Systematic internaliser’s pre-trade transparency for bonds, structured finance products, emission allowances and derivatives

MiFID II requirements for systematic internalisers (SIs) acknowledge the fact that internalisation of order flow by SIs has a material impact on price formation.

|

|

Consequently, the main purpose of the respective legal regime is to ensure that SI’s client orders are subject to trade transparency requirements on a level playing field with trading venues, while taking into account the different market participants' characteristics.

Legal framework stipulating requirements for systematic internalisers to make public firm quotes in respect of bonds, structured finance products, emission allowances and derivatives can be assessed as a rather complex, the respective provisions being dispersed across MiFIR, secondary legislation as well as regulatory clarifications.

The prices quoted by systematic internalisers are required to be such as to ensure that the systematic internaliser complies with its obligations under Article 27 of the MiFID II (obligation to execute orders on terms most favourable to the client), where applicable, and must reflect prevailing market conditions in relation to prices at which transactions are concluded for the same or similar instruments on a trading venue.

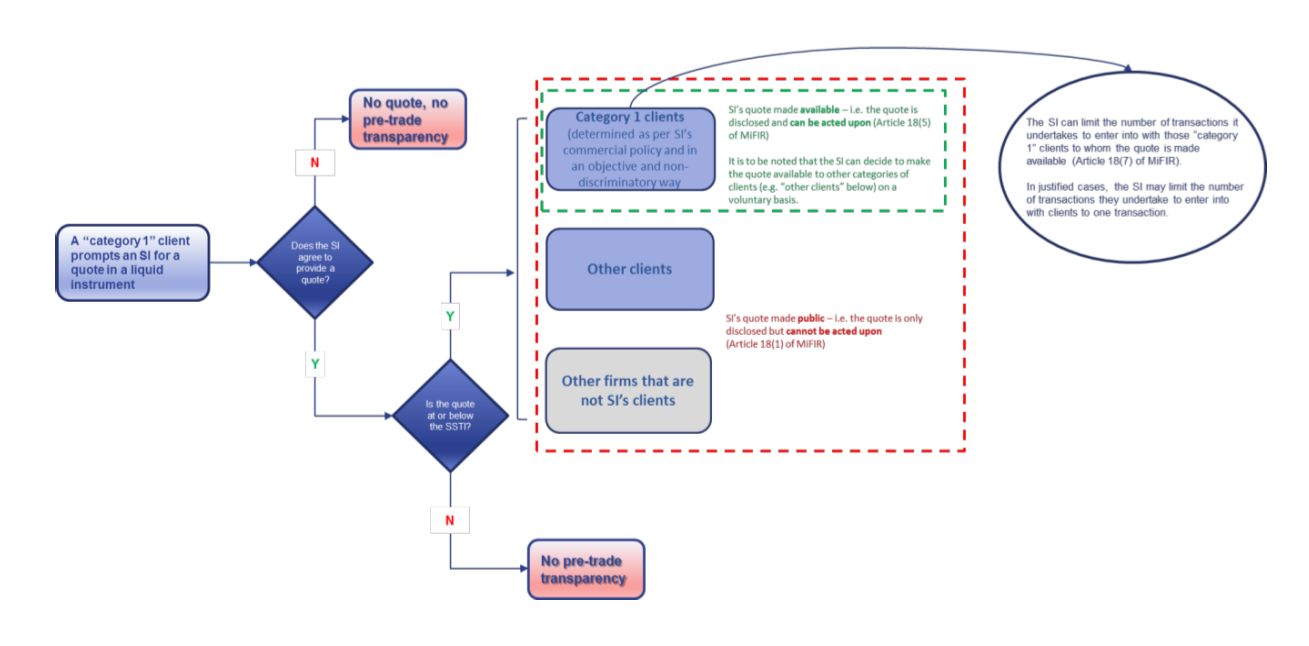

To understand systematic internaliser’s obligations with respect to pre-trade transparency for bonds, structured finance products, emission allowances and derivatives it is useful to highlight some key important distinctions:

1. Systematic internaliser in non-equity instruments, provides a quote to a client, in principle, on request;

2. When such request was made and the SI’s quote was delivered to the requesting client, there is the case to specify the instances and procedures when the said quote:

- is “made public”,

- is “available to their other clients” (within the same or other categories of clients).

3. Making quotes “available to their other clients” means that the quotes are disclosed and may be acted upon by other SI’s clients (Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35, Answer 9 updated on 3 October 2017). The respective provision is Article 18(5) MiFIR.

It is the voluntary decision of the SIs whether they make the quote available to other categories of clients.

4. When the SI’s quotes are “made public” (Article 18(1) and 18(8) MiFIR) the quotes are only disclosed and can not be acted upon.

It is noteworthy, SIs are subject to the obligation to make public firm quotes, subject to certain conditions, both in respect of equity instruments and non-equity instruments, however, while for equity instruments, the MiFIR provisions are further specified via a Commission Delegated Regulation, there are no equivalent Level 2 measures for non-equity instruments.

When it comes to the pre-trade transparency obligations imposed by MiFIR on systematic internalisers in respect of bonds, structured finance products, emission allowances and derivatives, the key issue are the thresholds, which are set by the secondary legislation in respect of each instrument.

Scope of the requirements - exceptions

The systematic internalisers’ obligation to publish a firm quote do not apply to financial instruments that fall below the liquidity threshold (Article 18(6) and Article 9(4) MiFIR).

Requirements to make public firm quotes in respect of bonds, structured finance products, emission allowances and derivatives do not apply to systematic internalisers when they deal in sizes above the size specific to the financial instrument (SSTI - Article 18(10) and Article 9(5)(d) MiFIR).

When the quoted size is above the SSTI systematic internalisers are also freed from the requirement to enter into transactions under the published conditions with any other client to whom the quote is made available (Article 18(6) and Article 9(5)(d) MiFIR).

Systematic internalisers’ obligation to publish firm quotes

The extent of the obligation for systematic internalisers to make public firm quotes in respect of bonds, structured finance products, emission allowances and derivatives is dependent on the liquidity of the market at issue.

Liquid markets

In the case of liquid markets as defined in MiFIR systematic internalisers must make public firm quotes in respect of bonds, structured finance products, emission allowances and derivatives traded on a trading venue for which they are systematic internalisers when the following conditions are fulfilled (Article 18(1)(a) of MiFIR):

(a) they are prompted for a quote by a client of the systematic internaliser;

(b) they agree to provide a quote.

The above requirements are neutral concerning the technology used for prompting quotes.

A systematic internaliser can be prompted for and provide quotes through any electronic system, client orders routed by an automated order router (AOR) including.

Illiquid markets

According to MiFIR (Article 18(2)), in relation to products traded on a trading venue for which there is not a liquid market, systematic internalisers must disclose quotes to their clients on request only if they agree to provide a quote.

This obligation may be waived where the following conditions are met:

(a) orders that are large in scale (LIS) compared with normal market size and orders held in an order management facility of the trading venue pending disclosure;

(b) actionable indications of interest in request-for-quote and voice trading systems that are above a size specific to the instrument (SSTI), which would expose liquidity providers to undue risk and takes into account whether the relevant market participants are retail or wholesale investors;

(c) when it comes to derivatives which are not subject to the trading obligation and to other financial instruments for which there is not a liquid market.

ESMA specified its views on the obligations for systematic internalisers dealing in non-equity instruments for which there is no liquid market in the Answer 5d (updated on 31 May 2017, Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35).

According to ESMA, “where a systematic internaliser receives a request from a client for a quote for an instrument which is traded on a trading venue and for which there is not a liquid market, and the systematic internaliser agrees to provide that quote, the systematic internaliser does not have an obligation to make this quote available to other clients and to make it public.

However, Article 18(2) of MiFIR requires the systematic internaliser to disclose to clients on request the quotes provided in illiquid financial instruments.

That obligation can be met by allowing clients, on a systematic or on a request basis, to have access to those quotes.

This is without prejudice to the possibility for systematic internalisers to benefit from a waiver for this obligation where, as set out in the last sentence of Article 18(2) of MiFIR, the conditions in Article 9(1) of MiFIR are met.”

Types of prices considered compliant as firm quotes

In the answer to the Question 10 (Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35, updated on 15 November 2017) ESMA has presented its stance as regards types of prices considered compliant as firm quotes.

ESMA referred, firstly, to the fact that according to Table 2 of Annex II of Commission Delegated Regulation (EU) 2017/583, the traded price of the transaction excluding, where applicable, commission and accrued interest, must be reported for the purpose of post-trade transparency.

In regard to quotes for the purpose of pre-trade transparency, ESMA explained that they should be aligned with post-trade transparency publication in case the transaction was finally executed and therefore the information to be made public should be the traded quote.

ESMA expects that the quote published is the real traded quote established by normal market practice, including all the product features or other components of the quote such as the counterparty or liquidity risk.

ESMA, moreover, expects that SIs make available to their clients any relevant risk adjustments and commissions applicable to the cohort within which they (the clients) fall in order for the clients to determine with a degree of certainty the price that would be applicable to them.

Making quotes public "on a reasonable commercial basis”

MiFIR requires that the quotes published by the SIs are made public in a manner which is easily accessible to other market participants "on a reasonable commercial basis" (Article 18(8) MiFIR).

The meaning and scope of this phrase is specified in Articles 6 - 11 of Commission Delegated Regulation (EU) 2017/567 of 18 May 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council with regard to definitions, transparency, portfolio compression and supervisory measures on product intervention and positions.

According to these provisions:

1. the price of market data must be based on the cost of producing and disseminating such data and may include a reasonable margin (Article 7);

2. the cost of producing and disseminating market data may include an appropriate share of joint costs for other services provided by systematic internalisers (Article 7);

3. market data use be made available at the same price and on the same terms and conditions to all customers falling within the same category in accordance with published objective criteria (Article 8);

4. any differentials in prices charged to different categories of customers must be proportionate to the value which the market data represents to those customers, taking into account:

(a) the scope and scale of the market data including the number of financial instruments covered and their trading volume;

(b) the use made by the customer of the market data, including whether it is used for the customer's own trading activities, for resale or for data aggregation (Article 8);

5. systematic internalisers must have scalable capacities in place to ensure that customers obtain timely access to market data at all times on a non-discriminatory basis (Article 8);

6. systematic internalisers are required to charge for the use of market data according to the use made by the individual end-users of the market data (‘per user basis’), this obligation may be waived where to charge on a per user basis would be disproportionate to the cost of making that data available, having regard to the scale and scope of the data, in case of a refusal to make market data available on a per user basis grounds must be provided and published on the SI’s webpage (Article 9);

7. systematic internalisers are required to put arrangements in place to ensure that each individual use of market data is charged only once (Article 9);

8. systematic internalisers must make market data available without being bundled with other services (Article 10);

9. prices for market data must be charged on the basis of the level of market data disaggregation provided for in Article 12(1) of MiFIR (Article 10);

10. systematic internalisers must disclose the price and other terms and conditions for the provision of the market data in a manner which is easily accessible to the public, the disclosure must include the following:

(a) current price lists, including:

— fees per display user;

— non-display fees;

— discount policies;

— fees associated with licence conditions;

— fees for pre-trade and for post-trade market data;

— fees for other subsets of information, including those required in accordance with Commission Delegated Regulation (EU) 2017/572;

— other contractual terms and conditions regarding the current price list;

(b) advance disclosure with a minimum of 90 days' notice of future price changes;

(c) information on the content of the market data including:

(i) the number of instruments covered;

(ii) the total turnover of instruments covered;

(iii) pre-trade and post-trade market data ratio;

(iv) information on any data provided in addition to market data;

(v) the date of the last licence fee adaption for market data provided;

(d) revenue obtained from making market data available and the proportion of that revenue compared to the total revenue of the market operator and investment firm operating a trading venue or systematic internalisers;

(e) information on how the price was set, including the cost accounting methodologies used and the specific principles according to which direct and variable joint costs are allocated and fixed joint costs are apportioned, between the production and dissemination of market data and other services provided by systematic internalisers (Article 11).

If systematic internalisers make market data available to the public free of charge the above provisions do not apply (with the exception of the requirement to make market data available on the same terms and conditions to all customers falling within the same category in accordance with published objective criteria and without being bundled with other services).

Streaming prices to clients

On 31 January 2017 ESMA explained that the systematic internaliser regime for non-equity instruments is predicated around a protocol whereby the systematic internaliser provides a quote or quotes to a client on request.

However, nothing prevents the systematic internaliser, especially in the most liquid instruments, to stream prices to clients.

Where those prices are firm, i.e. executable by clients up to the displayed size (provided the size is less than the size specific to the instrument), the systematic internaliser would be deemed to have complied with the quoting obligation under Article 18(1) of MiFIR.

The systematic internaliser can, in justified cases, execute orders at a better price than the streaming quote.

Quotes “made public in a manner which is easily accessible to other market participants”

Commission Delegated Regulation (EU) 2017/567 of 18 May 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council with regard to definitions, transparency, portfolio compression and supervisory measures on product intervention and positions

Article 13

Obligation for systematic internalisers to make quotes easily accessible

(Article 15(1) of Regulation (EU) No 600/2014)

1. Systematic internalisers shall specify and update on their website's homepage which of the publication arrangements set out in Article 17(3)(a) of Regulation (EU) No 600/2014 they use to make public their quotes.

2. Where systematic internalisers make their quotes public through the arrangements of a trading venue or an APA, the systematic internaliser shall disclose their identity in the quote.

3. Where systematic internalisers employ more than one arrangement to make public their quotes, publication of the quotes shall occur simultaneously.

4. Systematic internalisers shall make public their quotes in a machine-readable format. Quotes shall be considered to be published in a machine-readable format where the publication meets the criteria set out in Commission Delegated Regulation (EU) 2017/571.

5. Where systematic internalisers make public their quotes through proprietary arrangements only, the quotes shall also be made public in a human-readable format. Quotes shall be considered to be published in a human-readable format where:

(a) the content of the quote is in a format which can be understood by the average reader;

(b) the quote is published on the systematic internaliser's website and the website's homepage contains clear instructions for accessing the quote.

6. Quotes shall be published using the standards and specifications set out in Commission Delegated Regulation (EU) 2017/587.

ESMA’s answer to Question 5 (updated on 31 May 2017, Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35) specifies ESMA’s views on systematic internalisers’ obligations to make public firm quotes in respect of bonds, structured finance products, emission allowances and derivatives in comparison to arrangements applying as regards equity instruments.

ESMA referred firstly to Article 13 of the Commission Delegated Regulation (EU) No 2017/567 which stipulates how systematic internalisers should make their quotes public and easily accessible for equity instruments.

ESMA observed that there are no corresponding provisions on the publication arrangements for systematic internalisers for non-equity instruments, but Article 18(8) of MiFIR requires the quotes to be “made public in a manner which is easily accessible to other market participants”.

That said ESMA considers that systematic internalisers should use the same means and arrangements when publishing firm quotes in non-equity instruments as for equity instruments as specified in Article 13 of the Commission Delegated Regulation (EU) No 2017/567.

Furthermore, the quotes should be made public in a machine-readable format as specified in the above mentioned Regulation Commission Delegated Regulation (EU) No 2017/567 and the quotes should be time-stamped as specified in Article 9(d) of RTS 1 (Commission Delegated Regulation (EU) 2017/587 of 14 July 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council on markets in financial instruments with regard to regulatory technical standards on transparency requirements for trading venues and investment firms in respect of shares, depositary receipts, exchange-traded funds, certificates and other similar financial instruments and on transaction execution obligations in respect of certain shares on a trading venue or by a systematic internaliser).

ESMA has explicitly confirmed in the said Q&As that, as for equity instruments, also with respect to bonds, structured finance products, emission allowances and derivatives systematic internalisers are required to disclose their identity when making quotes public through the facilities of a regulated market or an APA.

Making the firm quotes published available to other SI’s clients

According to Article 18(5) of MiFIR systematic internalisers are required to make the firm quotes published available to their other clients.

Article 18(5) MiFIR

Systematic internalisers shall make the firm quotes published in accordance with paragraph 1 available to their other clients. Notwithstanding, they shall be allowed to decide, on the basis of their commercial policy and in an objective non-discriminatory way, the clients to whom they give access to their quotes. To that end, systematic internalisers shall have in place clear standards for governing access to their quotes. Systematic internalisers may refuse to enter into or discontinue business relationships with clients on the basis of commercial considerations such as the client credit status, the counterparty risk and the final settlement of the transaction.

“Making quotes available to their other clients” means that the quotes are disclosed and may be acted upon by other SI’s clients (Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35, Answer 9 updated on 3 October 2017).

Notwithstanding, SIs are allowed to decide, on the basis of their commercial policy and in an objective non-discriminatory way, the clients to whom they give access to their quotes.

To that end, systematic internalisers must have in place clear standards for governing access to their quotes.

Systematic internalisers may refuse to enter into or discontinue business relationships with clients on the basis of commercial considerations such as the client credit status, the counterparty risk and the final settlement of the transaction.

Answering to the question regarding the limitations to the commercial policy for restricting access to quotes in accordance with Article 18(5) of MiFIR (Question 8 updated on 3 October 2017, Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35) ESMA said:

“The commercial policy needs to be set out and made available to clients in advance. The commercial policy should determine meaningful categories of clients to which quotes are made available. Systematic internalisers should only be able to group clients based on non-discriminatory criteria taking into consideration the counterparty risk, or the final settlement of the transaction.

Furthermore, a number of provisions safeguard the ability of the systematic internaliser to properly manage risk. For example, a systematic internaliser may update its quotes at any time (Article 18(3) of MiFIR) and can limit the number of transactions they undertake to enter into with clients pursuant any given quote (Article 18(7) of MiFIR).”

Source of the diagram: Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35

SI’s requirement to enter into transactions under the published conditions

According to Article 18(6) MiFIR, systematic internalisers are required to enter into transactions under the published conditions with any other client to whom the quote was made available in accordance with the above rules when the quoted size is at or below the size specific to the instrument (SSTI).

Commission Delegated Regulation (EU) 2017/567 of 18 May 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council with regard to definitions, transparency, portfolio compression and supervisory measures on product intervention and positions

Article 16

Size specific to the instrument

(Article 18(6) of Regulation (EU) No 600/2014)

For the purposes of Article 18(6) of Regulation (EU) No 600/2014, the size specific to the instrument in respect of instruments traded on request for quote, voice, hybrid or other trading forms shall be as set out in Annex III to Commission Delegated Regulation (EU) 2017/583.

The SSTI is defined in this regard by Article 16 of Commission Delegated Regulation (EU) 2017/567 of 18 May 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council with regard to definitions, transparency, portfolio compression and supervisory measures on product intervention and positions, which, in turn, cross-refers to Annex III of the RTS 2 (see - Liquidity assessment, LIS and SSTI thresholds for non-equity financial instruments (Annex III to the Commission Delegated Regulation (EU) 2017/583 of 14 July 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council on markets in financial instruments with regard to regulatory technical standards on transparency requirements for trading venues and investment firms in respect of bonds, structured finance products, emission allowances and derivatives).

Systematic internalisers are allowed to establish non-discriminatory and transparent limits on the number of transactions they undertake to enter into with clients pursuant to any given quote (Article 18(7) MiFIR).

In the Answer 9 (updated on 3 October 2017, Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35) ESMA underlined systematic internalisers are allowed to limit the number of transactions they undertake to enter into with clients pursuant to any given quote under Article 18(7) of MiFIR even to one transaction.

As a minimum the quote provided to a client following the request for such a quote should be potentially executable by any other clients where for example the requesting client has decided not to trade against it (or to execute only part of it).

In any case, should SIs decide to establish non-discriminatory and transparent limits on the number of transactions they undertake to enter into with clients, they should make these limits public and provide a justification.

Moreover, MiFIR clearly stipulates (Article 18(5)) that systematic internalisers may refuse to enter into or discontinue business relationships with clients on the basis of commercial considerations such as the client credit status, the counterparty risk and the final settlement of the transaction.

In “justified cases”, SIs may execute orders at a better price than the quoted prices provided that this price falls within a public range close to market conditions.

In the Answer 23 (updated on 3 October 2017, Questions and Answers on MiFID II and MiFIR market structures topics, ESMA70-872942901-38) ESMA has explained what are those “justified cases” with respect to pre-trade transparency framework for systematic internalisers in shares, depositary receipts, ETFs, certificates and other similar financial instruments.

The respectve SI’s pre-trade transparency framework for bonds, structured finance products, emission allowances and derivatives was not mentioned by ESMA on this occasion, but - given that Article 15(2) of MiFIR is analogous in that regard to Article 18(5) - it seems that the parallels may be extended also to the latter regime.

In the said Answer 23 ESMA indicated that the purpose of these provisions is to ensure the efficient valuation of the respective instruments and to maximise the possibility for investment firms to obtain the best deal for their clients.

ESMA notes that marginal price improvements on quoted prices would challenge the efficient valuation of equity instruments without bringing any real benefits to investors.

As a consequence, and to ensure that price improvements do not undermine the efficient pricing of instruments traded, price improvements on quoted prices would only be justified when they are meaningful and reflect the minimum tick size applicable to the same financial instrument traded on a trading venue.

This is without prejudice to SIs’ ability to quote any price level when dealing in sizes above standard market size.

Update of the SI’s quotes

Systematic internalisers may update their quotes at any time.

ESMA referred specifically to the issue for how long the quotes provided by systematic internalisers should be firm or executable.

The authority's answer was that "the quote should remain valid for a reasonable period of time allowing clients to execute against it."

ESMA added that a systematic internaliser may update its quotes at any time, provided at all times that the updated quotes are the consequence of, and consistent with, genuine intentions of the systematic internaliser to trade with its clients in a non-discriminatory manner.

Withdrawal of the SI’s quotes

Systematic internalisers may withdraw their quotes under exceptional market conditions.

Application of the systematic internaliser pre-trade obligations on a package order level

In the answer to the Question 4c (Non-equity transparency, updated on 3 October 2017, Questions and Answers on MiFID II and MiFIR transparency topics, ESMA70-872942901-35) ESMA explained that for pre-trade transparency obligations to apply at package order level, including for an exchange for physical, an investment firm must be a systematic internaliser in all financial instrument components of the order.

Where an investment firm is prompted for a quote for a package order for which it is a systematic internaliser only for some components, the investment firm can decide either to provide a firm quote for the whole package or only for the components for which it is a systematic internaliser.