 of the ACER Guidance on REMIT. In case an inside information platform is temporarily unavailable, market participants shall refer to the backup solution provided by the IIP, as indicated in Chapter 4.2.2 of the ACER Guidance on REMIT. In the light of the persisting exceptional circumstances triggered by the Covid-19 pandemic, ACER extended the possibility for market participants to temporarily publish inside information on their own corporate website as a backup solution until 31 December 2022. Such an exceptional condition may apply only insofar as the market participant website that is used as a backup solution fulfils the relevant minimum data quality requirements of Chapter 4.2.2 of the ACER Guidance on REMIT, as indicated in the Open Letter on the on the disclosure of inside information through Inside Information Platforms and corporate websites as a backup solution in case of platform unavailability of 14 December 2021. Market participants using a backup solution shall provide information on the backup solution during registration, according to Article 9(5) of REMIT."

Further regulatory development came with the the ACER's REMIT No. Quarterly Issue 31 /Q4 2022, where the Agency adopted the following stance:

"As outlined in ACER's Guidance on the Application of REMIT, Inside Information Platforms (IPs) shall be the default mechanism for the effective disclosure of inside information that cannot be replaced by parallel forms of disclosure.

Market participants are reminded that, as of 1 January 2023, they may no longer use their corporate websites as backup solutions. ACE expects that this will lead to a more effective disclosure of inside information as required by REMIT and hence contribute to the transparency and integrity of the energy markets.

In the event of a contingency where the use of the primary IIP is not possible, the continuous disclosure of inside information shall be ensured through effective IIP-based backup solutions, which may include the use of a different IP (as a secondary or contingency means of disclosure). In ACER's opinion, this is the only way to ensure the undisrupted effective disclosure of inside information, which is essential for the functioning of the market".

Responsibility for transparency platform delays or technical failures

On the occasion of explaining the role and mutual interrelations of transparency platforms and market participants' websites in fulfilling the obligation to publish inside information under REMIT, the European energy market regulator has also made an important clarification on the scope of market participants' responsibility for transparency platform delays or technical failures. The two key facts were in the first place acknowledged: that market participants bear the ultimate responsibility for the disclosure of inside information, however, they do not have an influence on the operation of transparency platforms.

To account for the above circumstances, in the ACER's opinion market participants are not responsible for temporary technical problems of such platforms fulfilling the RIS requirements.

The crucial determination made on this occasion is that if the information was transmitted to the transparency platform in time, the market participant should not be charged for having breached the obligation to disclose inside information. If technical problems persist market participants have to use other platforms or their own website instead. The key reservation is however, that although delayed disclosure of inside information due to technical problems of transparency platforms does not imply a breach of the disclosure obligation, the market participant is not allowed to trade based on that information as long as it is not available to the market.

This thread has been referred to again in the minutes from 2021 Joint roundtable meeting of the ACER of 18 November 2021 with Inside Information and Transparency Platforms, which reads:

“It was underlined by ACER that the Guidance on the application of REMIT clearly exonerates the market participants from liability of the temporary unavailability of Inside Information Platforms (IIPs), insofar as they transmit information on time. Therefore, non-publication during such times will not be considered a breach of the obligation to publish inside information. Nevertheless, a robust IIP-based global backup solution that also covers publication is still essential”.

Most common errors

In the minutes from 2021 Joint roundtable meeting of the ACER of 18 November 2021 with AEMPs and Inside Information and Transparency Platforms ACER presented the most common errors made by market participants and/or Inside Information Platforms in the reporting of Urgent Market Messages (UMMs), either in the content of the message, or in incorrectly applying the schemas for reporting, which causes data polling issues. The two main errors that ACER highlighted were the reporting of empty XML elements when the field is optional instead of leaving the element out altogether (e.g. <fieldName></fieldName>) and the reporting of EICs not compliant with the EIC value type pattern for specific fields. A participant inquired whether including the optional fields within the XML file and reporting the field with a blank space as value would be considered compliant with the schema. ACER responded that this depended on whether the field had a defined pattern, but that in general, this approach should be avoided.

Data validation

As follows from minutes from 2021 Joint roundtable meeting of the ACER of 18 November 2021 with AEMPs and Inside Information and Transparency Platforms ACER starts investigating the issues of validation of reported data to ensure compliance with the schema. In response to the ACER’s question, some participants reported that in some cases, the service agreements in place between the Inside Information Platforms and the market participants do not allow to use any validation rules in the platform and that usually the only check in place is the one on the 16-character limit of the EIC. They also specified that validation is easier for the Urgent Market Messages (UMMs) reported through a platform’s graphical user interface (GUI) but difficult to apply for UMMs reported through a web service interface, and applying validation only for some interfaces would mean inconsistent treatment of data submitted by market participants.

In relation to the question posed by ACER, two platforms informed that they have validation rules during the on-boarding of new market participants. In their intervention, they specified that the EIC-X codes are checked against the ENTSO-E database, and the EICs for market area are checked against internal databases. Based on this feedback, ACER concluded that "validation is possible to some extent".

Compliance of market participants with ACER Guidance with regard to disclosure of inside information on an IIP

In the REMIT Quarterly Issue No. 29 /Q2 2022 published in July 2022 the ACER analysed CEREMP data as of June 2022 as regards the compliance of market participants with disclosure requirements of inside information on an IIP. The ACER’s analysis shows that only around 18% of the more than 15,500 registered market participants have indicated in the ‘Publication Inside Information’ field of CEREMP that they are using one or more IIPs listed on the REMIT Portal for inside information disclosure. Around 2% of those 18% have indicated more than one IIP. Another 18% of all market participants have indicated that the field is not applicable to them. As of 2022, market participants have the possibility to declare in CEREMP that they do not expect to have inside information. In this case, they are not requested to provide an IIP in the respective field.

At least 42% of market participants have indicated only their own website in the ‘Publication Inside Information’ field of CEREMP (according to the ACER Guidance on the application of REMIT, a simultaneous publication on a market participant’s website or social media may be used as an additional means of publication, but it cannot replace disclosure on IIPs). The performed analysis shows that, in 2021, less than 3% of market participants published inside information on an IIP listed on the REMIT Portal that has completed ACER’s assessment in both phases.

The ACER concluded that the majority of registered market participants were - at the time - not compliant with the ACER Guidance and/or that their registration information provided in CEREMP was not up-to-date.

Further perspectives

The document of 14 February 2023 “ACER-CEER Reaction to the European Commission’s public consultation on electricity market design" observes:

“In order to facilitate monitoring to detect potential trading based on inside information, the collection of inside information needs to be aligned with the current process for trade data reporting. ACER is currently pulling the data through webfeeds, but it should be pushed to ACER in the same way as trade data. This would also facilitate data sharing”.

Archives of REMIT historic inside information

Historic inside information should remain available on the market participants' website if not remained available by the inside information platform for a period of at least 2 years. This is to allow other market participants to learn best practice disclosure and to assess previous incidents of the same facilities. However, it seems that when considering periods of preservation of archives of REMIT historic inside information the periods of prescription in civil and criminal matters should be also taken into account. Given that REMIT framework involves potential criminal sanctions for breaches (imposed on national level), as well as civil liability, records of historic inside information published may in certain cases absolve the firm (or persons involved) from liability or represent an important proof of due diligence in REMIT observance. Periods of prescription are, however, particularly in criminal matters, usually far longer than the aforementioned 2 years.

Acknowledging the wide variety of prescription periods, which depend not only on the type of the crime but also on the specific national legal framework, it seems rational to establish the longest period of prescription, which may potentially apply, and to adjust the periods of preservation of REMIT archives accordingly. This seems to be the more cautious approach than using simple 2 years of preservation of REMIT archives.

Delayed information

Article 4(2) of REMIT provides for an exemption from the obligation to timely publish inside information in a number of specified cases.

|

REMIT Article 4(2)

A market participant may under its own responsibility exceptionally delay the public disclosure of inside information so as not to prejudice its legitimate interests provided that such omission is not likely to mislead the public and provided that the market participant is able to ensure the confidentiality of that information and does not make decisions relating to trading in wholesale energy products based upon that information. In such a situation the market participant shall without delay provide that information, together with a justification for the delay of the public disclosure, to the Agency and the relevant national regulatory authority having regard to Article 8(5). |

Publication of inside information may be delayed by the market participant under the the fulfilment of the following, cumulative preconditions:

1. the delay the public disclosure of inside information may follow only exceptionally, hence it mustn't amount to a regular and common market practice of a market participant,

2. market participant must be able to indicate its concrete legitimate interests that would be prejudiced If the information was not delayed,

3. such omission must not be likely to mislead the public,

4. the market participant is able to ensure the confidentiality of that information,

5. market participant is not allowed to make decisions relating to trading in wholesale energy products based upon that information,

6. the relevant information should be reported to the ACER and the relevant national regulatory authority without delay and include justification (in order to assist in fulfilling these obligations ACER has developed standard format for notification of delayed information - see below),

7. the decision to delay publication is a market participant's own responsibility, thus in case of potential legal challenge market participant bears the burden to demonstrate that all the above conditions are met and is exposed to all the consequences if he fails to do so.

It is noteworthy that Article 3(4)(b) of REMIT provides also for an exemption from the prohibition to trade on inside information before it is published (details in that regard see here).

The relevant electronic form - Delayed Information Notification Platform - is available via the ACER's REMIT Portal and can be used by market participants to comply with their notification obligations according to Articles 4(2) and 3(4)(b) of REMIT towards both the ACER and National Regulatory Authorities (NRAs). Pursuant to ACER's annual report on its activities in 2012 there were 1 058 notifications of delayed disclosure of inside information received in 2012 from across Europe. In 2014, the Delayed Information Notification Platform received 354 notifications on Article 3(4)(b) of REMIT, and 281 notifications on Article 4(2) of REMIT (ACER's annual report on its activities under REMIT in 2014, p. 48).

Nord Pool Consulting AS document of 15 August 2017 “REMIT Best Practice, A sector review on how to comply with REMIT related to inside information and market abuse“ (p. 35) provides some examples of situations potentially qualifying for the delay. This could be a situation where permanent shutdown of a production/consumption site is planned, and there is a need for a HR-process for affected employees. Another example could be in a situation where safety must be given priority over publication. However, it is reserved that the compliance of the above examples with REMIT has to be assessed on a case by case basis.

The above document, moreover, draws the attention to the following elements of the best practice regarding delayed information under REMIT:

1. there is the need to ensure that necessary processes and procedures are implemented in advance so that compliance can be ensured when it is decided that information should be delayed;

2. documentation must be made of who has access to the information when:

- drafting insider lists,

- ensuring confidentiality;

3. inform ACER and the relevant NRA(s) about the delayed publication - use the reporting solution on the ACER platform;

4. ensure that no information reaches trading personnel, or alternatively, stop trading.

Best practices on publishing inside information under REMIT

There exist some industry best standards as regards publishing inside information under REMIT. In particular they have been recommended in the Nord Pool Consulting AS document of 15 August 2017 “REMIT Best Practice, A sector review on how to comply with REMIT related to inside information and market abuse“ (p. 26, 34, 35, 2nd Edition updated on 15 January 2020). The said document, when referring to the requirement imposed on market participant to identify what kind of information they might possess could constitute inside information, accentuates that market participants using operational thresholds ought to to differentiate between a threshold suitable to normal market conditions versus a strained market situation and power balance in which much lower amounts could affect market prices. Moreover, each market participant should go through the specificities for its company to:

- identify all facilities (production/consumption/transmission) the market participant owns or is responsible for and specify in which situations inside information might occur,

- identify what kind of situations exist in general, not related to specific facilities, where inside information occurs or might occur (such as having access to customer orders),

- identify stress points/parts of the organisation that are vulnerable for information leaks – intentionally and non-intentionally,

- map information flow to identify any information that could contain or qualify (or potentially qualify) as inside information,

- identify in what kind of situations the market participant might receive inside information from other third parties.

In addition, a clear description of the process of identifying inside information and the point in time when it arise, should be implemented. This should also include descriptions on how to handle cases where it is uncertain whether a specific set of information constitutes inside information or not. The said document advises, as a general principle, that the persons sitting closest to the information were made responsible for the publishing. However, this should be weighed against the challenge of ensuring that they have the necessary insight and competence to be able to effectively fulfil the requirements for effective and timely publication pursuant to REMIT.

Market participants having many power plants often find it beneficial that inside information is published by the central dispatch centre as this allows for building a stronger competence amongst the persons responsible for publishing. Large power plants may arrange the information to be published directly from the plant. This may allow for faster publication and can also reduce the number of persons involved, and thereby the risk of market abuse. The optimal solution may differ from market participant to market participant, and must be assessed on an individual basis.

It is also recommended to include in the internal guidelines or to have separate guidelines containing the following:

1. definitions of:

- places for the publication of inside information,

- the relevant tools,

- kinds of information published, possible templates (with the information required by the ACER Guidance as a minimum);

2. alternative procedures in case of any issues with the system used for publication;

3. measures to ensure that:

- inside information is published as soon as possible, and at the latest within one hour,

- messages at all times are up to date.

Handling the third-party inside information

The recommended business practice in the respective area is in the first place to identify what kind of situations exist in general, not related to specific facilities, where inside information occurs or might occur (such as having access to customer orders). This screening in particular covers situations the market participant might receive inside information from other third parties.

In some cases, market participants may receive inside information from third parties, for example information from TSOs that affects or could affect the market participant, or information from an up-river production unit. According to REMIT, a market participant is only required to publish information if it relates to the participant’s own business. It is therefore critical to be able to correctly assess if the information is correct, and whether the market participant is obliged to publish the information or not.

If it is concluded that the information is inside information, but not related to the market participant but a third party, the aforementioned Nord Pool Consulting document recommends the following actions:

- protect the information, in particular, prevent information from being used in trading, and ensure that it can be documented how the information has been handled;

- prevent the information from reaching the trading floor;

- if a trader on the trading floor receives inside information: he/she should immediately leave the trading floor to ensure that no trading is done, and that the information is not spread to others, it is recommended to immediately contact compliance who can consider further actions;

- consider if it is necessary to stop relevant trading based on, or having a connection to, that information;

- contact the owner of the information to ensure that the information is published or will be published.

Rules for coordination among several market participants involved in the process

The aforementioned Nord Pool Consulting AS document of 15 August 2017 analyses, furthermore, the REMIT best practices for publication of inside information in situations where there are multiple market participants responsible (p. 36). Such situations, in practice, occurs where:

- there are several owners of a production/consumption facility/company,

- when publication is outsourced to a third party,

- where the owner/operator are not the same legal party/entity,

- where the balancing responsibility has been allocated to another party.

The need to differentiate this specific case arises in the context of decision whether market participant bearing responsibility to publish the inside information, shoud:

- publish the information separately (having accepted the significant risk to end up with publication discrepancies), or

- coordinate the publication.

NordPool Consulting argues in the above document of 15 August 2017 that the best practise in such situations is to coordinate the publication, typically by having one party publishing on behalf of all responsible parties. Such an arrangement does not influence on the legal responsibility for the publishing of inside information (which can not be legally outsourced - regardless of how the agreement is constructed).

Where the publication of inside information is coordinated among several market participants the following elements of best practice need to be accentuated:

- the party who is publishing information on other market participant’s behalf must possess sufficient knowledge and skills and have access to the relevant information;

- the parties are recommended to enter into a written contract where rights and responsibilities of each party are clearly defined;

- explicit courses of actions and contact persons may also be described in the agreement.

- an agreement to outsource the task of publishing inside information should always include the right for the owner of the information to publish the information itself if they consider this necessary in fulfilling their obligations (this may be relevant for situations where the parties do not agree on whether a certain information shall be published or not);

- there is the need to monitor the information published and continuously assess potential changes in the procedures or the agreement;

- market participant publishing inside information on behalf of cooperating parties should be required to have internal controls and be obliged to make the documentation available in the event of a request from competent authorities.

Small market participants’ status

It seems that small market participants deserve special status under the publication regime. In particular, they could submit a statement during their registration in CEREMP in which they could declare that they will never possess/publish any inside information.

Such a proposition was submitted by some market participants during 2021 Joint roundtable meeting of the ACER of 18 November 2021 with Inside Information and Transparency Platforms (see minutes from this meeting). However, regarding this issue “ACER clarified that all guidance pertaining to market participant registration was dependent on the relevant NRA, but that ACER may consider cooperating with National Regulatory Authorities (NRAs) on increasing consistency in NRAs’ practices in this regard”. Hence, it follows that for the time being small market participants are not granted any exemption under the REMIT from inside information disclosure regime.

Enforcement

The aforementioned ACER's annual report on its activities under REMIT in 2012 refers to:

- one case related to both potential non effective disclosure of inside information according to Article 4(1) of REMIT and potential insider trading according to Article 3(1) of REMIT;

- five cases related to potential non-effective disclosure of inside information according to Article 4(1) of REMIT.

The case referred to under point 1 above was brought to the Agency's attention through a notification from a competent national regulatory authority (NRA). Since the case potentially had cross-border impact, the Agency established and coordinated an investigatory group consisting of all concerned NRAs. The competent NRA's review led to the conclusion that the relevant inside information was not disclosed in a timely manner and that the market participant therefore was in possession of inside information when carrying out trading activities at day-ahead and intraday markets. The market participant may have applied the exemption in Article 3(4)(b) of REMIT, but since it did not comply with the reporting obligation of this exemption, the market participant was formally in breach of Article 3 of REMIT. However, in the absence of sanctioning rules at national level and since no actual price effect of the trade could be concluded, the market participant was informed on how to improve its compliance with REMIT requirements and only a statement of breach was issued.

Among five additional cases related to potential non-effective disclosure of inside information according to Article 4(1) of REMIT the two were taken up either by the Agency or the relevant NRA because of notifications of delayed disclosure of inside information and the three were taken up by the Agency following stakeholder contacts. In all these cases, the Agency worked with the concerned NRA which in turn contacted the concerned market participant. All cases were closed without a breach of REMIT being found. ACER in its report also indicates, it was repeatedly contacted regarding insufficient information published on events generating inside information. This concerned inter alia Urgent Market Messages (UMM) from market participants on company websites. In most cases, requests were considered as Q&As and not considered as cases. However, when a request was considered as a case, the Agency reviewed the relevant UMMs and requested additional background information about the market participant's trading behaviour and potential price effects either from the NRA concerned or from a competent market surveillance team from an organised market place concerned if considered useful. In most cases, the Agency found that the incident was not in conflict with REMIT. In the cases where the incident, indeed, was in conflict with REMIT, it had no effect on the market. In the latter case, it was normally agreed with the competent NRA that it identifies the elements of compliance that should be improved by the market participant in order to better meet REMIT requirements in future and the review of the case at stake was closed without further action.

ACER concludes the above review of the enforcement cases with the opinion that it expects that the number of cases under review will grow in the following years, in particular following the start of systematic data collection on the basis of the implementing acts.

In turn, UK Ofgem communication of 11 July 2014 notes the following shortcomings with regard to wholesale markets participants inside information publications:

- there is significant variation in the type of capacity changes that market participants report; some include the 'normal' capacity, some state the change in capacity, some state the capacity during an event and some include a mixture of all three,

- there is a lack of start and, in particular, estimated end times and dates of an event, sometimes there are dates but no times,

- many websites do not include timestamps to show when information has been published or updated,

- many market participants are not maintaining a public record of historical inside information notifications or updates to those notifications.

The aforementioned ACER's annual report on its activities under REMIT in 2014 (p. 47) recalls, with respect to the disclosure of inside information duties, the case where the Agency was notified by an NRA about an investigation regarding a potential breach of Article 4 of REMIT. A market participant was reporting unplanned unavailability of power plants inconsistently and in a way that was not compliant with the guidance established in the ACER Guidance on the application of REMIT. Some IT requirements included in the guidance (RSS feeds, 2 year history) were disregarded, and some content requirements were missing: timestamp of the publication, history of the publications about the same event. As the said ACER's report mentions the NRA questioned and interviewed the market participant and the market participant committed to implement the required improvements.

Another interesting enforcement practical example provided by the Ofgem related to de-rated capacity margins. It was reported that during specific periods between November 2015 and January 2016, National Grid Electricity Transmission plc’s (NGET) erroneously caused incorrect de-rated capacity margin calculations to be published through Elexon’s online platform, which resulted in false or misleading signals as to the supply of, demand for, or price of wholesale energy products being given to the market, contrary to Article 5 of REMIT, as defined under its Article 2(2)(b) (see Ofgem investigates National Grid Electricity Transmission plc under REMIT for publishing incorrect market information).

In turn ACER REMIT Quarterly Issue No. 27/Q4 2021 describes an example of enforcement action from the Latvian energy market: Latvian NRA issues decision on a breach of obligation to publish inside information. The regulator concluded that Latvenergo had breached Article 4(1) of REMIT, as it had not disclosed, in an effective and timely manner, the inside information it possessed about when the gas turbine actually returned to the operating mode and was synchronised with the electricity network. According to the regulator, this way the Latvenergo created an information asymmetry between market participants, which affected the transparency of the electricity market. The case seems rather obvious but represents a good practical example of the two-step approach to qualifying a specific fact as ‘inside information’ under REMIT (outlined in the Chapter 3 of the 5th Edition of the ACER Guidance on the application of REMIT).

Recent example of enforcement action is described in the ACER REMIT Quarterly Issue No. 34/Q3 2023: the Dispute Settlement and Sanctions Committee (CoRDiS) of the French National Regulatory Authority imposed on 27 July 2023 a fine of EUR 80,000 on TotalEnergies Electricite et Gaz France (TEEGF) for a breach of the obligation to publish in a timely manner inside information relating to outages of electricity generation facilities on seven instances between 1 January 2019 and 31 December 2020 (TEEGF disclosed inside information more than one, two or three hours later).

TEEGF did not breach the prohibition of insider trading under Article 3 of REMIT, since the inside information that was published in a non-timely manner was not found to have been used by the company to trade in related wholesale energy products.

CoRDiS also pointed out that had TEEGF invested in additional human resources and put in place appropriate supervisory measures and procedures, it would have been able to comply with its disclosure obligations under Article 4 of REMIT.

ACER's Q&As on REMIT (updated on 16 June 2017)

There’s an outage of a gas-fired power plant. What is the market participant’s obligation?

According to Article 4 of REMIT it is the market participant‘s obligation to publish inside information. The market participant should make an assessment on price sensitivity for either market (electricity and gas). If the outage of the gas-fired power plant is considered inside information relevant for the electricity market and the gas market, the information should be published in both markets, i.e. as an outage of an electricity production unit and as an outage of a gas consumption unit. ACER’s Guidance (Chapter 7.2.2) and MoP on data reporting (ANNEX VII) include data fields for inside information reporting which may help the market participants decide which information should be published as part of an Urgent Market Message.

Do final customers need to include the name and location of an asset when publishing inside information notifications?