Long-Term Transmission Rights (LTTRs)

Long-term transmission rights (LTTRs) mean:

- Physical Transmission Rights (PTRs) or

- Financial Transmission Rights (FTRs);

acquired in the forward capacity allocation (Article 2(2) of Commission Regulation (EU) 2016/1719 of 26 September 2016 establishing a guideline on forward capacity allocation (FCA Regulation)).

|

|

6 February 2023 ACER’s policy paper on the further development of the EU electricity forward market

1 June 2022

|

FTRs, in turn, divide into:

- Financial Transmission Right Obligations (FTRs obligations), and

- Financial Transmission Right Options (FTRs options).

The current FCA Regulation provides a framework which enables to issue LTTRs in a form of PTRs with Use-It-Or-Sell-It (UIOSI) principle and FTR options or obligations. However, only PTRs and FTR options are currently used on different borders, whereas FTR obligations are not used on any bidding zone border, nevertheless FTRs obligations are by default the underlying products in case long term cross-zonal capacities are allocated implicitly via market coupling (ACER and CEER, Draft Policy Paper on the Further Development of the EU Electricity Forward Market for Consultation, 1 June 2022, p. 23, 24).

If there is sufficient inter-market coordination and liquidity, FTRs are considered the preferred product, however, until these conditions are not attained, PTRs are regarded as the most suitable transitory solution.

The ACER in its policy paper of 6 February 2023 on the further development of the EU electricity forward market underlines that PTR with UIOSI and FTR options are financially fully equivalent – they offer the same level of hedging to the holder (except in very specific cases such as scarcity situations (curtailment in day-ahead market) where FTR holder would be exposed to imbalance prices which may be higher than DA prices, whereas PTR holder would still be exposed to day-ahead prices). PTR/FTR options (with UIOSI) raise several regulatory concerns regarding the objectives of efficient forward market functioning:

1. Hedging with FTR options is more costly as the values of FTR options represent only positive market spread, which may be significantly higher than average market spread. Higher prices also mean higher costs of collaterals.

2. The value of FTR options is more difficult to estimate. Market participants need to forecast prices for each market time unit during delivery period and then take the average of the positive values. This may be quite a challenge for FTR options with long maturity times and delivery periods.

3. PTR/FTR options are not well suited to integrate forward markets. Integration of forward markets with cross-zonal capacities would require an arbitrage between two markets, i.e. buying/selling futures in one bidding zone, buying PTRs or FTRs and selling/buying futures in another bidding zone. As futures are predominant hedging contracts in zonal forward markets, PTR/FTR options are not compatible with such arbitrage as they do not enable risk-free arbitrage or such arbitrage comes at a higher cost than necessary.

4. FTR options may significantly reduce the volume of allocated FTRs. First, because FTR options do not allow for netting of cross-zonal capacity and no capacity can be allocated in the opposite direction due to allocation of FTR options. Second, in FTR options the cross-zonal capacity is usually allocated fully in both directions, which means there are no capacity leftovers. This means that the objective of having daily auctions or continuous trading with capacity leftovers would be significantly reduced. Such trade would be possible only if market participants (re)sell some FTR options and thereby release some previously allocated capacity.

5. Having both FTR options and obligations would contribute to market fragmentation as it would establish three different products per bidding zone or per border with different prices and separate secondary markets.

6. In light with the difficulty of FTR options valuation, FTR options are likely significantly contributing to undervaluation. Hence, keeping FTR options may not be able to address this problem. While undervaluation on the one hand causes loss of congestion income for TSOs and end consumers, it on the other hand means significant risk-free profits for market participants. This may partly explain the preference for PTR/FTR options.

The said ACER and CEER Draft Policy Paper of 1 June 2022 also observes that the current FCA Regulation provides a framework in which long term cross-zonal capacities are allocated with explicit allocation and LTTRs are issued to market participants based on such allocation. These are issued on bidding zone borders only, which means only between neighbouring bidding zones which are interconnected. This setup results from historical development where cross-border trading began between neighbouring bidding zones only based on available interconnection capacity. Only after the markets have been properly integrated and especially with the introduction of flow-based capacity calculation, it became apparent that the option to allocate LTTRs also between non-neighbouring bidding zones is also feasible, but is not yet integrated in the legal framework.

Overall, the long-term supply contracts and corresponding long term transmission rights are considered essential energy markets' features to ensure cross-border trade between bidding zones and delivery of reliable energy for customers (Eurelectric letter to the DG FISMA of 19 November 2015 titled “Eurelectric‘s concerns on the negative impact of Financial Transmission Rights being classified as financial instruments under MiFID II on the completion of the internal energy market”).

ENTSO-E policy paper of December 2022 on the EU's Electricity Forward Markets expressed an opinion that LTTRs are designed to be 'market participant-friendly' with low entry barriers ('market-friendly' collateral scheme, no trading fees, no reporting obligations according for financial regulations) compared to the trading of derivatives, as they are a complimentary product to secure a firm hedge.

|

|

PTRs and FTRs are auctioned by Transmission System Operators (TSOs) and can, theoretically, be traded on secondary capacity market. PTRs and FTRs enable market participants to cover the risks of changing conditions between the contracting and delivery of contracts and to hedge short-term price differentials between two neighbouring bidding zones. In most of Europe the cross-border access to forward electricity markets is based on transmission rights.

However, there is limited number of liquid forward markets in Europe (ACER/CEER Annual Report on the Results of Monitoring the Internal Electricity Market in 2015, September 2016 (MMR 2015), p. 35, 37). In the Nordic and Baltic markets and within Italy, cross-border access to forward markets is based on contracts which cover the difference between the relevant “hub” price (which represents the forward price reference for a group of bidding zones) and each specific bidding zone price. Examples of these contracts are the so-called Electricity Price Area Differentials (EPADs) in the Nordic and Baltic markets or FTRs within Italy. A shift towards the use of Financial Transmission Rights instead of Physical Transmission Rights was observed e.g. in Italy, Denmark and Belgium.

The FCA Regulation foresees LTTRs to be the issued on all EU bidding zone borders, nevertheless, the relevant National Regulatory Authorities (NRAs) may decide to derogate from the requirement to issue LTTRs on a specific border, after consultation with market participants and an assessment concluding that the existing electricity forward market provides sufficient hedging opportunities. With respect to the latter reservation the ACER/CEER Annual Report of October 2017 on the Results of Monitoring the Internal Electricity and Gas Markets in 2016 (Electricity Wholesale Markets Volume, p. 42) refers to the Nordic NRAs’ (except Norway) decisions on the assessment whether the electricity forward markets in the Nordic region provide sufficient hedging opportunities in the bidding zones concerned. Based on different indicators, the Finnish and Swedish NRAs have concluded that the existing hedging opportunities are sufficient in their respective areas of jurisdiction, while the Danish NRA has concluded that there are insufficient hedging opportunities in the two Danish bidding zones (DK1 and DK2). Pursuant to these decisions, TSOs were not requested to implement any specific measure on borders connecting the respective bidding zones. On the borders between DK1 and SE3 and between DK2 and SE493, TSOs were not requested to introduce LTTRs, but to ensure that other long-term cross-zonal hedging products are made available to support the functioning of the electricity wholesale markets.

The ACER and CEER Draft Policy Paper of 1 June 2022 on the Further Development of the EU Electricity Forward Market refers to this forward market arrangement as “contracts for differences (CfDs) without coupling” and notes the following respective features:

- TSOs are not involved, PX offers trading with CfDs to market participants,

- those CfDs allow the market participants to hedge the price difference between a zone and a hub.

- the supply and demand of CfDs in respective zones A and B is perfectly matched – there is no cross-zonal matching,

- in the settlement after delivery, the market participants will have the following financial flow through the PX (negative value indicate pay for buy orders):

𝐴𝑚𝑜𝑢𝑛𝑡 𝑡𝑜 𝑝𝑎𝑦/𝑟𝑒𝑐𝑒𝑖𝑣𝑒 = 𝐶𝑓𝐷 𝑉𝑜𝑙𝑢𝑚𝑒 ∗ ((𝑍𝑜𝑛𝑎𝑙 𝑆𝑝𝑜𝑡 𝑃𝑟𝑖𝑐𝑒 - 𝐻𝑢𝑏 𝑆𝑝𝑜𝑡 𝑃𝑟𝑖𝑐𝑒) -𝑀𝑎𝑡𝑐h𝑒𝑑 𝐶𝑓𝐷𝑃𝑟𝑖𝑐𝑒) [€/𝑀𝑊h]

ACER observes that, in principle, also another model is possible i.e. CfDs with coupling, which relies on power exchanges to facilitate trade with CfDs, which can be done based on auctions as well as continuous trading. In this case it includes market coupling, which is traditionally able to better allocate cross-zonal capacities compared to explicit auctions. This enables more continuous trading and secondary markets as well as effective hedge against cross-zonal price risk. CfDs with coupling pool the forward market liquidity to a common hub thereby giving the same market access to all bidding zones and more likely reducing bid-ask spreads and risk premia.

According to Article 35(8) of the Harmonised Allocation Rules (HAR), the LTTRs are deemed to have been allocated by the Single Allocation Platform to the auction registered participant from the moment the said participant has been informed of the auction results and the contestation period is closed.

LTTRs’ pricing

It may be important from the market participant's perspective that pursuant to the rules elaborated on forward capacity allocation in the EU Internal Electricity Market (Article 40 of the FCA Regulation), the price of long term transmission rights for each bidding zone border, direction of utilisation and market time unit will be:

- determined based on the marginal price principle, and

- expressed in euro per megawatt.

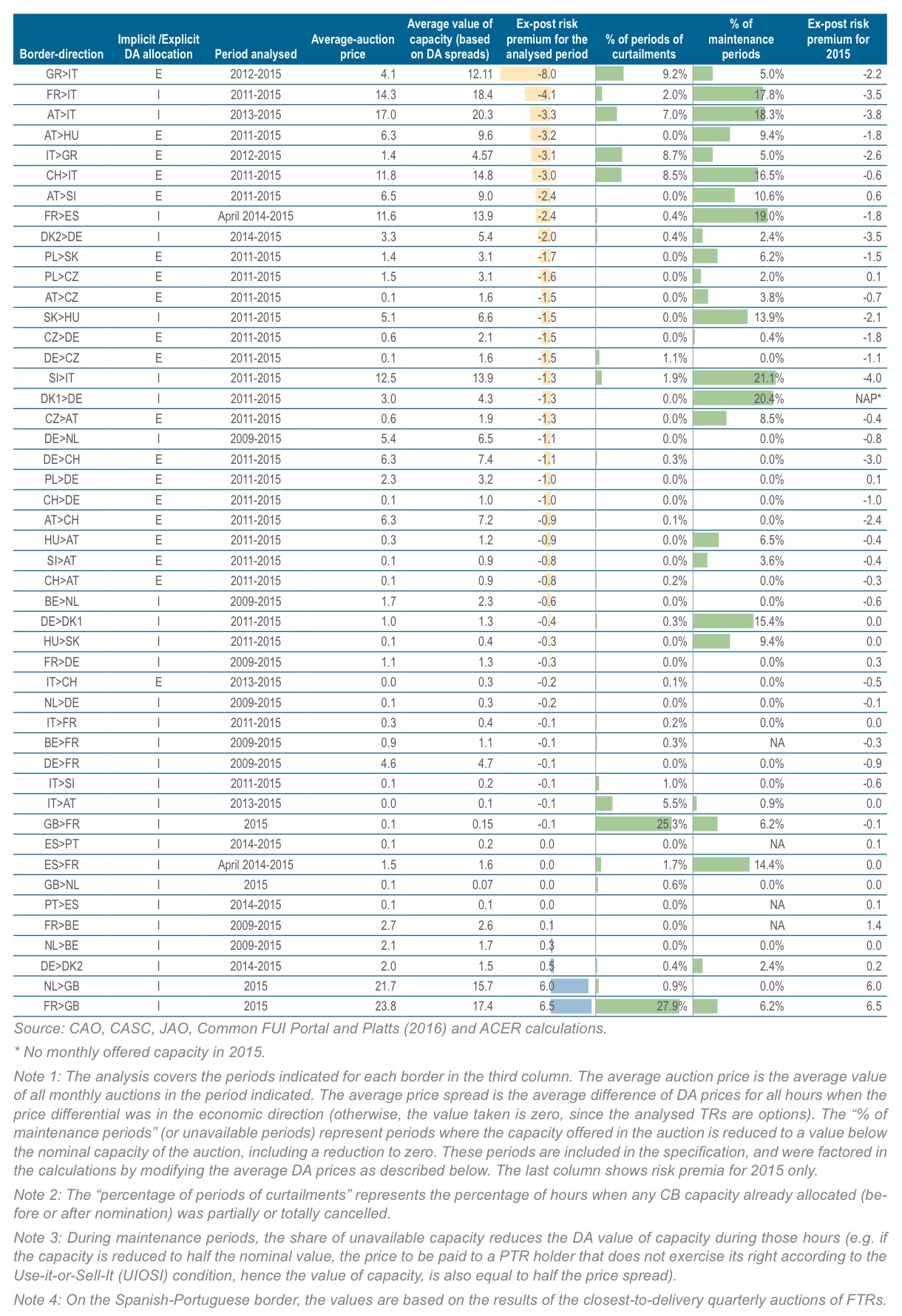

Table: Discrepancies between the auction price of transmission rights (monthly auctions) and the day-ahead price spreads for a selection of EU borders – various periods 2009 - 2015 (euros/MWh), source: ACER/CEER Annual Report on the Results of Monitoring the Internal Electricity Market in 2015, September 2016, p. 36

Practically, in the model for Bidding Zone Border Long-Term Transmission Rights (BZB LTTRs), currently applied in continental Europe, the LTTRs’ settlement applies as follows (it is described in the ACER and CEER Draft Policy Paper of 1 June 2022 on the Further Development of the EU Electricity Forward Market).

In principle, the TSOs and the Single Allocation Platform are involved. TSOs allocate long-term cross-zonal capacities and issue LTTRs (financial or physical) to market participants. Those LTTRs allow the market participants to hedge the price difference between two neighbouring zones (in a specific direction in case of PTRs or FTR options). The above example is valid for the currently allocated FTR options or PTRs (FTR obligations are not considered here) where the market participants can hedge different borders and directions. The auction price and quantity is defined by a welfare optimization of the bids of the market participants and the volume of cross-zonal capacities offered by TSOs. In the settlement phase, there are two steps at which financial flows take place.

First, following the LTTR auction, the market participant will pay to the TSO through the SAP the following amount:

𝐴𝑚𝑜𝑢𝑛𝑡 𝑡𝑜 𝑝𝑎𝑦 = 𝐿𝑇𝑇𝑅 𝑉𝑜𝑙𝑢𝑚𝑒 ∗ 𝐴𝑢𝑐𝑡𝑖𝑜𝑛 𝑃𝑟𝑖𝑐𝑒 𝑜𝑓 𝐿𝑇𝑇𝑅

After delivery, the market participants (except those which choose to nominate PTRs) will receive from the TSO through the SAP the following remuneration (in case of obligations also the negative market spread is taken into account):

𝐴𝑚𝑜𝑢𝑛𝑡 𝑡𝑜 𝑟𝑒𝑐𝑒𝑖𝑣𝑒 = 𝐿𝑇𝑇𝑅 𝑉𝑜𝑙𝑢𝑚𝑒 (Zone A⇒ Zone B) ∗ max(0, 𝑍𝑜𝑛𝑎𝑙 𝑆𝑝𝑜𝑡 𝑃𝑟𝑖𝑐𝑒 𝐵 - 𝑍𝑜𝑛𝑎𝑙𝑆𝑝𝑜𝑡 𝑃𝑟𝑖𝑐𝑒 𝐴)

According to the MMR 2015, on average, PTR auction prices on most borders continued to be below the recorded day-ahead price spreads in 2015. Based on the said data ACER suggests that the three relevant factors that negatively affect the value of transmission rights are:

- the lack of market coupling,

- the probability of curtailments, and

- the periods of maintenance.

The first factor should be addressed immediately, with the completion of the day-ahead market coupling project across the EU. The impact of curtailments should be mitigated by the implementation of stronger firmness regimes as envisaged in the FCA Regulation. Periods of maintenance (also known as ‘reduction periods’ or periods of unavailability) seem to significantly reduce the value of transmission rights. ACER explains this by the fact that a transmission right that is subject to reduction periods does not fully meet market participants’ needs. In this case, market participants would remain exposed to risks during those periods, which unavoidably reduces the value of the product.

There are various ways of mitigating the impact of maintenance periods in risk premia. One possibility is to ensure that maintenance is scheduled when the impact on prices is likely to be lower (e.g. during periods of lower demand). Another (complementary) measure would be to ensure that the capacity offered by TSOs in a given timeframe does not exceed the maximum amount that can be offered even during maintenance periods, offering the remaining capacity through separated products in the same timeframe or simply leaving the remaining capacity for subsequent timeframes. On the one hand, this would increase the value of transmission rights and on the other, this may shift some capacity from long-term to closer-to-delivery timeframes, including the day-ahead timeframe.

In theory, if LTTRs would be used for hedging purposes, the LTTR prices should on long-term average be above the expected market spread (including also a positive risk premium). A negative risk premium could occur only in case where the seller of the contract is more interested to hedge than the buyer (ACER’s policy paper of 6 February 2023 on the further development of the EU electricity forward market).

Principles for LTTRs remuneration

Principles for LTTRs remuneration are laid down in Article 35 of the FCA Regulation - see box below.

FCA Regulation Article 35

Principles for long-term transmission rights remuneration

1.The relevant TSOs performing the allocation of transmission rights on a bidding zone border through the single allocation platform shall remunerate the long-term transmission rights holders in case the price difference is positive in the direction of the long-term transmission rights.

2.The holders of FTRs — obligations shall remunerate the relevant TSOs through the single allocation platform allocating transmission rights on a bidding zone border in case the price difference is negative in the direction of the FTRs — obligations.

3.The remuneration of long-term transmission rights in paragraphs 1 and 2 shall comply with the following principles:

(a) where the cross-zonal capacity is allocated through implicit allocation or another method resulting from a fallback situation in the day-ahead time frame, the remuneration of long-term transmission rights shall be equal to the market spread;

(b) where the cross-zonal capacity is allocated through explicit auction in the day-ahead time frame, the remuneration of long-term transmission rights shall be equal to the clearing price of the daily auction.

4.In case allocation constraints on interconnections between bidding zones have been included in the day-ahead capacity allocation process in accordance with Article 23(3) of Regulation (EU) 2015/1222, they may be taken into account for the calculation of the remuneration of long-term transmission rights pursuant to paragraph 3.

In the Decision No 15/2021 of 29 November 2021 on the TSOs’ proposal for amendment of the harmonised allocation rules for long-term transmission rights the ACER concluded, on the basis of legal provisions of the FCA Regulation, that the TSO’s proposal for inclusion of a cap for remuneration of LTTRs in the HAR lacks legal basis and that, consequently, the proposed cap could not be part of the HAR.

According to the ACER:

- compensation of capacity curtailments and remuneration of LTTRs are fundamentally different events taking place before and after, respectively, of the day-ahead firmness deadline and cannot be compared or assessed together;

- the provisions determining the remuneration of LTTRs cannot illegally profit from being placed to a section covering the caps for compensation of capacity curtailments, just to enjoy the benefits of its provisions, because the FCA Regulation only allows the introduction of a cap on compensations - Article 35 of the FCA Regulation, as well as Article 48 of the HAR envisage the remuneration of LTTRs based on market spread, therefore no cap is possible;

- a modification of the HAR to allow caps on the remuneration of LTTRs in case of decoupling would require amendments to the FCA Regulation;

- the wording of Article 35(3) of the FCA Regulation clearly states that the prescribed remuneration regime is an obligation (‘shall comply with’, ‘shall be equal to market spread’), which does not provide flexibility for alternatives.

LTTRs' status under the financial market legislation and the REMIT Regulation

ACER classifies FTRs and PTRs as wholesale energy products under the REMIT Regulation. In the document: Frequently Asked Questions (FAQs) on REMIT transaction reporting, Answer to the Question 4.1.6 (published on 30 April 2021) the Agency said as follows:

“According to Q&A II.3.8., the Agency's understanding of Article 2(4) of REMIT and of Article 3(1) of the REMIT Implementing Regulation is that FTRs and PTRs are wholesale energy products that are listed as reportable contracts according to Article 3(1) of the REMIT Implementing Regulation. This is why the Agency has to consider FTRs and PTRs as wholesale energy products that will be reported to the Agency pursuant to Article 8(1) of REMIT, as long as ESMA does not specify in its guidance documents that these wholesale energy products are identified as financial instruments according to MiFID II that have to be reported under MiFIR and/or EMIR. The reporting obligation concerning any similar product should follow the same logic.

As long as the relevant products are not reportable under MiFIR or EMIR, the reporting obligation under REMIT applies even if the financial authorities were to define the relevant products as financial instruments in MiFID II. As long as these products are not reported under MiFIR or EMIR, the reporting under REMIT does not constitute a case of double reporting under Article 8(3) of REMIT.”

In turn, in the Decision No 15/2021 of 29 November 2021 on the TSOs’ proposal for amendment of the harmonised allocation rules for long-term transmission rights the ACER observed that the transfer of transmission rights between participants should be facilitated, and that the secondary market for transmission rights with frequent trading and price indications could increase the quality of FTRs as hedging instruments (in line with Article 3 of the FCA Regulation), “but this cannot be achieved, unless FTRs are clearly exempted from financial instruments’ regulation”.

Nevertheless, in the ACER’s opinion, a creation of a secondary market, as well as the regulation of financial instruments are out of the scope of the harmonised allocation rules for LTTRs.

Regional design of LTTRs

The current FCA Regulation and Regulation EU 2019/943 provide a framework for TSOs:

- to issue LTTRs or

- to apply equivalent measures that enable to hedge price risks across bidding zone borders;

except in cases where regulatory authorities identify that the forward market provides sufficient hedging opportunities in the concerned bidding zones.

This framework resulted in three different regimes across Europe:

1. The long term transmission rights in the form of PTRs or FTR options are issued in capacity calculation regions of Core, Italy North, South East Europe and South-West Europe regions as well as on bidding zone borders FI-EE, EE-LV, DK1-DE, DK1-NL, DK2-DE and DK1-DK2. These transmission rights are issued within the framework of the Joint Allocation Office and Harmonised Allocation Rules as established by the FCA Regulation.

2. In Nordic CCR TSOs currently issue long-term transmission rights only on DK1-DK2 border. On the remaining borders, regulatory authorities decided that forwards and futures linked to the Nordic system price forward market as well as CfDs are sufficient to provide hedging possibilities to market participants active in the Nordic bidding zones. Recently some Nordic regulatory authorities are discovering that some bidding zones may not provide sufficient hedging opportunities. For example, in March 2022 the Finnish regulatory authority informed ACER that it has identified insufficient hedging opportunities in the Finnish bidding zone.

3. In bidding zones within Italy, the TSO allocates the so-called Contracts Covering the Risk of Volatility of the Fee for Assignment of Rights of Use of Transmission Capacity (‘CCCs’) which are a form of FTR obligations linked to a hub price (which is the Italian PUN price) and the volume of allocated CCCs from different bidding zones is limited with long-term transmission capacity between bidding zones.

The regionally specific regime mainly results from the historical development on how regional markets have been setup before the integration into EU market. In particular, the different approach to bidding zones (i.e. the Nordic and Italian market favouring small bidding zones to manage congestions more efficiently) is a major contributor to a different forward market design.

Rules on the regional design of long term transmission rights are developed pursuant to the procedure stipulated in Article 31 of the FCA Regulation (see box).

Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the internal market for electricity (recast), Article 9

Forward markets

1. In accordance with Regulation (EU) 2016/1719, transmission system operators shall issue long-term transmission rights or have equivalent measures in place to allow for market participants, including owners of power-generating facilities using renewable energy sources, to hedge price risks across bidding zone borders, unless an assessment of the forward market on the bidding zone borders performed by the competent regulatory authorities shows that there are sufficient hedging opportunities in the concerned bidding zones.

2. Long-term transmission rights shall be allocated in a transparent, market based and non-discriminatory manner through a single allocation platform.

3. Subject to compliance with Union competition law, market operators shall be free to develop forward hedging products, including long-term forward hedging products, to provide market participants, including owners of power-generating facilities using renewable energy sources, with appropriate possibilities for hedging financial risks against price fluctuations. Member States shall not require that such hedging activity be limited to trades within a Member State or bidding zone.

Allocation rules must contain at least the description of the following items:

(a) type of long term transmission rights:

(b) forward capacity allocation timeframes;

(c) form of product (base load, peak load, off-peak load);

(d) the bidding zone borders covered.

What is particularly noteworthy, among the terms, conditions and methodologies that require the approval by all regulatory authorities of the concerned region are:

- the regional design of long term transmission rights;

- the regional requirements of the Harmonised Allocation Rules;

- the regional compensation rules (Article 4(7)(c) and (e) of the FCA Regulation).

The rules developed for the European Capacity Calculation Regions (CCRs) reflect the above set-up.

ACER First implementation monitoring report of 18 January 2019 on capacity allocation and congestion management and forward capacity allocation (p. 19) indicates that all regional designs for LTTRs define LTTRs as base-load products with the possibility of specific reduction periods (with the exception of CCRs Channel and IU, where the form of the product may be also be the peak-load and off-peak-load). The Core CCR TSOs' proposal for the regional design of long-term transmission rights in accordance with Article 31 of Commission Regulation (EU) 2016/1719 of 10 March 2017 envisions a month and year as the forward capacity time-frames for long term transmission rights issued in the Core CCR. The said long term transmission rights are to be issued in form of base load products with a fixed amount of MW over the product period, the product form may include reductions periods, i.e. specific calendar days and/or hours within the product period, in which cross zonal capacities with a reduced amount of MW are offered, taking into account a foreseen specific network situation (e.g. planned maintenance, long-term outages, foreseen balancing problems).

In the CCR Core, TSOs initially proposed a regional design for LTTRs for all bidding zone borders except CZ-SK and DE/LU-AT. The amended TSOs proposal introduces PTRs on the bidding-zone border CZ-SK and FTR Options on the bidding-zone border DE/LU-AT. The ACER’s Monitoring Report of 30 January 2019 on the implementation of the CACM Regulation and the FCA Regulation explains this evolution as follows:

“The introduction of FTR Options on the DE/LU-AT border is at least partly the result of an exceptionally high volume of offered long-term cross-zonal capacity on this border (i.e. 4.9 GW) and of the fact that the calculation of this capacity is not coordinated with other TSOs in a CCR.

If PTRs were introduced and all the PTRs were physically nominated in the day- ahead timeframe, this would create high physical flows in the wider region which would imply very low capacity left to be offered in the day ahead timeframe in the wider region.

In case of FTR Options, the volume of offered long-term cross-zonal capacity has no impact on physical flows on other borders in the region and thereby does not reduce the day-ahead cross-zonal capacity on those borders”

Interesting evolution can be seen in the decisions taken as regards LTTRs’ types - while the initial TSOs’ document “Core CCR TSOs’ proposal for the regional design of long-term transmission rights in accordance with Article 31 of Commission Regulation (EU) 2016/1719” of 19 July 2018 envisioned FTRs options only on the three bidding zones’ borders, i.e. NL-BE, BE-FR, AT-DE/LU (the rest being PTRs with the UIOSI principle) in the subsequent paper: “2nd amendment of the Core CCR TSOs’ regional design of long-term transmission rights based on Article 4(12) of Commission Regulation (EU) 2016/1719” of 25th January 2019 the FTRs-options’ scope was extended to further five interconnections (see table below). In the light of the earlier remarks regarding fundamental characteristics of specific types of LTTRs, this tendency appears to confirm growing maturity of cross-border electricity markets within the EU.

The timelines for the implementation of the single day-ahead coupling (SDAC) evidently also have a respective bearing, as the ACER Decision No 15/2019 on the Core CCR TSOs’ proposal for the regional design of long-term transmission rights of 30 October 2019 mentions that the national regulatory authorities of the DE-AT-PL-4M MC project (market coupling on DE/LU-PL, DE/LU-CZ, CZ-PL, SK-PL, AT-CZ and AT-HU bidding zone borders) requested the respective TSOs to implement FTRs on the AT-CZ, AT-HU borders for the long-term allocation in parallel with the implementation of the single day-ahead coupling on those borders. Therefore, as the said Decision states, after the date of implementation of single day-ahead coupling on those borders, all long-term cross-zonal capacities on those borders will be allocated in the form of FTR Options, without affecting the status of the already allocated PTRs.

Introducing FTR Options on the respective bidding zone borders have been motivated by the ACER in the said Decision No 15/2019 of 30 October 2019 with the following reasons:

(i) this allows TSOs to offer to market participants the total long-term cross-zonal capacities in long-term auctions for hedging purposes and

(ii) in the day-ahead timeframe, the total day-ahead cross-zonal capacities are available for market coupling as they are not being reduced by physical nominations of LTTR .

The recitals 41 - 44 of the said ACER Decision No 15/2019 of 30 October 2019 read:

“(41) The Agency supports the reasoning that the use of FTR Options is consistent with the objective to maximise the cross-zonal capacities available for single day-ahead coupling, and in that regard is more efficient than the use of physical transmission rights.

(42) On the other hand, the Agency acknowledges that as a consequence of the introduction of FTR Options in a situation where the day-ahead market would not clear in a specific bidding zone, financial risks would be higher for holders of FTR Options than for holders of PTRs as the latter would have the ability to balance their position by physically nominating their exchanges from neighbouring bidding zones with PTRs. Holders of FTR Options would be compensated at the day-ahead market spread, which is the difference between the day-ahead price of the neighbouring bidding zone and the day-ahead price of the not cleared bidding zone (currently capped at 3,000€/MWh), while being exposed to the imbalance settlement price in that zone, which can be capped at a price higher than 3,000€/MWh.

(43) Nevertheless, the Agency finds the general policy objectives of introducing FTR Options, maximising the liquidity of the single day-ahead coupling and harmonising the type of LTTR as more important than mitigating the risks highlighted by some stakeholders related to partial clearing of the day-ahead market. The Agency notes that a situation where the market would not clear in specific bidding zones has not occurred yet in the EU to this day and therefore the Agency considers such risks to be outweighed by the benefits of maximising the liquidity of the single day-ahead coupling.

(44) Further, the Agency notes that the origin of the risks involved with the FTR Options lies with the non-harmonised maximum and minimum prices in different timeframes and established pursuant to Commission Regulation (EU) 2015/1222 (the ‘CACM Regulation’) and Commission Regulation (EU) 2017/2195 (the ‘Electricity Balancing Regulation’). Therefore, if the identified risks due to non-harmonised maximum and minimum prices persist or increase, the Agency advocates a solution by which these price limits would need to be harmonised across different timeframes. Also, until these price limits are harmonised, regulatory authorities may consider other national transitory measures”.

Hence, the recitals of the Decision No 15/2019 of 30 October 2019 the ACER confirms the inherent risks of the current market design involving FTR Options related to the partial clearing of the day-ahead market. The said risks consist in the fact that the holders of FTR Options in the occurrence of partial clearing of the day-ahead market would be compensated in at the day-ahead market spread, which is the difference between the day-ahead price of the neighbouring bidding zone and the day-ahead price of the not cleared bidding zone (currently capped at 3,000€/MWh), while being exposed to the imbalance settlement price in that zone, which can be capped at a price higher than 3,000€/MWh. However, such risks must be mitigated by market participants by themselves with other means as the energy market regulator gives in this regard the priority to maximising the liquidity of the single day-ahead coupling.

The above arguments are also visible in the ACER First implementation monitoring report of 18 January 2019 on capacity allocation and congestion management and forward capacity allocation (p. 19), which explains the evolution and interdependencies as regards the DE/LU-AT border as follows:

“The introduction of FTR Options on the DE/LU-AT border is at least partly the result of an exceptionally high volume of offered long-term cross-zonal capacity on this border (i.e. 4.9 GW) and of the fact that the calculation of this capacity is not coordinated with other TSOs in a CCR.

If PTRs were introduced and all the PTRs were physically nominated in the day-ahead timeframe, this would create high physical flows in the wider region which would imply very low capacity left to be offered in the day ahead timeframe in the wider region.

In case of FTR Options, the volume of offered long-term cross-zonal capacity has no impact on physical flows on other borders in the region and thereby does not reduce the day-ahead cross-zonal capacity on those borders.”

The types of long-term transmission rights on each of the Core bidding zone borders pursuant to the document: “2nd amendment of the Core CCR TSOs’ regional design of long-term transmission rights based on Article 4(12) of Commission Regulation (EU) 2016/1719“ of 25 January 2019, are set out in the table below.

|

Core CCR borders

|

Type of Long-Term Transmission Right |

|

NL-BE |

FTR options |

| NL-DE/LU | FTR options |

| BE-FR |

FTR options |

| BE-DE/LU | FTR options |

| FR-DE/LU | FTR options |

| PL-DE/LU | Physical transmission rights pursuant to UIOSI principle |

| PL-CZ | Physical transmission rights pursuant to UIOSI principle |

| CZ-DE/LU | Physical transmission rights pursuant to UIOSI principle |

| PL-SK | Physical transmission rights pursuant to UIOSI principle |

| AT-DE/LU | FTR options |

| AT-CZ | FTR options |

| AT-SI |

Physical transmission rights pursuant to UIOSI principle |

| SI-HR | Physical transmission rights pursuant to UIOSI principle |

| HR-HU | Physical transmission rights pursuant to UIOSI principle |

| AT-HU | FTR options |

| HU-SK | Physical transmission rights pursuant to UIOSI principle |

| HU-RO | Physical transmission rights pursuant to UIOSI principle |

| CZ-SK | Physical transmission rights pursuant to UIOSI principle |

| SI-HU | Physical transmission rights pursuant to UIOSI principle |

On 12 December 2019 the TSOs adopted the 3rd amendment of the Core CCR TSOs’ regional design of long-term transmission rights based on article 4(12) of Commission Regulation (EU) 2016/1719 (subject to approval by all respective national regulatory authorities).. Approved 3rd amendment introduces the implementation of financial transmission rights options at all bidding zone borders in Core CCR (except SI-HR) following the implementation of the Core Flow-Based Day-Ahead Market Coupling Project.

Shortcomings of the current design of LTTRs

As the EFET observed in its document of March 2022 (EFET Insight into Forward Trading in Wholesale Electricity Markets):

“Long-term transmission rights (physical or financial) issued by transmission system operators (TSOs) are the most reliable tool to connect national forward markets with each other: they allow buyers and sellers of electricity to secure physical capacity on an interconnector one year to a few months in advance, and/or to lock in a financial security against the price difference between two price zones (usually countries)."

Nevertheless, this maximum one year product when it comes to securing capacity on an interconnector seems to be the major obstacle in concluding cross-border Power Purchase Agreements (PPAs) (where at least 5 years would be required).

Aforementioned ACER and CEER Draft Policy Paper of 1 June 2022 also observes that market participants enter into long term contracts on a continuous basis, but they are only able to acquire LTTRs in very few occasions. Two elements to improve this discrepancy could be to introduce more frequent auctions and to facilitate secondary market. The regulators elaborate on the problems of the current EU electricity market design for LTTRs as follows:

- No continuous/secondary market: The alternative hedging strategy with LTTRs is not available on a continuous basis to support the continuous nature of electricity trading, in particular in forward timeframe. This is because LTTRs are auctioned only at specific times and no secondary market exists, where market participants could buy LTTRs at the time when they settle a new trade which exposes their position.

- Inadequate maturities: The alternative hedging strategy with LTTRs is limited only to shorter maturities, namely year ahead (yearly LTTRs auction about one month before the start of the delivery year) and month ahead (monthly auction about few weeks before the start of the delivery month). This does not enable such a strategy to be used for longer-term deliveries or other within-year deliveries (e.g. quarters or seasons), which are generally available at liquid forward markets. This puts market participants, which can only use the alternative strategy, in an even worse position compared to participants which can rely on zonal forward market for hedging without the need for LTTRs.

- Inefficient products: LTTRs are currently offered only in a form of PTRs or FTR options which offer only a hedge against a positive market spread. On the one hand, this is a flexibility appreciated by many market participants, as they are not obliged to pay the market spread to TSOs in case it is negative. On the other hand, it reduces the volumes of offered LTTR products (because the LTTRs in the opposite direction cannot be netted in terms of allocated cross-zonal capacity), makes the hedging more expensive (as the prices for LTTR options are theoretically higher than for obligations), limits the possibility to have zone-to-hub LTTRs products and makes forecasting of prices more complex (as these products are not directly comparable with the prices of futures contracts that are obligations by default).

The above critical arguments regarding current European set-up for the LTTRs have been further developed by the EU energy market regulator In the document of 6 February 2023 “ACER’s policy paper on the further development of the EU electricity forward market”. The ACER observes that although the LTTRs can be used in many different ways, in particular as basis risk products to support proxy hedging, although they are currently not very efficient for this purpose. Current LTTRs are also not very useful for continuous arbitrage between forward markets since they are not accessible continuously and with the same product timeframes and maturities as futures contracts. Further, LTTRs are issued as options which are not suitable for risk-free arbitrage between two futures contracts. Rather than supporting integration of forward markets, LTTRs seem to be predominantly used for speculation, where market participants accept certain future price risks, but only under the expectation of a profit (this may be one of the reasons for LTTRs’ undervaluation). In case TSOs allocate long-term transmission rights, ACER recommends that these are allocated in a form of FTR obligations with a full financial firmness. ACER reserves that at this stage the agency does not exclude the possibility of FTR options, however, they “may be added only after careful evaluation of their impact on the efficient functioning of electricity forward market”

ENTSO-E's Response of December 2022 to the European Commission Public Consultation on Electricity Market Design goes even further and considers a completely new approach which questions the entire economic efficiency of the LTTR market. This (alternative) policy option relies on the purely financial forward electricity markets where the long-term market evolves without TSOs, and hedging products for the future will be developed based on need by other market operators. Terminating the LTTR market is expected to reduce the complexity of the overall forward market, increase its flexibility and support the formation of correct long-term electricity prices.

FCA Regulation, Article 31

Regional design of long-term transmission rights

1. Long-term cross-zonal capacity shall be allocated to market participants by the allocation platform in the form of physical transmission rights pursuant to the UIOSI principle or in the form of FTRs – options or FTRs – obligations.

2. All TSOs issuing long-term transmission rights shall offer long-term cross-zonal capacity, through the single allocation platform, to market participants for at least annual and monthly timeframes. All TSOs in each capacity calculation region may jointly propose to offer long-term cross-zonal capacity on additional timeframes.

3. No later than six months after the entry into force of this Regulation, TSOs in each capacity calculation region where long-term transmission rights exist shall jointly develop a proposal for the regional design of long-term transmission rights to be issued on each bidding zone border within the capacity calculation region.

No later than six months after the coordinated decisions of the regulatory authorities of the bidding zone border to introduce long-term transmission rights pursuant Article 30(2), TSOs of the concerned capacity calculation region, shall jointly develop a proposal for the regional design of long-term transmission rights to be issued on each bidding zone border within the concerned capacity calculation region.

Regulatory authorities of Member States in which the current regional design of long-term transmission rights is part of a TSO cross-border re-dispatch arrangement for the purpose of ensuring that operation remains within operational security limits may decide to maintain physical long-term transmission rights on its bidding zone borders.

4. The proposals referred to in paragraph 3 shall include a time schedule for implementation and at least the description of the following items specified in the allocation rules:

(a) type of long-term transmission rights;

(b) forward capacity allocation timeframes;

(c) form of product (base load, peak load, off-peak load);

(d) the bidding zone borders covered.

5. The proposals shall be subject to consultation in accordance with Article 6. For the proposed long-term transmission rights to be issued, each TSO shall duly consider the result of the consultation.

6. The allocation of physical transmission rights and FTRs – options in parallel at the same bidding zone border is not allowed. The allocation of physical transmission rights and FTRs – obligations in parallel at the same bidding zone border is not allowed.

7. A review of long-term transmission rights offered on a bidding zone border may be launched by:

(a) all regulatory authorities of the bidding zone border, at their own initiative; or

(b) all regulatory authorities of the bidding zone border based upon a recommendation from the Agency or joint request by all TSOs of the concerned bidding zone border.

8. All TSOs in each capacity calculation region shall be responsible for undertaking the review as provided for in paragraph 9.

9. Each TSO involved in the review of long-term transmission rights shall:

(a) assess the offered long-term transmission rights taking into account the characteristics in paragraph 4;

(b) if considered necessary, propose alternative long-term transmission rights, taking into account the result of the assessment in subparagraph (a);

(c) carry out a consultation in accordance with Article 6 regarding:

(i) the results of the assessment of the offered long-term transmission rights;

(ii) if applicable, the proposal for alternative long-term transmission rights.

10. Following the consultation referred to in paragraph 9(c) and within three months of the issuance of the decision to launch a review, the TSOs of the capacity calculation region concerned shall jointly submit a proposal to the competent regulatory authorities to maintain or amend the type of long-term transmission rights.

Regulatory chronicle

Regulatory chronicle